Managing Unbilled Receivables: Enhancing Cash Flow and Minimizing Risk with Kapittx

July 26, 2023The Role of CFOs in Driving Accounts Receivable Process Improvement Initiatives

August 24, 2023In today’s fast-paced business landscape, maintaining healthy cash flow is vital for the success and growth of any organization. Efficient accounts receivable management plays a pivotal role in achieving this goal by optimizing cash flow and ensuring timely collection of outstanding payments. In this blog, we will delve into the significance of streamlined accounts receivable management and introduce Kapittx, a cutting-edge AR automation platform that specializes in helping businesses achieve optimal cash flow through efficient accounts receivable management.

Understanding Accounts Receivable Management

A. Accounts Receivable Defined

Accounts receivable refer to the money owed to a business by its customers for goods or services provided on credit. It represents a significant portion of a company’s assets, and its management is critical for maintaining financial stability.

B. Key Components of Accounts Receivable Management

Efficient accounts receivable management encompasses various essential components, including invoicing, credit terms, and collections. Proper invoicing ensures that customers receive clear and accurate bills, reducing payment disputes and delays. Setting appropriate credit terms is crucial to strike a balance between providing customers with flexibility and ensuring timely payments. Effective collections involve proactive follow-ups on outstanding invoices, minimizing delays and bad debts.

C. Challenges in Accounts Receivable Management

Managing accounts receivable efficiently is not without its challenges. Businesses often face issues like late payments, delinquent accounts, and bad debts, which can significantly impact cash flow and overall financial health.

