Accounts Receivable Mistakes and Their Implications

September 6, 2023Challenges Faced In Accounts Receivables and Their Solutions

September 12, 2023In the dynamic world of modern business, effective accounts receivable (AR) management has become a linchpin for sustained growth and financial stability. The increasing demand for streamlined financial processes necessitates the adoption of innovative solutions.

Every company invests substantial resources to grow the business and revenue. However, that revenue must be converted into cash.

The team and the processes responsible for converting revenue to cash by effectively managing receivables are –

- Also managing 100% of company’s revenue

- Either can save or lose millions in the form of bad debt and interest cost

- As a customer touch point, can influence customer service and satisfaction, directly affecting revenue.

Why current AR process is not effective?

Traditional accounting ERPs with spreadsheets, once considered revolutionary, have become outdated in the face of rapid advancements in Automation, Machine Learning, and Artificial Intelligence (AI). The historical approach of relying on spreadsheets, emails, phone calls, and personal visits to manage receivables has persisted through generations. However, the limitations of these traditional processes, marked by manual tasks and delays, are evident in the current fast-paced business landscape.

The Challenge of Traditional AR Processes:

Traditional AR processes are notorious for their inefficiencies, resulting in delayed payments and increased Days Sales Outstanding (DSO). Their lack of agility poses a significant challenge for businesses striving to navigate fluctuating payment behaviors, complex customer interactions, and the growing demand for real-time data insights.

The Emergence of Innovative Solutions:

Acknowledging the critical need for a modern approach to AR management, innovative platforms like Kapittx have come to the forefront. These solutions leverage automation, analytics, and AI to effectively address the complexities of the modern business environment, empowering CFOs and finance organizations to take control of their receivables and cash flow.

Benefits of AI-Powered AR Tools and Processes:

- Increased Cash Flow and Reduced DSO: AI-powered tools streamline processes, resulting in quicker payments and a notable reduction in Days Sales Outstanding.

- Boost in Credit Sales and Margins: Improved efficiency enhances credit sales and profit margins, contributing to overall revenue growth.

- Enhanced Productivity of Collection and Sales Teams: AI-driven automation increases the productivity of collection and sales teams, saving valuable time for managers and CFOs.

- Reduced Bad Debt and Interest Costs: Advanced analytics minimize the risk of bad debt, leading to substantial savings in interest costs.

- Lower Administrative Costs: Automation across the revenue cycle reduces administrative costs, optimizing overall financial operations.

- Decrease in Deductions and Concessions Losses: AI-powered tools help identify and mitigate deductions and concessions losses, preserving revenue.

- Enhanced Customer Service: Improved efficiency and responsiveness contribute to enhanced customer service, fostering stronger client relationships.

- Decreased Administrative Burden on Sales Force and Management: Automation reduces the administrative burden on the sales force and management, allowing them to focus on core revenue-generating activities.

Drivers of Receivable Management

What are the drivers of receivable management? Which are within the control and outside the of control of the receivable management team? When is a good time to change your AR process :

Receivables management is an art that requires finesse in human interactions and creative problem-solving. Simultaneously, it is a science that leverages data, analytics, and technology to optimize processes, manage risks, and drive strategic decision-making. The most successful CFOs, Finance Controllers, Credit Managers or Receivables Managers are those who seamlessly integrate both the artistic and scientific aspects, adapting to the dynamic nature of the field. It encompasses business processes, technological tools, workforce skills and motivation, corporate culture, evolving behaviors of customers and colleagues, an optimal organizational structure, performance metrics, incentives, and adaptability to navigate shifting external factors.

The quality of the revenue cycle operation is reflected in the receivables asset. Any mistake in the order, fulfillment, invoicing, payment, or customer satisfaction process will result in a delayed or incomplete payment in the receivables ledger.

