10 Reasons Why AI powered Accounts Receivable Automation Is a Game Changer

March 21, 2024Unlocking the Power of AI in Accounts Receivable

April 2, 2024Tally Accounting Software, is one of the most widely used enterprise resource planning (ERP) software systems in India and other countries. It’s renowned for its robust accounting and inventory management capabilities, making it a popular choice for businesses of all sizes, from small enterprises to large corporations.

Tally for Accounting offers a range of features that cater to various aspects of business management, including accounting, finance, inventory, sales, purchase, point of sales, manufacturing, costing, job costing, payroll, and branch management.

Here’s a comprehensive overview of Tally ERP:

Accounting:

Tally for Accounting offers comprehensive accounting functionalities, allowing businesses to manage their financial transactions efficiently. It supports various types of vouchers such as sales, purchase, receipt, payment, journal, and contra vouchers. Users can maintain multiple companies and generate financial statements like balance sheets, profit and loss statements, cash flow statements, and more.

Inventory Management:

Tally Accounting software facilitates effective inventory management by enabling businesses to track stock movements, manage batches and expiry dates, handle multiple units of measurement, and generate reports to analyze stock levels and trends. This helps businesses optimize inventory levels, reduce carrying costs, and improve overall operational efficiency.

Tax Compliance:

Tally ERP ensures compliance with tax regulations by providing features for GST (Goods and Services Tax) compliance in India, TDS (Tax Deducted at Source), TCS (Tax Collected at Source), and more. It simplifies tax calculations, generates accurate tax reports, and helps businesses file tax returns seamlessly.

Financial Management:

With Tally Accounting Software, businesses can efficiently manage their finances by automating tasks such as invoicing, billing, expense tracking, and bank reconciliations. It also supports budgeting, cost center management, and financial forecasting, enabling businesses to make informed decisions and maintain financial health.

Reporting and Analysis:

Tally ERP offers a wide range of customizable reports and analytical tools that provide insights into various aspects of business performance. Users can generate reports on sales, purchases, cash flow, profitability, aging analysis, and more, helping them monitor key metrics and identify areas for improvement.

Integration and Customization:

Tally ERP can be integrated with other software applications and third-party solutions, enabling businesses to streamline their operations and enhance productivity. Additionally, it provides a flexible platform for customization, allowing businesses to tailor the software according to their specific requirements and workflows.

Ease of Use and Accessibility:

Tally Accounting Software is known for its user-friendly interface and intuitive navigation, making it easy for users to learn and use the software effectively. It offers both offline and online modes of operation, allowing users to access their data anytime, anywhere, and from any device with an internet connection.

Security and Data Protection:

Tally ERP ensures the security and integrity of business data through robust security features such as user authentication, data encryption, access controls, and audit trails. This helps businesses safeguard sensitive information and comply with data privacy regulations.

Overall, Tally ERP is a comprehensive and feature-rich ERP solution that addresses the diverse needs of businesses across industries. Its user-friendly interface, powerful functionalities, and emphasis on compliance make it a preferred choice for businesses seeking to streamline their operations, improve efficiency, and achieve growth

Why upgrade Tally ERP with AI powered accounts receivable software?

It’s important to note that like many other ERPs, Tally Accounting Software exhibits certain constraints that can notably influence a company’s operations, These limitations fall under -restricted scalability, limited collaborative features, constrained automation, or challenges in integrating with external systems. One crucial function that has a direct impact is Accounts Receivable. The constraints highlighted above, force companies to manage accounts receivable manually which can have a significant impact on the cash flow.

In today’s rapidly evolving digital landscape, the integration of AI-powered accounts receivable software with Tally ERP can address its inherent limitations and propel mid-sized companies toward greater operational excellence. While Tally ERP excels in recording transactions and generating financial statements, it falls short in scalability and collaborative capabilities within an organization and with its clientele.

The advent of AI-powered accounts receivable software brings forth a transformative approach to the limitations of Tally ERP. It automates routine tasks, accelerates cash flow by swiftly recognizing and applying payments, and enhances customer interactions by providing more personalized and timely service. Furthermore, using AI in accounts receivable to complement Tally Accounting software, offers valuable insights into customer payment behaviors, enabling more strategic decision-making.

By adopting AI in accounts receivable with Tally Accounting software, companies can break down data silos, ensuring seamless communication between legacy systems and modern applications. This not only extends the life of existing Tally ERP, but also reduces infrastructure costs.

