Unlocking the Power of AI in Accounts Receivable

April 2, 202410 Game-Changing Trends in Accounts Receivable Automation

April 23, 2024In the intricate dance of B2B transactions, the moment of payment can sometimes be as elusive as a shadow. Customers often murmur the age-old refrains: “The invoice? Lost in transit,” or “A timely reminder? Alas, none was received.” It’s a dance where the rhythm is set by reminders, and the absence of a beat can lead to a misstep known as non-collection. Heeding the wisdom of the proverb, “A Stitch in time, saves nine,” we understand that timely nudges are the stitches that save the fabric of cash flow.

Dunning, the art of sending these reminders, is not a monotonous drumbeat but a symphony of strategies. It ranges from the gentle tap of a verbal nudge to the crescendo of a stern letter, and in some discordant cases, the cacophony of threats. Yet, in the realm of B2B, where the currency is not just money but relationships, dunning transforms into something more nuanced.

Leveraging an AI powered dunning management software like Kapittx, who have honed this art to a science, ensuring that each reminder resonates with the unique frequency of the relationship it seeks to preserve. The dunning management system isn’t a one-size-fits-all; it’s a bespoke suit tailored to fit the stature of each enterprise, big or small. One need to craft communication templates with the precision of a master tailor, making them as personalizable as they are configurable.

Kapittx abides by the CPPP mantra—Consistent, Persistent, Polite, and Personalized. This is a compass in the labyrinth of AI powered accounts receivable, guiding you to not just recover dues but to fortify the bridges of business relationships.

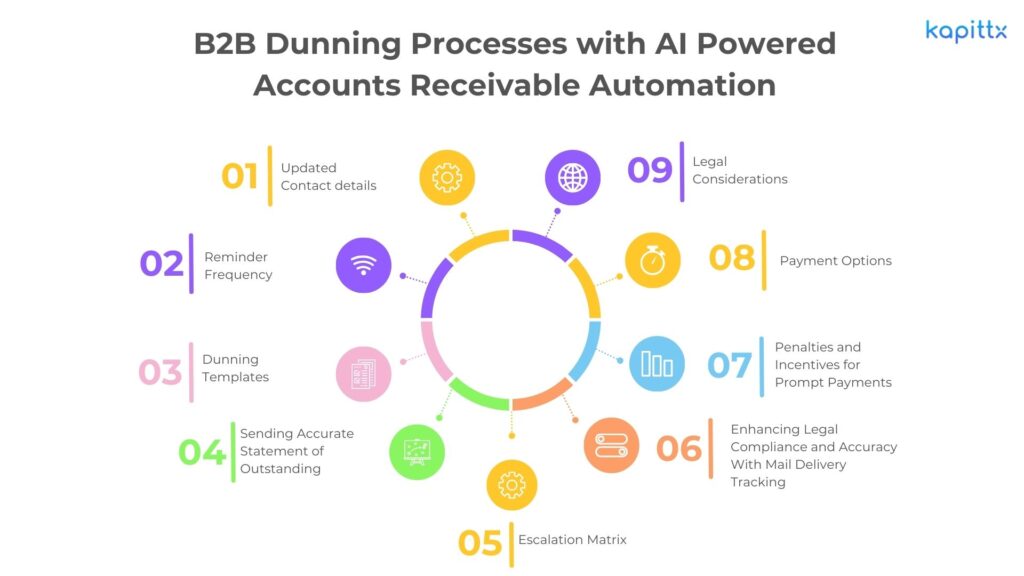

Enhancing B2B Dunning Processes with AI Powered Accounts Receivable Automation

Leveraging cutting-edge technology, particularly AI powered accounts receivable automation, is paramount to streamline processes and optimize outcomes. Here’s how integrating AI into dunning processes can elevate your collections strategy and drive tangible results.

Following are the essential prerequisites for an effective B2B Dunning process:

1. Updated Contact details

It is always essential to keep an updated contact list of the relevant persons on the customer side. Enterprise buyers have multiple stakeholders like procurement, supply chain management, finance, etc. Sometimes, due to role change or resignation, these contacts may change. It is essential to keep your system updated for these changes, as there is nothing more frustrating than sending emails to a non-existent mailbox or worse, to the wrong person. An AI powered dunning management system can help in the early identification of contact gaps which includes contact changes through tracking of email bounces.

2. Reminder Frequency

Determining the ideal frequency for reminders is a delicate balance. Dunning process automation allows for tailored approaches, whether it’s weekly or centered around key invoice events, ensuring sensitivity and respect for ongoing business negotiations.

In B2B engagements, communication around collections must be tactful and considerate to preserve business relationships. It’s important to coordinate with your sales team to ensure collection efforts don’t conflict with ongoing negotiations.

An AI powered dunning management system for reminder frequencies will enable you to consider two categories:

Fixed Frequencies: Weekly, Fortnightly, Monthly, Quarterly, etc.

Event-Based Frequencies: Set reminders for a certain number of days post-invoice or pre-due date.

A best practice is to issue a friendly reminder shortly after invoicing, followed by a gentle nudge just before the due date, escalating to more frequent reminders past the due date if necessary.

This version aims to be clear and respectful, emphasizing the importance of maintaining positive client relations while managing collections effectively.

3. Dunning Templates

Leverage dunning management software to utilize templates that maintain a professional tone across all communications. Customizable based on customer type and invoice age, these templates ensure accuracy in financial details, crucial for preserving customer trust.

