How does AR automation help with faster invoice processing

May 11, 202310 Accounts Receivable KPIs to Help Improve AR Collection

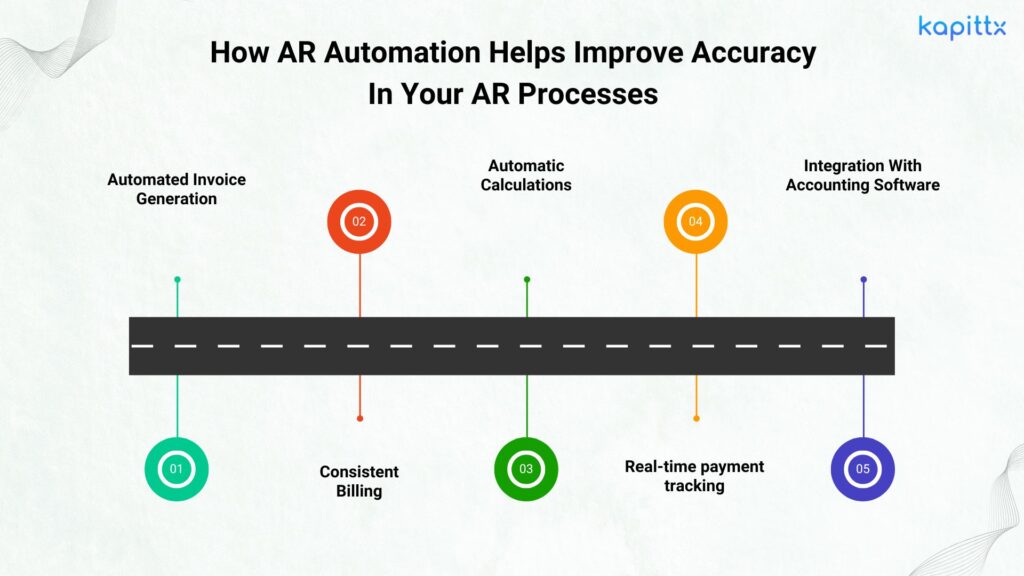

May 25, 2023Accounts receivable (AR) automation is a valuable tool that can help businesses improve accuracy in their invoicing and payment collection processes. By automating certain tasks, AR automation can reduce the risk of errors caused by manual data entry and other human factors. In this blog post, we’ll explore how AR automation helps improve accuracy in your AR processes.

- Automated invoice generation: One of the most significant sources of errors in the invoicing process is manual data entry. By automating the process of generating invoices, you can eliminate errors caused by typos, incorrect customer information, or other human errors. This not only improves accuracy but also saves time and effort.

- Consistent billing: With AR automation, you can set up templates for your invoices, ensuring consistency across all of your invoices. This reduces the risk of errors caused by differences in formatting, data entry, or other factors. Consistent billing also makes it easier for customers to understand and pay their bills, which can lead to faster payments and improved cash flow.

- Automatic calculations: Invoicing often requires complex calculations, such as discounts, taxes, and shipping charges. AR automation can automate these calculations, reducing the risk of errors caused by manual calculations. This ensures that each invoice accurately reflects the amount owed and reduces the risk of disputes or delayed payments.

- Real-time payment tracking: AR automation allows you to track payments in real-time, ensuring that all payments are accurately recorded and applied to the appropriate invoices. This reduces the risk of errors caused by manual data entry or delays in recording payments.

- Integration with accounting software: AR automation can integrate with your accounting software, ensuring that all invoice and payment data is accurately recorded in your system. This reduces the risk of errors and duplication of effort associated with manually entering data.

AR automation is an effective way to improve accuracy in your AR processes. By automating certain tasks, AR automation can reduce the risk of errors caused by manual data entry, inconsistencies in billing, incorrect calculations, and delays in payment processing. If you are looking to improve accuracy in your AR processes, consider implementing an AR automation system to help streamline your invoicing and payment collection processes.

Kapittx is a Software-as-a-Service (SaaS) platform to automate the critical process of Accounts Receivables or Debtors. It enables various stakeholders like Sales, Accounts, Logistics, and Customers to collaborate effectively and get paid faster. Founded in 2019, by veterans in the Payments, Finance, and Technology domains, Kapittx is built to integrate with your existing processes seamlessly. The easy-to-use interface, enables businesses in diverse fields like manufacturing, services, technology, transportation, etc customize it to their own unique requirements. Kapittx recognizes that each industry and each company handles receivables in a different way and aims to eliminate the barriers to getting paid faster.

Click here to see a case study from Kapittx.

Check out Kapittx’s LinkedIn here.