How does AR Automation help improve accuracy

May 18, 2023Accounts Receivable Turnover Ratio – its importance and how to calculate

June 4, 2023You can improve what you can measure; this statement very much goes for managing your accounts receivable ( AR ) and AR collection. While managing your accounts receivable, the AR Collection performance is one of the most measurable business functions. The amount of cash collected, the amount of receivables written off, the amount within defined aging categories, and many other receivables dimensions are all finite numbers easily measured by accounting systems.

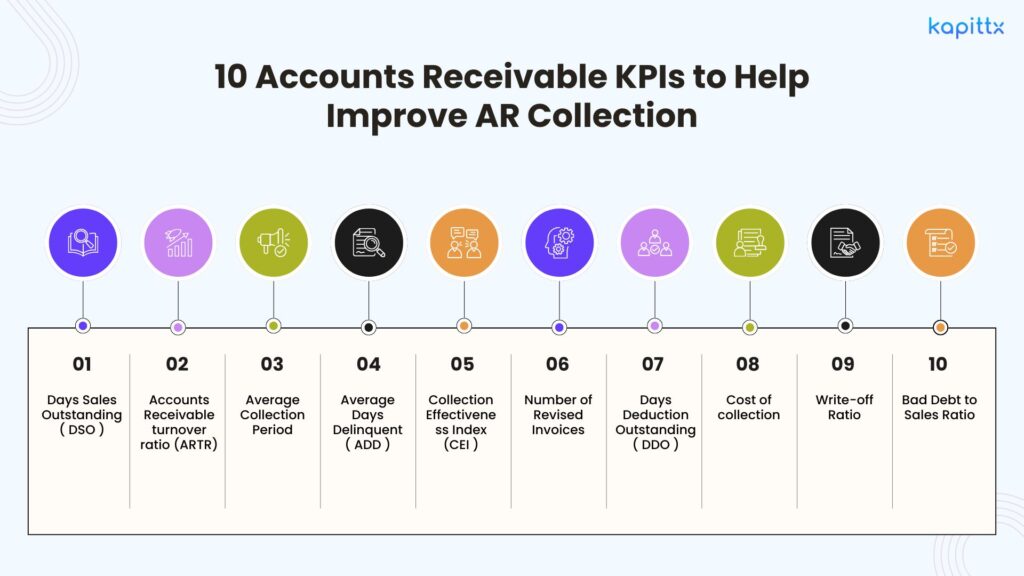

10 Accounts Receivable KPIs ( key performance indicators ) that will help improve AR collection performance and productivity of your Accounts Receivable team are –

Days Sales Outstanding ( DSO ) :

DSO is one of the best KPI indicators of a company’s ability to convert its receivables to cash. Most companies will review their receivables on a weekly basis, and adding DSO as a measurement can significantly improve the review process. Generally, DSO is determined on a monthly, quarterly or annual basis and can be calculated by dividing the amount of accounts receivable during a given period by the total value of credit sales during the same period and multiplying the result by the number of days in the period measured.

The Formula for Days Sales Outstanding Is

Accounts Receivable turnover ratio ( ARTR ):

This ratio indicates the relationship between revenue from operations and average accounts receivables during the year.

Average accounts receivables are calculated by adding the accounts receivable at the beginning of a period as well as at the end of the period and by dividing the total by two.

While calculating this ratio, the provision for bad debt and doubtful debts is not deducted from total accounts receivable, so it may not give a false impression that accounts receivable are collected quickly.

Average Collection Period :

Accounts Receivable turnover ratio can also be converted into the Average Collection Period – the number of days within which the cash is collected from accounts receivable :

If the Average Collection Period is 32 days means that, on average, accounts receivable take 32 days to get converted into cash. In other words, credit sales are locked up in accounts receivable for 32 days.

An increase in the average collection period indicates the blockage of funds with accounts receivable, which increases the risk of bad debts. A higher average collection period is, thus, an indication of the inefficiency of the accounts receivable management process

Average Days Delinquent ( ADD ):

At times DSO, Average Collection Period or Accounts Receivable Turnover Ratio may not be adequate to measure the AR performance. Average Days Delinquent, also known as delinquent days sales outstanding, complements other key metrics. At any given time, on average, it gives a view of how many days late customers’ payments are.

As one of the critical KPIs, average days delinquent tells AR Specialists how late customers’ payments are on average, at a particular moment in time. This KPI offers a good sense of whether your average late-paying customer is delinquent by just a little or by a lot.

