How Accounts Receivable Affect Your Cash Flow Management?

December 1, 2023How Can Gen AI Revolutionize Your Accounts Receivable Process?

March 5, 2024Companies in their endeavor to increase shareholder value or improve their ability to serve customers better, three inventions have had a significant influence on the way organizations functions –

- Internet: The Internet invention in the 1960s has revolutionized the way information is accessed, shared and communicated. It not only transformed various aspects of human life, it changed the fundamentals of commerce.

- The World Wide Web ( WWW ): Tim Berners-Lee’s invention of the World Wide Web has transformed how people access and share information online. It has facilitated the creation of websites, online platforms, and digital content, revolutionizing communication, collaboration, and commerce. It changed the way companies operate.

- The Smartphones: One of the earliest devices often considered a precursor to the modern smartphone is the IBM Simon Personal Communicator, which was introduced in 1994. The IBM Simon combined the functions of a mobile phone with features such as a touchscreen interface, email capabilities, and basic applications like a calendar and address book. While the concept of a “smartphone” has evolved over time, but the modern smartphone, as we recognize it today is ubiquitous and play a central role in our daily lives, offering a wide range of functions beyond basic communication, including internet access, social media, photography, navigation, and more

In the current era of intelligent economy, questions to be asked are – Is ChatGPT the next big invention? Will it reshape the way we use AI and do business? Is AI the ultimate solution to Accounts Receivable collections?

What is Artificial Intelligence and ChatGPT?

The concept of artificial intelligence (AI) has been around for several decades, with its roots tracing back to the mid-20th century. The term “artificial intelligence” was coined in 1956 during the Dartmouth Conference, where researchers gathered to discuss the potential for machines to simulate human intelligence. It’s important to note that AI is a broad and evolving field, and its development has been characterized by periods of both excitement and skepticism.

ChatGPT on the other hand, is a specific implementation of AI, standing for “Generative Pre-trained Transformer”. It’s a language model developed by OpenAI that utilizes deep learning techniques to understand and generate human-like text based on the input it receives.

ChatGPT has catalyzed advancements in AI research, expanded the possibilities for human-computer interaction, and contributed to the broader adoption of AI technologies across industries and domains. ChatGPT represents a milestone in AI-driven natural language understanding, enabling machines to comprehend and generate human-like text, thereby advancing communication between humans and computers. It brings conversational AI capabilities to various platforms and devices, enhancing user interactions and enabling new applications in customer service, virtual assistants, and more.

Use of AI in Accounts Receivable collections :

AI has the potential to significantly transform human-computer interactions in the finance function, leading to enhanced productivity and efficiency. As organisations mature towards an intelligent economy powered by AI, what you will probably see is every human brain amplified by 10x by AI. Will the amplified capacity by using AI-based Collections Software will make a difference to the manual or automated accounts receivable process? To set the context on AI in accounts receivable, we need to acknowledge that accounts receivable collections is a critical function that affects your cash flow, customer satisfaction, and business performance. For the manual or automated accounts receivable process to function five pillars play a big role.

- Your company’s operations and the ability to deliver what you promise to the customers

- Customer engagement

- Accounts and receivable team

- Collaboration with your internal stakeholders, especially related to invoice disputes

- Use AR data to make informed decisions

However, for many decades, the accounts and receivable function has been neglected and under-invested in terms of technology adoption. Most companies still rely on manual, people-dependent, and outdated processes that involve a combination of ERP and XLS technologies. These processes are inefficient, error-prone, and time-consuming, resulting in delayed payments, high costs, and poor customer experience.

Fortunately, there is a better way to manage your accounts receivables collections with AI powered accounts receivable. The use of AI in accounts receivable management is a game-changer that can transform your accounts receivable and make it more efficient, effective, and human. AI can help you automate and optimize your accounts receivable workflows, from invoice creation to cash application, and provide you with valuable insights and analytics to improve your decision-making and performance. AI powered accounts receivable can also help you enhance your customer relationships, by providing personalized and proactive communication, resolving disputes faster, and offering flexible payment options.

In this article, we will explore how AI powered accounts receivable is leading the digital transformation of accounts receivable collections, and how you can leverage AI to streamline and improve your AR process..

With AI in Accounts Receivable, what will change?

From the company’s point of view Accounts receivable collections process is very personalized and unique to your business. There is no universal AI powered accounts receivable tool or model that will fit all companies. You need to understand your accounts receivable collections process and map which aspect of the process needs improvement.

Fundamentally, AI in Accounts receivable will influence two areas –

- Human judgments and decisions with enriched and curated data

- Automated accounts receivable software doing manual repetitive work more efficiently than humans

AI in accounts receivable can enhance human judgment and decision-making in accounts receivable collections by providing valuable insights and recommendations based on data analysis and machine learning.

Decision making by using AI in accounts receivable

AI can provide finance professionals with real-time insights and predictive analytics, enabling them to make informed decisions quickly. By leveraging AI powered accounts receivable collection forecasts and scenario analysis, finance teams can better anticipate risks and opportunities, leading to more effective decision-making Let us study few use cases –

- Credit Risk Assessment: By analyzing various data points within your company and the external data feeds, you can assess the creditworthiness of customers enabling you to make informed decisions about credit extension and payment terms. This significantly reduces the risk in accounts receivable collections.

- Cash flow planning: AI in accounts receivable can predict cash flow patterns by analyzing past payment behavior and market trends.

- DSO reduction strategies: To reduce DSO, the algorithms in AI powered accounts receivable software can optimize collection strategies by prioritizing accounts based on their likelihood of payment and recommending the most effective method of collection.

4. Process Optimization: AI can analyze the accounts receivable collections process to identify bottlenecks, inefficiencies, and areas for improvement, enabling companies to streamline workflows and reduce cycle times.