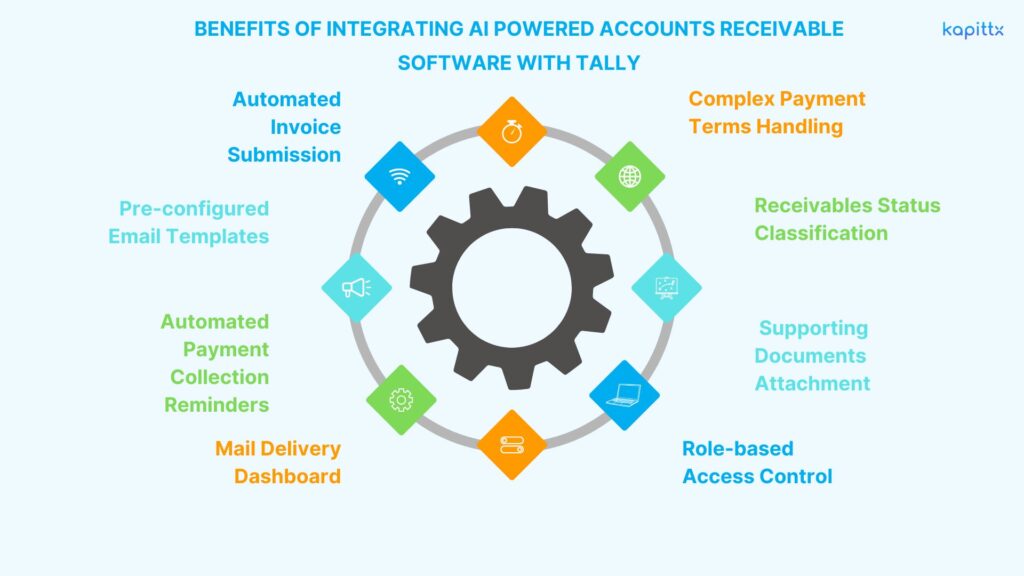

Benefits of integrating AI powered accounts receivable software with Tally

In fast-paced business environment, managing accounts receivable effectively is crucial for maintaining cash flow and ensuring timely payments from customers. While Tally has been a popular choice for accounting and inventory management, an AI powered accounts receivable software like Kapittx offers several advantages that address the specific challenges faced by businesses in managing accounts receivable. Let’s explore some key benefits of integrating AI powered accounts receivable software with Tally

1. Automated Invoice Submission: Delays in invoice submission can lead to delayed payments from customers, impacting cash flow. AI powered accounts receivable software with Tally offers automated invoice submission, eliminating manual processes and ensuring that all invoices are submitted on time. This feature helps businesses avoid delays and improve their accounts receivable automation process.

2. Pre-configured Email Templates: Drafting emails for payment reminders or invoice follow-ups can be time-consuming, and the tone and content of emails may vary between individuals. With pre-configured email templates, businesses can save time and ensure consistency in communication. This feature helps create professional and consistent emails, reducing the risk of miscommunication with customers.

3. Automated Payment Collection Reminders: Tally with AI powered accounts receivable software provides configurable rule-based reminders that are automatically sent to customers at predefined intervals or trigger points. The automated payment collection reminders eliminate the manual task of sifting through outstanding statements and selecting customers for reminders. Automated payment collection reminders ensure complete coverage of all eligible customers, improving the efficiency of accounts receivable management.

4. Mail Delivery Dashboard: Tracking email delivery status is crucial to ensure that customers receive invoices and reminders promptly. AI powered accounts receivable software like Kapittx has an intelligent mail delivery dashboard that provides insights into mail delivery status, including delivered, bounced, spam, or clicked emails. This enables businesses to take appropriate action and follow up effectively with customers.

5. Complex Payment Terms Handling: Many businesses have complex payment terms based on specific events or milestones. Kapittx offers a configurable milestone payment plan option, automatically calculating due dates based on predefined conditions. This feature simplifies the handling of complex payment terms, ensuring accurate invoicing and timely payments.

6. Receivables Status Classification: An AI powered accounts receivable automation process flows enables businesses to classify receivables into categories such as accepted, collectible, disputed, and rejected. This classification provides insights into the status of receivables, enabling management to focus on matters that require intervention and prioritize collection efforts effectively.

7. Supporting Documents Attachment: In addition to invoices, buyers often require suppliers to submit supporting documents such as proof of delivery or purchase orders. Given the limitation of Tally to stored documents, Accounts receivable software like Kapittx allows users to attach supporting documents to invoices, either individually or in bulk. This feature enhances transparency and facilitates compliance with buyer requirements.

8. Role-based Access Control: Tally ERP users typically have access to all company data, regardless of their role, leading to potential security risks and unwanted friction within organizations. Kapittx offers role-based access control, allowing businesses to assign invoices or customers to specific users based on their roles. This ensures data security and restricts access to sensitive information, improving overall organizational efficiency.

In conclusion, upgrading Tally ERP with AI-powered accounts receivable software is not just about automation; it’s about transforming the accounts receivable function into a more strategic, customer-focused, and efficient component of the business. This integration ensures you’re your company remains competitive and agile in a dynamic economic environment.