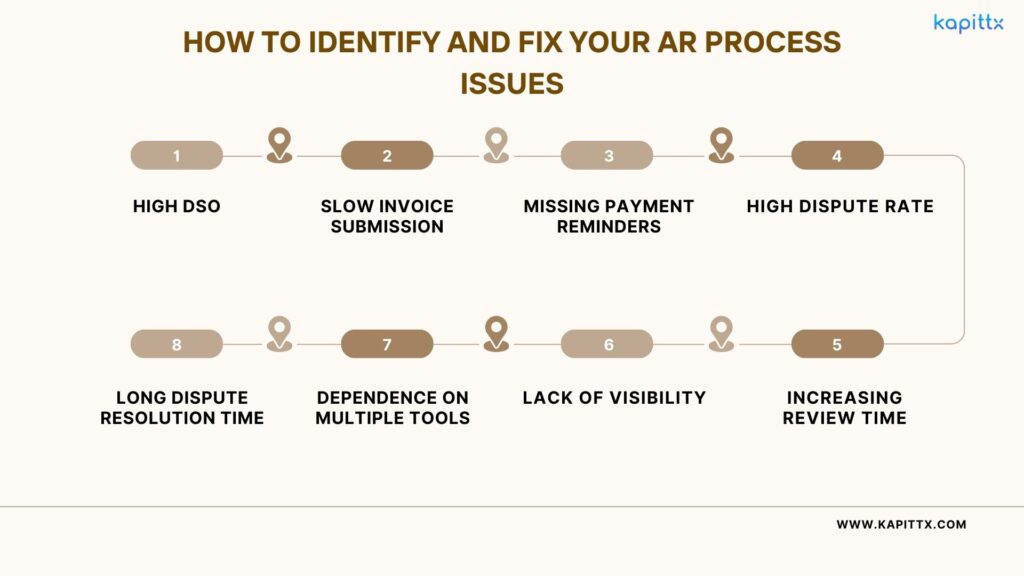

How to identify and fix your AR process issues

Accounts receivable is a critical function that affects your cash flow, customer satisfaction, and profitability. However, many businesses struggle with inefficient and outdated AR processes that lead to poor performance and customer dissatisfaction. Here are some common indicators that your AR process needs a rehaul:

- High DSO: If invoice collection period is 50% more than the credit period, it means you are taking too long to collect payments from your customers. This can affect your working capital and cash flow. High DSO can also indicate that you are not managing your customer credit risk effectively, or that you are not enforcing your payment terms consistently.

- Slow invoice submission: If you are not sending your invoices to your customers within 2 to 5 days of invoice generation, you are missing out on the opportunity to get paid faster. Delayed invoice submission can also cause confusion and disputes with your customers, especially if they receive multiple invoices at once or if the invoice details are inaccurate or incomplete.

- Missing payment reminders: If you are not sending timely and friendly payment reminders to your customers, you are letting them forget or ignore their payment obligations. Payment reminders are an essential part of your AR process, as they help you maintain a positive relationship with your customers and encourage them to pay on time.

- High dispute rate: If you are receiving a lot of invoice disputes from your customers, it means that there is something wrong with your invoicing process or your product or service delivery. Invoice disputes can cause delays in payment, damage your customer trust, and increase your administrative costs.

- Long dispute resolution time: If you are not resolving invoice disputes quickly and efficiently, you are prolonging the payment cycle and creating frustration for your customers. Dispute resolution time is a key metric that reflects your customer service quality and your AR process effectiveness.

- Dependence on multiple tools: If you are using different tools to manage your receivables, such as accounting ERP, spreadsheets, and report generating tools, you are creating unnecessary complexity and inefficiency in your AR process. Using multiple tools can cause data inconsistency, duplication, and errors, as well as increase your operational costs and time.

- Lack of visibility: If you are not able to track and analyze the reasons for payment delays, you are missing out on valuable insights that can help you improve your AR process and customer experience. Understanding the root causes of payment delays can help you identify and address the internal and external factors that affect your AR performance.

- Increasing review time: If you are spending more time reviewing your receivables than acting on them, you are wasting your resources and losing your competitive edge. Reviewing your receivables is important, but it should not take away from your core activities, such as collecting payments, resolving disputes, and building customer relationships.

According to a study, 70% of the invoice payments are delayed not because customers want to delay, but due to internal challenges and broken AR processes. Therefore, it is crucial to optimize your AR process and eliminate the inefficiencies and errors that cause payment delays.

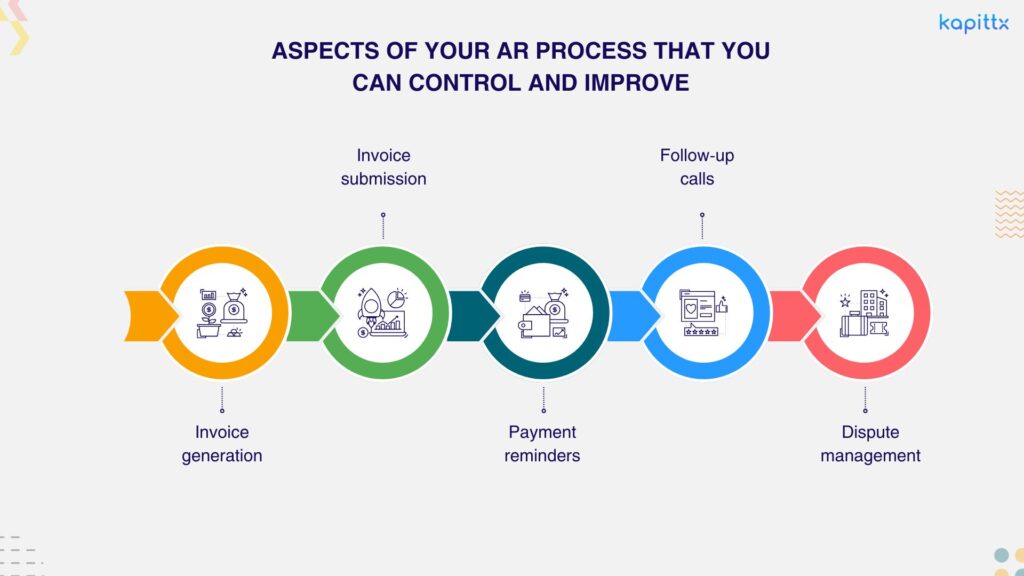

Aspects of your AR process that you can control and improve:

- Invoice generation: You can automate your invoice generation process and ensure that your invoices are accurate, complete, and compliant with your customer’s requirements. You can also use electronic invoicing to reduce paper usage, printing costs, and delivery time.

