Accounts Receivables Management (ARM)

November 4, 2022How can Accounts Receivables Automation help CFOs

January 23, 2023Understanding the basics of Accounts Receivable (AR) and the related terms is crucial for businesses to effectively manage their cash flow and maintain positive relationships with your customers. Improving accounts receivable is a complex task. For the beginners, the process of accounts of accounts should start with the basics of understanding of various terminologies required to accounts receivable collection and its only then on can focus on improving accounts receivable.

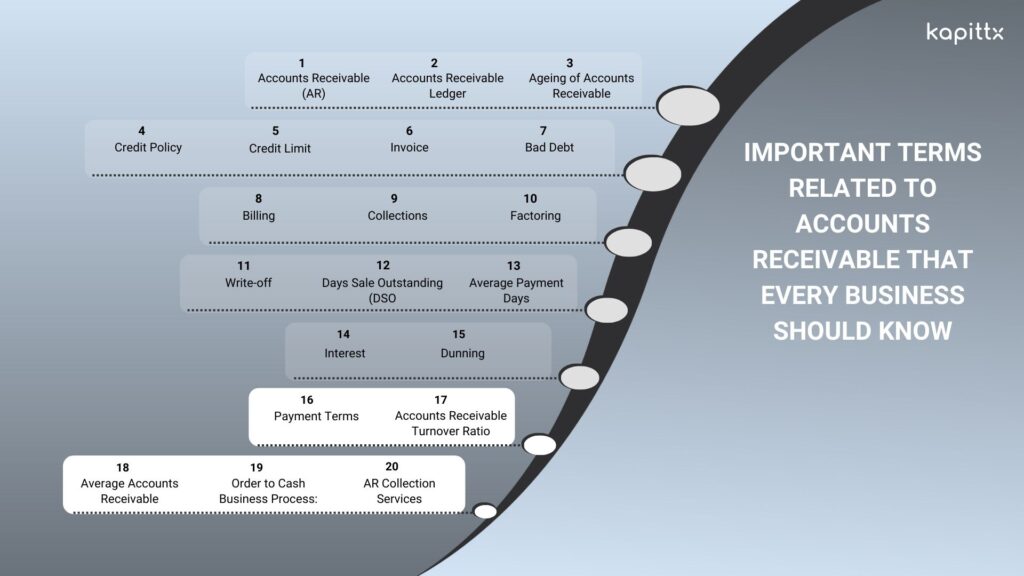

Here is a glossary of some important terms related to Accounts Receivable that every business should know.

1. Accounts Receivable (AR): This is the amount of money that a company is entitled to receive from its customers for goods or services that have been sold but not yet paid for. Accounts receivable is considered a current asset on a company’s balance sheet.

2. Accounts Receivable Ledger: When business done on credit, customer own that money to your company. An accounts receivable ledger is a comprehensive list of customers and the amounts owed to your company. An accounts receivable ledger is a subledger that records all the credit sales, payments, and adjustments for each customer.

3. Ageing of Accounts Receivable: This is a method of classifying accounts receivable by the length of time an invoice has been outstanding. It is used to identify and prioritize overdue invoices and make collection efforts more efficient. Accounts are typically categorized as current, 30 days overdue, 60 days overdue, and so on.

4. Credit Policy: A credit policy is a set of guidelines that a company uses to determine the creditworthiness of its customers. This includes factors such as credit history, financial stability, and payment history. A strict credit policy can help reduce the risk of bad debts, but it can also limit a company’s customer base.

5. Credit Limit: A credit limit is the maximum amount of credit that a company is willing to extend to a customer. This is determined based on the customer’s creditworthiness and the company’s risk tolerance. Credit limits are used to help manage the company’s exposure to bad debt.

6. Invoice: An invoice is a claim document sent to a customer that lists the goods or services provided and the total amount due for payment. Invoices should include a clear payment due date and instructions for making payment.

7. Bad Debt: A bad debt is an account receivable that is unlikely to be collected. This can occur when a customer is unable or unwilling to pay an invoice. Bad debts must be written off and will be an expense for the company.

8. Billing: Billing is the process of issuing invoices to customers for goods or services provided. This includes creating and sending invoices, recording payments, and following up on overdue invoices.

9. Collections: Collections is the process of attempting to collect payment on overdue accounts receivable. This includes contacting customers with past-due invoices, negotiating payment plans, and taking legal action if necessary.

10. Factoring: Factoring is the practice of selling accounts receivable to a third party at a discount in order to receive cash immediately. This can be a useful option for companies that need cash quickly and are willing to accept a lower payment for their receivables.

11. Write-off: A write-off is a process of removing a bad debt from the accounts receivable balance. This is done once it has been determined that the debt is unlikely to be collected.

12. Days Sale Outstanding (DSO): Days Sales Outstanding (DSO) is a financial metric that measures the number of days it takes a business to collect payment from its customers. A high DSO indicates that a business is having a hard time collecting payments from its customers, which can negatively impact cash flow and financial stability. there is a clear need to reduce DSO for businesses.

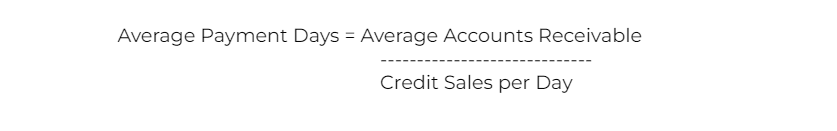

13. Average Payment Days: It is a financial metric that measures average number of days it takes a company to collect payment from its customers after making a sale. As an alternative to Days Sales Outstanding ( DSO ) , it indicates the efficiency of the company’s accounts receivable management and its cash flow position. A lower average payment days means that the company is able to collect cash faster from its customers, and a higher average payment days means that the company is extending more credit to its customers, which may increase the risk of bad debts and reduce the liquidity of the company.

The formula for calculating average payment days is:

14. Interest: The interest on delayed payments payable by the customer. Delay is the period after Due Date. Calculated either daily or monthly.

15. Dunning: the process of sending reminders for outstanding receivables, especially on Overdue receivables.

16. Payment Terms: The agreed upon credit period for a specific customer or invoice. Typically these are Net30, Net60 etc indicating that Due Date is 30/60 days after the invoice date. Some Terms could be complex too with milestones etc.

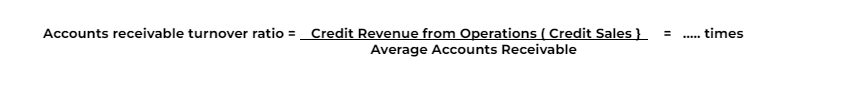

17. Accounts Receivable Turnover Ratio: Accounts Receivable turnover ratio categorized under Activity Ratios, is one of the key metrics measured by companies to assess the company’s financial health and can provide insight into a company’s ability to collect on outstanding invoices. To evaluate a company, Accounts Receivable turnover ratios are used by investors and analysts to assess its liquidity and determine the effectiveness of its credit and collection policies.

Turnover indicates the speed or number of times the capital employed has been rotated in the process of doing business. In other words, these ratios indicate how efficiently the working capital and inventory is being used to obtain sales. Higher turnover ratios indicate better use of capital or resource and, in turn, lead to higher profitability

This ratio indicates the relationship between revenue from operations and average accounts receivables during the year.

The formula of accounts receivable turnover Ratio is :

18. Average Accounts Receivable: Average accounts receivables are calculated by adding the accounts receivable at the beginning of a period as well as at the end of the period and by dividing the total by two.

19. Order to Cash Business Process: The process which involved in entirety from processing the order till the cash collected in know as Order to cash business process.

20. AR Collection Services: To collect payment from their customer, companies leverage the AR collection services from third part organizations. The AR Collection Services can include software, outsourcing, consulting, or training to improve the efficiency and effectiveness of the accounts receivable collection process

The process of accounts receivable management is a crucial part of financial management for any business. By understanding the key terms related to Accounts Receivable, businesses can better manage their cash flow and maintain positive relationships with their customers.

Kapittx is a Software-as-a-Service (SaaS) platform to automate the critical process of Accounts Receivables or Debtors. It enables various stakeholders like Sales, Accounts, Logistics and Customers to collaborate effectively and get paid faster. Founded by veterans in Payments, Finance and Technology domains, Kapittx is built to integrate with your existing processes seamlessly. The easy-to-use interface, enables businesses in diverse fields like manufacturing, services, technology, transportation etc customise it to their own unique requirements. Kapittx recognises that each industry and each company handles receivables in a different way and aims to eliminate the barriers to getting paid faster.

Click here to see a case study from Kapittx.

Check out Kapittx’s LinkedIn here.