To calculate Average Days Delinquent ( ADD ) one need to know the Days Sales Outstanding (DSO ) and Best Possible Days Sales Outstanding ( BPDSO )

Collection Effectiveness Index (CEI ):

Getting a view on what percentage of Accounts Receivable can be retrieved from the customers is a critical indicator to improve AR Performance. The Collection Effectiveness Index ( CEI ) is a critical KPI to to calculate a company’s ability to retrieve their receivables from their customers. In a given time period, CEI compares the amount of AR that was available for collection to the amount that was collected.

Collection Effectiveness Index formula involves the following parameters –

Beginning receivables – Receivables at the start of the month of a company’s open receivables.

Monthly credit sales – total amount of sales made of credit in that month.

Ending total receivables – all open receivables, including current and overdue receivables.

Ending current receivables – open receivables that are not overdue.

A collection effectiveness index near 85% or above is a good indicator that the collection process is highly effective.

Number of Revised Invoices:

If 12% of your invoices have errors and only 2% of the benchmarked company’s invoices have errors, the receivables results can be very different, even if other factors are equivalent

Invoicing accuracy is one of the most important KPIs that can affect effectiveness and efficiency of accounts receivables management and the AR performance.

Calculating the number of revised invoices is simple. For example, if the company issued 10,000 invoices and 600 non–error-based credit memos during the second quarter of the year, its number of revised invoices would be 6%.

Monitoring number of revised invoices as a KPI month over month or quarter over quarter is one way to measure your accounts receivable ( AR ) performance, and can help you identify areas where you need to improve.

Days Deduction Outstanding ( DDO ):

A deduction occurs when a customer pays an invoice less than the full amount. Customers take deductions when they do not agree with the amount of the invoice or if they believe they are owed money by the supplier. Instead of waiting for the supplier to issue a credit memo, which would be applied to their next remittance, companies take the deduction because it keeps money in their bank now rather than waiting weeks for the credit memo.

Days Deduction Outstanding (DDO) is another important KPI to improve AR performance. This indicator is used to demonstrate how effective a company is at resolving deductions as part of its deduction management process. It refers to the number of days that the account receivables specialist will need to resolve an outstanding deduction. To calculate DDO, the amount of the open deductions is divided by the average value of deductions incurred within a certain period of time.

Cost of collection:

The cost associated with the collection of accounts receivable is a crucial KPI to assess AR performance. The cost of collection looks at the amount of time and money the company is spending to collect payments. This includes the cost of employee time, technology infrastructure, postage, and other expenses related to getting payments from customers.

While many companies measure the resources allocated as part of the Accounts Receivable team, the most crucial factor that gets missed is the time spent by management and supporting members from other business functions.

One of the ways to minimize the inherent cost in collection activities, including management time, is to invest in accounts receivable automation software.

Write-off Ratio:

If we say Collection Efficiency Index ( CEI ) of more than 85% is great, achieving anything closer to 100% CEI will be nirvana. This will mean a risk in the collection portfolio will lead to bad debts and eventually be written off. The write-off ratio becomes one of the critical KPIs to measure Accounts receivable ( AR ) performance and to minimize the impact on the bottom line.

Write-off ratio is the ratio used by a company to measure the written-off receivables in percent compared to the company’s total receivables outstanding. The accounts receivable is written off as bad debt indicating that the company is highly unlikely to receive back the remaining money that was written off.

While there will always be some bad debt that one cannot avoid, it is in the company’s interest to keep the write-off ratio as low as possible.

Bad Debt to Sales Ratio:

Quality of sales revenue and ability to deliver as per customer’s expectation will have direct implications on the bad debts. One of the KPI to measure is the bad debt-to-sales ratio.

Bad debt to sales ratio is a financial metric that compares the amount of money a company loses due to unpaid invoices to its total sales.

The formula for bad debt to sales ratio is

It is calculated by dividing the bad debt expense by the net sales. For example, if a company has $10,000 in bad debt and $100,000 in net sales, its bad debt to sales ratio is 10%. This means that the company loses 10% of its sales revenue to uncollectible accounts.

A high bad debt to sales ratio may indicate that a company has poor credit and collection policies, or that it is facing difficulties in recovering payments from its customers. A low bad debt to sales ratio may indicate that a company has effective credit and collection policies, or that it has a loyal and reliable customer base.

Conclusion :

While the Accounts Receivable KPIs are a great indicator of you’re your teams collection performance, the overriding principle in receivables metrics and reporting is to keep it simple and avoid consuming a great deal of time in their preparation.

The Accounts Receivable KPIs should be used to obtain a general idea of the performance achieved and help you compare with other organizations.

Click here to see a case study from Kapittx.

Check out Kapittx’s LinkedIn here.