- Invoice submission: You can automate your invoice submission process and send your invoices to your customers via their preferred channel, such as email, web portal, or EDI. You can also use invoice tracking to confirm that your invoices are received and opened by your customers.

- Payment reminders: You can automate your payment reminder process and send personalized and friendly reminders to your customers via their preferred channel, such as email, SMS, or phone. You can also use payment reminder templates to ensure consistency and professionalism in your communication.

- Follow-up calls: You can automate your follow-up call process and schedule and execute calls to your customers based on their payment behavior and risk profile. You can also use call scripts to ensure that your calls are polite, respectful, and effective.

- Dispute management: You can automate your dispute management process and capture, categorize, and assign disputes to the right person or team. You can also use dispute resolution workflows to ensure that disputes are resolved in a timely and satisfactory manner.

Aspects of your AR process that you cannot control:

- Customer errors: If your customer makes a mistake in placing an order, receiving a product or service, making a payment, or updating their information, it can result in a past due or short payment in your receivables ledger. You can try to prevent customer errors by providing clear and accurate information, instructions, and support to your customers.

- Customer dissatisfaction: If your customer is unhappy with your product or service, or with your customer service, they may withhold or delay their payment as a form of protest or retaliation. You can try to prevent customer dissatisfaction by delivering high-quality products and services, and by providing excellent customer service.

Automation is revolutionizing receivables management. Credit and collection software offers work flow, data management, and analysis tools that surpass even the best ERP systems. By enabling access to all the information related to the invoice-to-cash process and providing the tools to act on that data from a single user interface, companies that have adopted receivables management software have achieved dramatic improvements in performance, as seen by reduced DSO and delinquencies. But efficiency is not the only benefit. The data collected from credit and collection activities also provides valuable customer and process insights that can be used to enhance customer profitability, invoice accuracy, and customer satisfaction. When used properly, receivables management automation becomes the missing link between back office operations and front line customer relationship management.

What to look for to modernise your AR Process?

In the ever-evolving landscape of finance, the adoption of automation is crucial for staying competitive and optimizing operational efficiency. Modernizing your Accounts Receivable (AR) process through automation is not just a trend but a strategic move to enhance productivity, minimize errors, and foster a more agile business environment.

Key Considerations for Modernizing Accounts Receivable process with Automation:

- Integration Capabilities:

Ensure that the automation solution seamlessly integrates with existing systems, ERPs, and other relevant tools to avoid disruptions and enhance overall efficiency.

- Scalability:

Choose an automation solution that can scale alongside your business growth. This ensures that the system remains effective and adaptable as your AR needs evolve.

- User-Friendly Interface:

Opt for an automation platform with an intuitive and user-friendly interface. This reduces the learning curve for your team and promotes swift adoption across different departments.

- Data Security and Compliance:

Prioritize platforms that adhere to stringent data security standards and compliance regulations. Protecting sensitive financial information is paramount in the modern business landscape.

- Customization and Flexibility:

Look for automation tools that offer customization options to tailor the solution to your specific AR processes. Flexibility is key to accommodating diverse business requirements.

- Workflow Automation:

Identify a solution that automates routine and time-consuming tasks, such as invoice processing, payment reminders, and data entry. This not only saves time but also reduces the risk of human errors.

- Analytics and Reporting:

Choose a platform that provides robust analytics and reporting features. Real-time insights into AR performance empower decision-makers to identify trends, make informed decisions, and strategize for the future.

- Collaboration Features:

Opt for automation tools that facilitate collaboration among team members and stakeholders. Effective communication and seamless collaboration are crucial for a streamlined AR process.

- Customer Experience Enhancement:

Prioritize solutions that enhance the customer experience. Automation can improve the speed and accuracy of invoicing, payment processing, and dispute resolution, leading to increased customer satisfaction.

- Cost-Benefit Analysis:

Conduct a thorough cost-benefit analysis to assess the potential return on investment. While automation involves an upfront investment, the long-term benefits in terms of efficiency and cost savings often outweigh the initial costs.

Modernizing your Accounts Receivable process through automation is not just a technological upgrade; it’s a strategic decision to future-proof your finance operations. By considering these key factors, you can select the right automation solution that aligns with your business goals, enhances efficiency, and propels your organization toward sustained success in the dynamic financial landscape.