10 Accounts Receivable KPIs to Help Improve AR Collection

May 25, 2023Streamlining Accounts Receivable: Boosting Collection Efficiency with Kapittx’s Intelligent Reminders

July 26, 2023Financial ratio analysis is a powerful tool used by companies to assess their financial health and make informed decisions. It involves examining various financial ratios that reflect the company’s liquidity, solvency, activity, and profitability. These ratios provide insights into the company’s financial position, operational efficiency, and overall performance, making them essential for stakeholders such as management and investors.

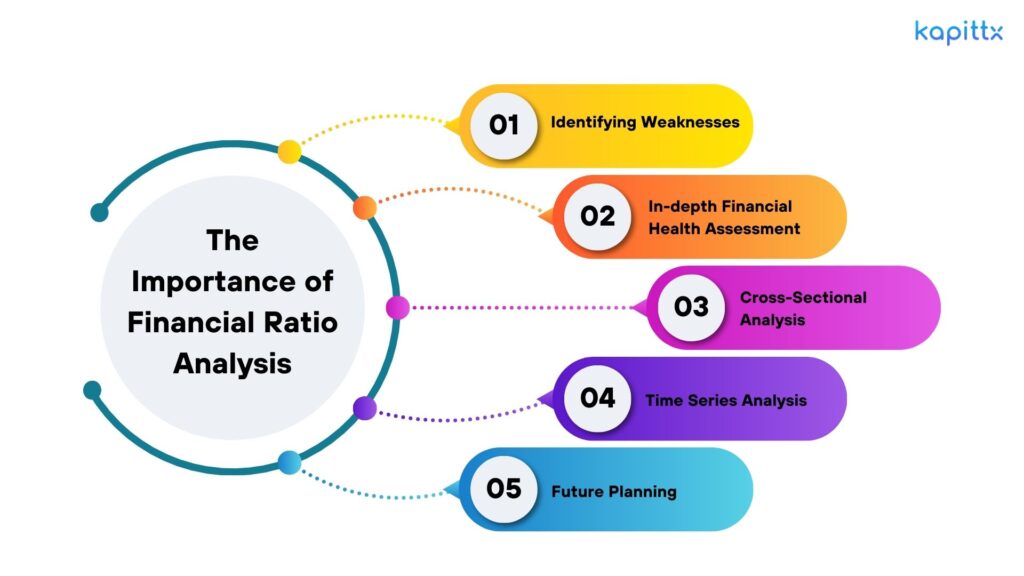

The Importance of Financial Ratio Analysis: Financial ratio analysis serves several critical purposes:

- Identifying Weaknesses: It helps pinpoint areas that require immediate attention and improvement.

- In-depth Financial Health Assessment: It offers a deeper understanding of the company’s liquidity, solvency, activity, and profitability.

- Cross-Sectional Analysis: It allows for comparison with industry peers to gauge relative performance.

- Time Series Analysis: It enables the comparison of current financial ratios with historical data to track progress or identify trends.

- Future Planning: It aids in making forecasts and preparing strategic plans for the future.