5. Optimization of Payment Terms: AI powered accounts receivable software can analyze historical data to identify optimal payment terms for different customer segments, helping companies offer personalized terms to incentivize timely payments.

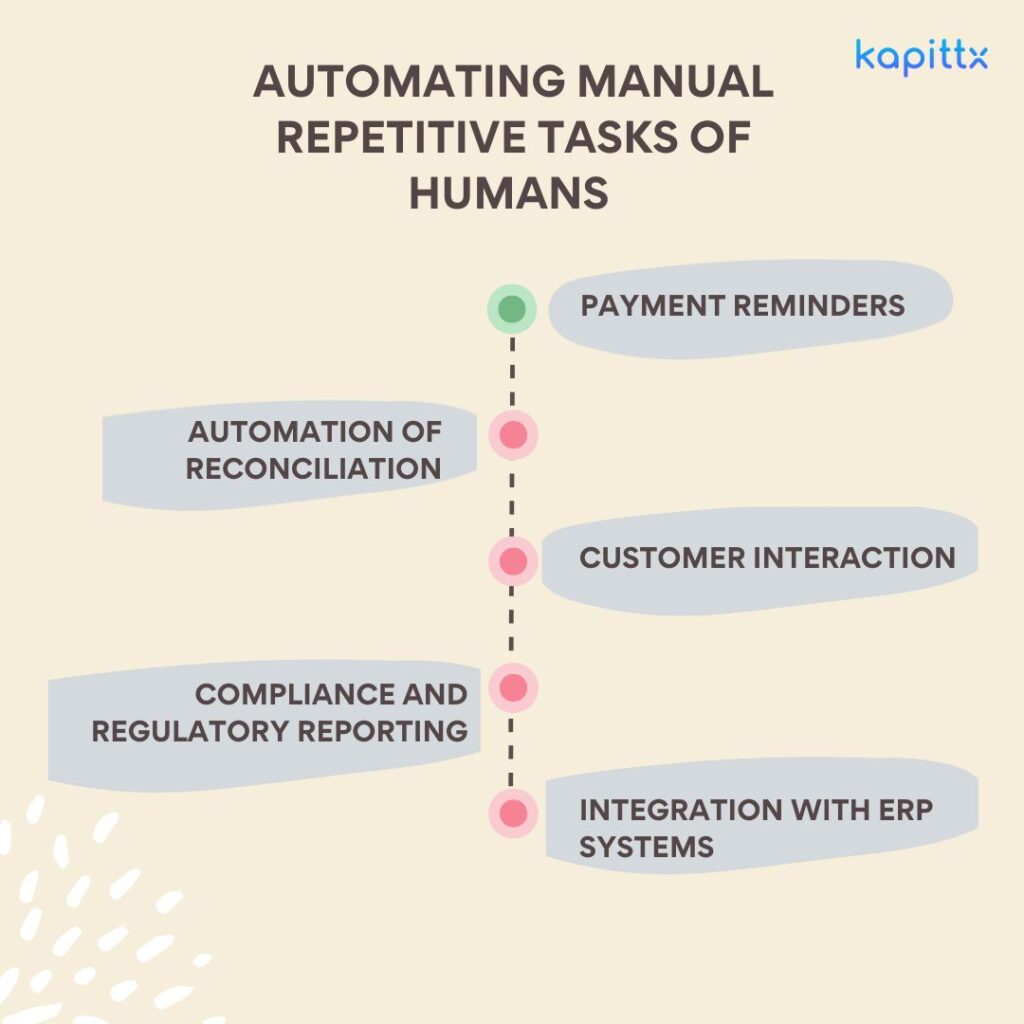

Automating manual repetitive tasks of humans :

AI in accounts receivable can be a game changer to your accounts and receivable function by enhancing the credit and collection team’s capabilities, automating their day-to-day routine tasks, and enhancing overall productivity. This will enable them to focus more on customer interactions and other strategic areas that can impact your company’s growth. I few automated accounts receivable examples could be –

- Payment Reminders: Sending manual payment reminders can be taxing and time-consuming. AI in Accounts receivable software can automate repetitive tasks such as invoice generation, payment reminders, and data entry. This reduces manual effort, minimizes errors, and speeds up the accounts receivable process.

- Automation of Reconciliation: AI can automate repetitive and time-consuming tasks such as data entry, reconciliation, and report generation. This frees up finance professionals to focus on more strategic activities that require human judgment and creativity.

- Customer Interaction: AI-powered accounts receivable can complement customer-facing applications that handle inquiries related to billing, payments, and financial transactions can improve customer satisfaction and reduce the burden on finance teams to address routine queries.

4. Compliance and Regulatory Reporting: AI can assist accounts and receivable teams in ensuring compliance with regulatory requirements and streamlining the reporting process. AI powered accounts receivable systems can automate compliance checks, monitor regulatory changes, and generate accurate reports, reducing the risk of errors and penalties.

5. Integration with ERP Systems: AI powered accounts receivable solutions can seamlessly integrate with existing enterprise resource planning (ERP) systems, providing real-time insights and streamlining data management across the organization.

Conclusion :

AI has the potential to revolutionize the finance, accounts and receivable functions by augmenting human capabilities, automating routine tasks, improving decision-making, and enhancing overall productivity. By leveraging AI technologies effectively, finance, accounts and receivable professionals can unlock new levels of efficiency and effectiveness in their roles, ultimately driving value for their organizations. The advancements in AI, offer significant potential to improve the efficiency, accuracy, and effectiveness of the accounts receivable collections process, enabling companies to enhance cash flow, reduce bad debts, and strengthen customer relationships.