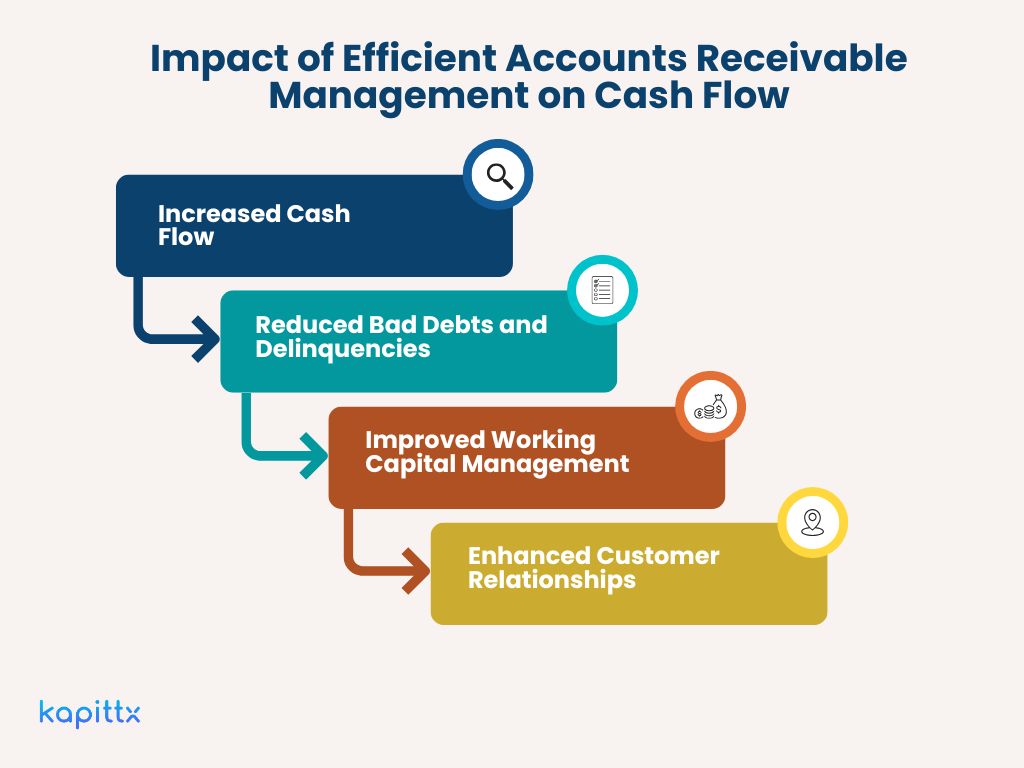

Impact of Efficient Accounts Receivable Management on Cash Flow

A. Increased Cash Flow

Efficient accounts receivable management shortens the time between invoicing and payment, resulting in faster cash inflows. By promptly collecting outstanding debts, businesses can enhance their liquidity and finance essential operations and growth initiatives. An essential metric in this regard is Days Sales Outstanding (DSO), which measures the average time it takes to collect receivables. Effective management leads to a reduced DSO, improving the overall cash flow.

B. Reduced Bad Debts and Delinquencies

Implementing efficient credit and collection policies helps minimize bad debts and delinquencies. Thorough credit checks allow businesses to assess a customer’s creditworthiness before extending credit. Setting appropriate credit limits ensures that customers do not accumulate excessive debt, reducing the risk of defaults. Proactive collections efforts, including regular reminders and polite follow-ups, encourage customers to settle their dues promptly.

C. Improved Working Capital Management

Efficient accounts receivable management directly impacts working capital by reducing the cash tied up in outstanding invoices. The freed-up capital can then be used for critical business operations, such as investing in inventory, capital expenditures, and marketing initiatives. Moreover, improved working capital management enhances a company’s financial stability, making it better equipped to weather economic uncertainties.

D. Enhanced Customer Relationships

Streamlined accounts receivable processes lead to improved customer relationships. Clear and accurate invoicing minimizes confusion and fosters a positive customer experience. Timely communications regarding outstanding payments demonstrate professionalism and respect for the customer’s time. Offering flexible payment options further enhances customer satisfaction and loyalty, paving the way for long-term business relationships.