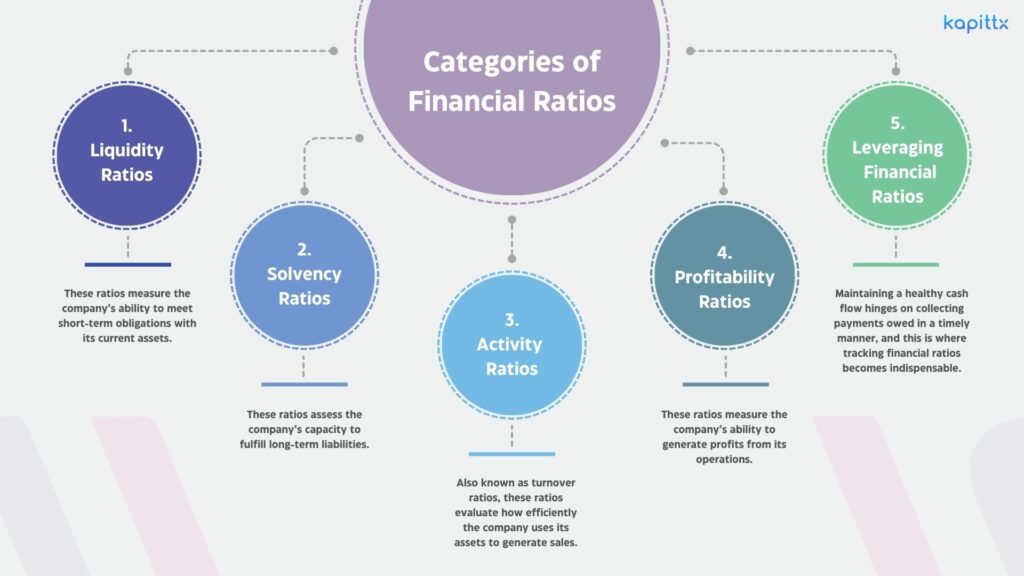

Categories of Financial Ratios Financial ratios can be broadly classified into four categories:

A. Liquidity Ratios: These ratios measure the company’s ability to meet short-term obligations with its current assets. Key liquidity ratios include:

i. Current Ratio

ii. Quick Ratio

B. Solvency Ratios: These ratios assess the company’s capacity to fulfill long-term liabilities. Important solvency ratios are:

i. Debt-Equity Ratio

ii. Debt to Total Asset Ratio

iii. Proprietary Ratio

iv. Interest Coverage Ratio

C. Activity Ratios: Also known as turnover ratios, these ratios evaluate how efficiently the company uses its assets to generate sales. Significant activity ratios include:

i. Inventory Turnover Ratio

ii. Accounts Receivable Turnover Ratio or Trade Receivables Turnover Ratio

iii. Trade Payables Turnover Ratio

iv. Working Capital Turnover Ratio

D. Profitability Ratios: These ratios measure the company’s ability to generate profits from its operations. Essential profitability ratios are:

i. Gross Profit Ratio

ii. Operating Profit Ratio

iii. Net Profit Ratio

iv. Operating Ratio

v. Earnings Per Share

vi. Price-Earning Ratio

vii. Return on Investment

Financial ratio analysis is an indispensable part of strategic financial management. By calculating and comparing these ratios over consecutive accounting years, companies can make data-driven decisions that enhance their financial stability and growth prospects.

Leveraging Financial Ratios: Enhancing Accounts Receivable Management:

Maintaining a healthy cash flow hinges on collecting payments owed in a timely manner, and this is where tracking financial ratios becomes indispensable. These ratios serve as vital metrics, offering insights into the efficiency and effectiveness of accounts receivable management. Let’s delve into how monitoring financial ratios can significantly bolster AR management strategies.

Understanding Accounts Receivable Management

Before we dive into the role of financial ratios, it’s crucial to grasp the essence of accounts receivable management. AR management involves overseeing outstanding invoices and ensuring their timely conversion into cash. It’s a balancing act between extending credit to customers to encourage sales and mitigating the risks associated with delayed or defaulted payments.

The Power of Financial Ratios

Financial ratios are powerful tools that allow businesses to assess various aspects of their financial health and performance. When it comes to AR management, several key ratios come into play:

Days Sales Outstanding (DSO): DSO measures the average number of days it takes for a company to collect payment after a sale has been made. A high DSO indicates that it’s taking longer for the company to convert its accounts receivable into cash, potentially signaling inefficiencies in the collections process.

Accounts Receivable Turnover Ratio: This ratio measures how efficiently a company is managing its AR by comparing net credit sales to the average accounts receivable balance. A higher turnover ratio suggests that the company is collecting its outstanding invoices more quickly.

Aging of Accounts Receivable: This analysis categorizes outstanding invoices by their age, typically into buckets such as current, 30-60 days, 60-90 days, and over 90 days past due. By examining the aging of AR, businesses can identify overdue accounts and take appropriate actions to expedite collections.

Accounts Receivable turnover ratio categorized under Activity Ratios, is one of the key metrics measured by companies to assess the company’s financial health and can provide insight into a company’s ability to collect on outstanding invoices.

To evaluate a company, Accounts Receivable turnover ratios are used by investors and analysts to assess its liquidity and determine the effectiveness of its credit and collection policies.

In general, Activity Ratios are calculated on the basis of the cost of sales or sales. Therefore, these ratios are also called “Turnover Ratios”. Turnover indicates the speed or number of times the capital employed has been rotated in the process of doing business. In other words, these ratios indicate how efficiently the working capital and inventory are being used to obtain sales. Higher turnover ratios indicate the better use of capital or resources and, in turn, lead to higher profitability.

Some important turnover ratios are –

i) Accounts Receivable Turnover Ratio ( ARTO )

ii) Accounts Payable Turnover Ratio

iii) Inventory Turnover Ratio

iv) Working Capital Turnover Ratio

Accounts Receivable Turnover Ratio:

This ratio indicates the relationship between revenue from operations and average accounts receivables during the year.

Average accounts receivables are calculated by adding the accounts receivable at the beginning of a period as well as at the end of the period and by dividing the total by two.

While calculating this ratio, the provision for bad debt and doubtful debts is not deducted from total accounts receivable, so it may not give a false impression that accounts receivable are collected quickly.

Accounts Receivable turnover ratio can also be converted into the number of days within which the cash is collected from accounts receivable :

If the Average Collection Period is 45 days means that, on average, accounts receivable take 45 days to get converted into cash. In other words, credit sales are locked up in accounts receivable for 45 days.

An increase in the average collection period indicates the blockage of funds with accounts receivable, which increases the risk of bad debts. A higher average collection period is, thus, an indication of the inefficiency of the accounts receivable management process or high customer dissatisfaction.

Significance of Accounts Receivable Turnover Ratio:

The significance of the AR turnover ratio is that this ratio indicates the speed with which the amount is collected from accounts receivable. The higher the ratio, the better it is. It indicates that the amount from accounts receivable is being collected more quickly.

The more quickly the accounts receivable are collected, the less the risk from bad debts, and so the lower the expenses of collection and increase in the liquidity of the firm. A lower accounts receivable ratio will indicate a need to revisit the accounts receivable management process and tighten the firm’s credit sales policy. It also means that credit sales have been made to customers who do not deserve much credit and expose your company to losses due to bad debts. For example, a comparison between two periods, if the accounts receivable turnover ratio has decreased from 12 times to 8 times, it indicates that the amount from accounts receivable is not being collected in time. The company’s policy relating to the collection of accounts receivable and the selection of customers for credit sales purposes is not sound.

Now, let’s explore how tracking AR turnover ratio can lead to tangible improvements in accounts receivable management:

Identifying Collection Issues: By regularly monitoring DSO and accounts receivable turnover ratio, businesses can pinpoint inefficiencies in their collections process. For instance, a sudden increase in DSO may indicate that certain customers are taking longer to pay, prompting the need for closer scrutiny and follow-up.

Optimizing Credit Policies: Analyzing the aging of accounts receivable provides valuable insights into the creditworthiness of customers and the effectiveness of credit policies. Businesses can adjust credit terms and limits based on the aging analysis to minimize the risk of late payments or defaults.

Improving Cash Flow Forecasting: Accurate cash flow forecasting relies on understanding the timing of cash inflows from accounts receivable. By tracking DSO and accounts receivable turnover, businesses can better predict future cash flows and make informed decisions about budgeting and investment.

Enhancing Customer Relationships: Proactive management of accounts receivable, facilitated by financial ratio analysis, can strengthen relationships with customers. Timely follow-up on overdue invoices demonstrates a commitment to service excellence and encourages prompt payment, fostering trust and loyalty.

Conclusion

In the realm of accounts receivable management, knowledge is power, and financial ratios serve as the compass guiding businesses toward improved efficiency and profitability. By diligently tracking metrics such as DSO, accounts receivable turnover ratio, and aging of accounts receivable, organizations can gain invaluable insights, optimize their collections process, and ultimately bolster their financial health. In today’s dynamic business landscape, leveraging the analytical prowess of financial ratios is not just advantageous—it’s essential for sustained success.