An AI powered dunning management system will help you in maintaining all communications, tailored to the customer profile, accuracy in financial details—such as document references, invoice dates, due dates, and outstanding balances—is imperative.

4. Sending Accurate Statement of Outstanding

Without an automated dunning management system, professionals often find themselves manually transferring data from ERP systems into a format suitable for communication. This process is not only time-consuming but also fraught with the risk of transcription errors, which can result in customer dissatisfaction and potential loss of business.

To mitigate these risks, it is advisable to employ an AI powered automated dunning systems like Kapittx. These platforms seamlessly integrate with your ERP/Billing systems, ensuring that reminders are accurate and correspond only to genuine outstanding invoices. Moreover, they intelligently cease reminders once the payment is received, thereby maintaining the integrity of customer communications and enhancing satisfaction.

By leveraging such automation, your collections teams can focus on strategic tasks rather than mundane data entry, while also preserving the trust and satisfaction of their customers.

5. Escalation Matrix

Understanding the customer’s hierarchy allows for strategic escalation of outstanding dues. Effective management of outstanding dues is a delicate balance between persistence and tact. When escalated to the CXO level, it’s common to encounter the “you should’ve told me before” response. To avoid this, as well as the risk of irritating the buyer with excessive top-level reminders, understanding the customer’s internal hierarchy is essential.

This hierarchy is often outlined in the Purchase Order/Contract or recorded in your Sales CRM system. The initial reminders should be directed to the primary user of the product/service. If there’s no resolution, subsequent reminders can include the purchasing/procurement department. Only if necessary should the matter be escalated to the CXO level.

AI-powered dunning management can configure personalized escalation workflows, ensuring reminders reach the appropriate levels without causing undue irritation. Platforms like Kapittx facilitate the configuration of these escalation workflows, allowing for a personalized approach for each customer. This ensures that communication is appropriately escalated, maintaining professional relationships while effectively addressing outstanding dues.

6. Enhancing Legal Compliance and Accuracy With Mail Delivery Tracking

In today’s digital age, the importance of tracking email delivery cannot be overstated. This practice serves two critical purposes:

Verification of Accurate Addresses: Firstly, tracking ensures that communications reach the intended recipients. This is particularly crucial in a business environment where accurate contact details are the linchpin of smooth operations. By confirming that emails are delivered to the correct addresses, companies can maintain effective correspondence with clients, partners, and stakeholders.

Legal Documentation: Secondly, and perhaps more importantly, email tracking provides indispensable legal evidence. In the event of disputes or litigation, having a detailed record of sent, delivered, and opened emails can be a decisive factor. It substantiates the sender’s claim of due diligence and attempted communication.

AI powered accounts receivable automation platforms like Kapittx are at the forefront of this technology, offering mail-tracking. With Kapittx, businesses benefit from intelligent tracking systems that not only confirm the delivery of emails but also provide comprehensive reporting. This level of detail is invaluable for auditing purposes and legal protection.

7. Penalties and Incentives for Prompt Payments

The strategic use of penalties and incentives can significantly influence payment behaviors in B2B transactions. This “carrot and stick” approach, when applied judiciously, can enhance the effectiveness of your dunning process. The AI powered dunning management system enables you to achieve this effectively facilitating dastr payments.

Penalties for Delayed Payments: Communicating the consequences of late payments is essential. While many contracts include clauses for delayed payment interest, these are often overlooked. However, in certain scenarios, it’s advisable to assert these penalties within the outstanding statement. This inclusion serves as a tangible reminder to the buyer of the financial repercussions of delayed payment, thereby encouraging quicker settlement of dues.

Incentives for Early Payments: Conversely, offering incentives for early payment can be an equally effective tactic. When smartly integrated into dunning communications, these incentives can motivate buyers to prioritize your invoices. The benefits of such incentives often outweigh the costs, as the reduction in collection expenses and the improvement in cash flow can offset the discounts provided.

Implementing a Balanced Approach: It’s crucial to find a balance that maintains positive client relations while also ensuring timely payments. The key is to communicate these financial policies clearly and consistently, ensuring that buyers are aware of both the penalties for tardiness and the rewards for promptness.

By incorporating penalties for late payments and incentives for early settlements into your dunning strategy, you can create a compelling motivation for buyers to adhere to payment terms. This not only accelerates the collection process but also reinforces the importance of meeting financial obligations in a timely manner.

8. Payment Options

The efficiency of payment processes is a cornerstone of customer satisfaction. An AI powered accounts receivable system integrated with Payments will enable embedding payment links in reminders and integrating with sophisticated B2B payment platforms. You’re not just simplifying the payment process; you’re enhancing the overall customer experience and paving the way for a more efficient, secure means of collections.

9. Legal Considerations

In situations where traditional dunning efforts yield minimal results, proactive legal considerations become essential. AI powered dunning systems facilitate proactive legal actions, including the delivery of legal notices via email and electronic proof of delivery gathering. By weighing legal options early and leveraging AI-driven insights, businesses can optimize recovery strategies while minimizing costs and risks.

Conclusion :

Incorporating AI powered accounts receivable automation software into B2B dunning processes revolutionizes collections management, enabling businesses to optimize efficiency, accuracy, and customer engagement. By leveraging AI driven insights and automation capabilities, organizations can navigate complex collections challenges with agility and precision, driving tangible results and maintaining robust financial health.