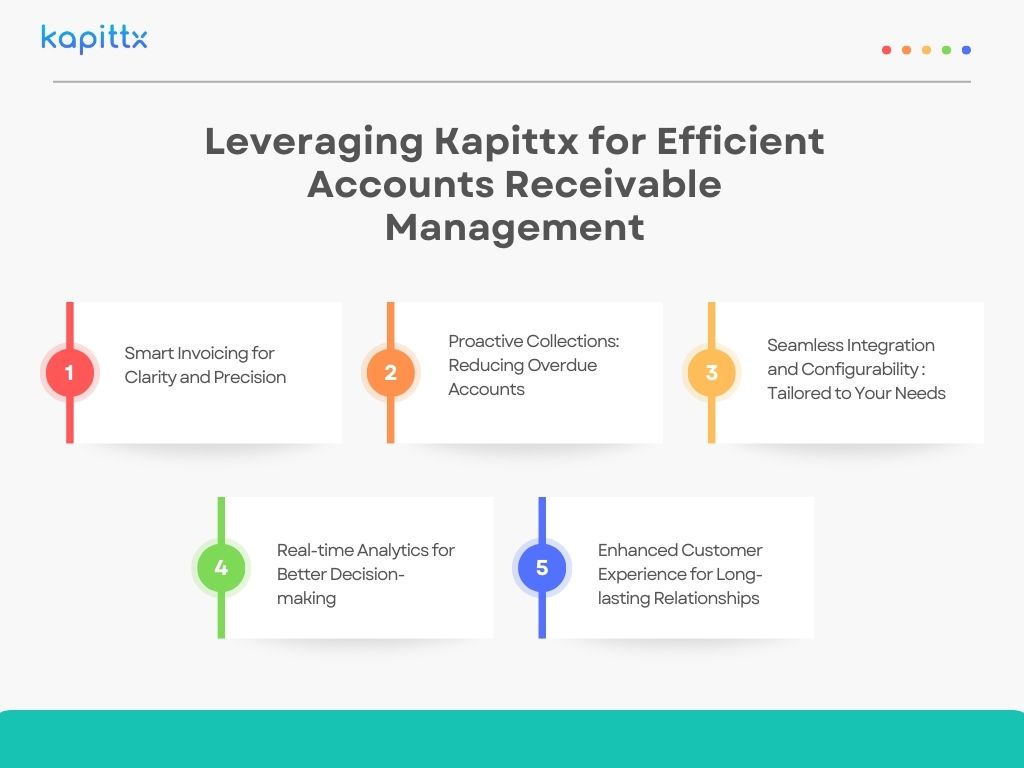

Leveraging Kapittx for Efficient Accounts Receivable Management

In today’s fast-paced business world, cash flow optimization is the lifeblood of any successful organization. Introducing Kapittx, the industry-leading accounts receivable automation platform that takes the hassle out of managing your receivables efficiently. With a suite of powerful features, Kapittx empowers businesses to streamline their entire accounts receivable process, ensuring faster cash inflows and mitigating common pain points associated with managing outstanding payments.

A. Smart Invoicing for Clarity and Precision

The first step in effective accounts receivable management is clear and accurate invoicing. Kapittx’s intelligent invoicing system ensures that your invoices are error-free and delivered to your customers promptly. By providing itemized billing details, personalized customer information, and transparent payment terms, Kapittx minimizes disputes and delays caused by confusion or discrepancies. Say goodbye to late payments resulting from ambiguous invoices, and let Kapittx set a new standard of professionalism and clarity in your billing process.

B. Proactive Collections: Reducing Overdue Accounts

Chasing overdue payments can be time-consuming and often strains customer relationships. Kapittx automates the collections process, ensuring timely and polite follow-ups with customers for outstanding payments. Through automated reminders and personalized notifications, Kapittx encourages customers to fulfill their payment obligations promptly. By reducing the number of overdue accounts, you can significantly enhance your cash flow and focus on more critical aspects of your business without sacrificing customer satisfaction.

C. Seamless Integration and Configurability : Tailored to Your Needs

Kapittx understands that every business has unique requirements and workflows. With its seamless integration capabilities, Kapittx can effortlessly integrate with your existing accounting and enterprise resource planning (ERP) systems, minimizing disruptions to your operations during implementation. Moreover, the platform offers customizable features, allowing you to tailor the accounts receivable management process to align with your specific business needs. Whether you operate in retail, manufacturing, or services, Kapittx adapts to your business, not the other way around.

D. Real-time Analytics for Better Decision-making

Making strategic decisions based on real-time data is crucial in modern business environments. Kapittx’s advanced analytics provide valuable insights into your accounts receivable performance, allowing you to identify trends, patterns, and potential areas of improvement. With access to key metrics like Days Sales Outstanding (DSO), collection efficiency, and customer payment behavior, you can make data-driven decisions to optimize your cash flow, reduce outstanding debts, and enhance overall financial management.

E. Enhanced Customer Experience for Long-lasting Relationships

Kapittx recognizes the significance of maintaining positive customer relationships. By streamlining the accounts receivable process, your customers experience a seamless and hassle-free payment experience. Clear and accurate invoicing, timely communications, and the provision of flexible payment options foster trust and loyalty. Happy customers are more likely to become repeat clients, contributing to your long-term business success.

Conclusion

Efficient accounts receivable management is the cornerstone of cash flow optimization and financial stability for businesses. By reducing DSO, minimizing bad debts, and improving working capital management, organizations can achieve sustainable growth and success. Kapittx’s advanced platform offers a comprehensive solution to these challenges, empowering businesses to streamline their accounts receivable processes and unlock their full potential.

In conclusion, we encourage you to take the next step toward transforming your accounts receivable management by experiencing the power of Kapittx firsthand. Schedule a live demo with our team to see how our platform can help you enhance your cash flow, reduce bad debts, and build stronger customer relationships. During the demo, our experts will walk you through the platform’s key features, answer any questions you may have, and tailor the solution to your specific business needs.

Don’t miss this opportunity to gain a competitive edge in your industry and optimize your financial performance. Take control of your cash flow with Kapittx today. Click the link below to schedule your demo and embark on a journey toward efficient accounts receivable management: