Empowering Technology and IT Services with Financial Efficiency

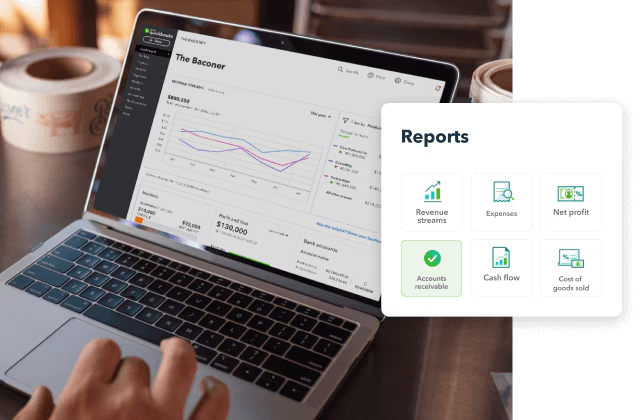

Kapittx is committed to helping Technology and IT services companies optimize their financial operations, ensuring that you can focus on what you do best—driving innovation and delivering exceptional service to your clients. With our AI Powered Accounts Receivable Automation software, you can streamline your financial processes, reduce DSO, and achieve greater financial stability.

Why Technology and IT Services Companies Choose Kapittx

Developing a Robust Accounts Receivable Management Strategy for IT Services Companies

For IT companies, managing cash flow effectively is critical to scaling operations, meeting payroll, and investing in innovation. Complex billing cycles, recurring contracts, and milestone-based payments add layers of complexity to Accounts Receivable (AR) management. Kapittx automated payment reminders, AR analytics, and dispute resolution best practices, are designed to address the unique needs of Technology and IT companies.

A strong AR strategy ensures predictable cash flow and enhances client relationships in IT services. Here’s how to build one:

Accurate

Invoicing

Avoid payment delays by ensuring invoices align with agreed-upon contracts and milestones.

Customizable Payment Plans

Offer flexible payment terms for long-term clients to maintain trust and loyalty.

Integrated Billing Systems

Use ERP or cloud-based platforms for real-time invoice generation, tracking, and reconciliation

Data-Driven

Insights

Leverage AR analytics to monitor client payment behavior and identify risk areas proactively.

Case Study: Improving AR Management for a Mid-Sized IT Services Firm

Background

An IT products and services company struggled with delayed milestone payments from enterprise clients, causing cash flow constraints during project execution.

Solution

The firm adopted an AI-driven AR analytics tool to identify late-paying clients and implemented automated reminders tailored to project milestones.

Outcome

- Reduced Days Sales Outstanding (DSO) by 20%.

- Improved collection rates by 35%.

- Enhanced client satisfaction through consistent communication.

Key Components of an Effective AR Management Strategy for IT Services Companies

- Contract Management

Clearly define payment terms, including due dates, milestone triggers, and penalties for delays. - Automation Tools

Use cash application software to reconcile payments for recurring or milestone-based billing models. - Client Segmentation

Prioritize follow-ups based on client risk profiles and payment histories. - Performance Tracking

Monitor metrics such as DSO, overdue invoices, and dispute resolution times to refine processes.

Automated Payment Reminders: Keeping IT Company’s Cash Flow on Track

Recurring billing and milestone payments often lead to missed due dates in IT services. Automated payment reminders can simplify collections and ensure timely payments.

Benefits of Automated Payment Reminders

Case Study: Payment Reminder Automation for a SaaS Provider

Background

A SaaS company with monthly subscription billing faced delayed renewals, leading to cash flow inconsistencies.

Solution

Automated reminders were deployed with customized messaging for upcoming renewals, due dates, and overdue accounts.

Outcome

- Reduced overdue invoices by 40%.

- Improved retention rates for clients on recurring billing cycles.

- Strengthened client relationships through timely, non-intrusive communication.

AR Analytics: Actionable Insights for IT Services Companies

AR analytics is a game-changer for IT services companies dealing with diverse payment terms and high-value contracts. It offers actionable insights into payment behaviors, helping optimize AR processes.

Key Advantages of AR Analytics

- Payment Behavior Trends Track late payments and recurring issues to address bottlenecks proactively.

- Cash Flow Forecasting Predict cash flow gaps by analyzing payment trends across projects and clients.

- Client Risk Assessment Segment clients based on payment histories to refine credit policies and payment terms.

Best Practices for AR Analytics in IT Services

- Integrate analytics tools with billing platforms for seamless reporting.

- Use data insights to negotiate favorable terms with clients.

- Regularly review metrics like DSO and outstanding payments to ensure financial health.

Efficient Cash Application: Optimizing Payment Reconciliation for IT Services Companies

For IT services companies, reconciling payments against milestone-based invoices or recurring billing models is often time-consuming. AI-powered cash application tools streamline this process, ensuring accuracy and speed.

Steps to Optimize Cash Application

- Automated Matching

Use AI to match payments with invoices across multiple billing models, including subscriptions and project milestones. - Minimized Errors

Reduce errors in reconciliation to avoid disputes and improve operational efficiency. - Real-Time Reporting

Enable real-time updates to AR records, ensuring accurate cash flow visibility.

Case Study: AI-Powered Cash Application for a Managed IT Services Provider

Background

A managed services provider struggled with delayed reconciliation for multi-year contracts with milestone payments.

Solution

AI-driven cash application software automated payment matching and reduced manual interventions.

Outcome

- Improved reconciliation rates from 70% to 95%.

- Reduced unapplied cash by 50%

- Enhanced client trust with quicker dispute resolutions.

Dispute Management: Enhancing Client Relationships for IT Services Companies

Disputes are common in IT services due to billing errors, unclear milestones, or contract misalignment. A structured dispute management process ensures issues are resolved efficiently while maintaining strong client relationships.

Best Practices for Dispute Management in IT Services

- Proactive Communication Regularly update clients on invoice status and resolve concerns before they escalate.

- Centralized Dispute Logging Use software to track disputes from initiation to resolution, ensuring accountability.

- Quick Turnaround Times Set SLAs for resolving disputes to minimize payment delays.

KPIs to Measure AR Success for IT Services Companies

Track these metrics to evaluate the effectiveness of your AR strategy:

Days Sales Outstanding (DSO): Shorter DSO indicates faster cash collections.

Dispute Resolution Time: Measure the average time taken to resolve client disputes.

Recurring Billing Efficiency: Monitor renewal rates and on-time payments for subscription clients.

Why Kapittx is Ideal for IT Services Companies

Kapittx provides cutting-edge solutions to address the unique AR challenges of IT services companies:

AI-powered cash application tools for milestone and recurring billing reconciliation.

Automated payment reminders for timely client communication.

Advanced AR analytics tools to unlock actionable insights.

Efficient dispute resolution frameworks to preserve client relationships.

- With Kapittx, IT services companies can streamline AR processes, improve cash flow predictability, and enhance client satisfaction.

Transforming AR Management for IT Services

Effective AR management is essential for IT services companies to ensure steady cash flow, support business growth, and maintain strong client relationships. By adopting innovative solutions like automated payment reminders, AR analytics, and AI-powered cash application tools, businesses can optimize financial operations and drive long-term success.

Ready to elevate your AR management? Discover how Kapittx can transform your business today!

Benefits of using Kapittx AI Powered Accounts Receivable Automation Software

- Seamless Integration with Your Ecosystem: Kapittx integrates seamlessly with your existing ERP, CRM, and financial systems.

- Enhanced Customer Relationships: Set up automated reminders, and provide a transparent billing and AR process, enhancing customer satisfaction and retention.

- Insights to Actions: Gain instant access to key metrics and insights with well designed dashboards that keep you informed of your financial health.

- Integrated Document Management: Never miss sending a list supporting documents along with the invoice to expedite payment approvals.

- Proactive Dunning Strategies: Automate follow-ups, reminders, and dunning processes to ensure timely payments and reduce bad debt.

Talk To Expert

FAQs

What is the AR process in IT industry?

The Accounts Receivable (AR) process in the IT industry is crucial for maintaining healthy cash flow and ensuring timely payments for services rendered. Here’s a step-by-step overview of the AR process:

Credit Assessment and Approval: Evaluate the creditworthiness of potential clients before extending credit. This involves analyzing financial statements, credit references, and payment history.

Unbilled transactions: Based on the delivery commitments, have a view of what is in the pipeline to bill. Many companies monitor unbilled transactions as they recognise the unbilled revenue

Invoicing: Generate and send invoices to clients for services provided. Ensure that invoices are accurate and include all necessary details such as service descriptions, amounts, and payment terms.

Tracking and Monitoring: Keep track of all outstanding invoices and monitor payment statuses. This helps in identifying overdue payments and taking necessary actions.

Collections: Follow up with clients on overdue payments. This may involve sending reminders, making phone calls, or negotiating payment plans.

Payment Processing: Record payments received from clients and update the accounts receivable ledger. Ensure that payments are accurately posted to the correct accounts.

Reconciliation: Regularly reconcile the accounts receivable ledger with the general ledger to ensure accuracy and identify any discrepancies.

Reporting: Generate reports on accounts receivable status, including aging reports, to provide insights into the financial health of the business and identify any potential issues.

By following these steps, IT companies can effectively manage their accounts receivable, maintain a steady cash flow, and build strong relationships with their clients.

What are the 5 strategies for effective accounts receivable management?

Effective Accounts Receivable (AR) management is crucial for maintaining healthy cash flow and achieving financial goals. Here are the top 5 strategies for successful AR management:

Establish Clear Credit Policies: Define credit terms and criteria for evaluating customer creditworthiness. This helps in reducing the risk of bad debts and ensures that only reliable customers are extended credit.

Timely Invoicing and Follow-Up: Send invoices promptly and follow up on overdue payments regularly. Implementing a systematic reminder system can help in reducing the Days Sales Outstanding (DSO).

Automate AR Processes: Use automation tools to streamline the AR process, reduce manual errors, and improve efficiency. Automated reminders, payment tracking, and reconciliation can significantly enhance AR management.

Offer Multiple Payment Options: Provide customers with various payment options, such as credit card payments, bank transfers, and online payment gateways. This makes it easier for customers to pay on time and improves cash flow.

Maintain Strong Customer Relationships: Building and maintaining positive relationships with customers can lead to better payment behaviors. Communicate effectively, resolve disputes quickly, and offer flexible payment plans when necessary.

Like any strategy, an AR strategy requires a goal in terms of cash or DSO target measured over time. Based on the company’s cash position and debtors list, one can define a short-term or mid-term AR strategy and accordingly press the button on the relevant components to gain maximum benefits.

In the hub of the Wheel of Accounts Receivable Strategy are the company’s goals to ingest cash by reducing DSO. The spokes of the wheel are key operating components that can potentially decide the accounts receivables outcome. Like in a wheel, the hub and spokes are connected; each component described will significantly impact the cash flow goals.

What is the role of Accounts Receivable department in IT industry?

The Accounts Receivable (AR) department in the IT industry plays a crucial role in managing the financial health and cash flow of the company. Here are the key functions and responsibilities of the AR department:

Credit Management: Assessing the creditworthiness of clients and setting credit terms and limits to minimize the risk of bad debts.

Invoicing: Generating and sending accurate invoices to clients for services rendered or products delivered. This includes tracking billable hours, project milestones, and any additional costs.

Payment Processing: Recording and processing payments received from clients, ensuring they are accurately posted to the correct accounts.

Collections: Following up with clients on overdue payments through reminders, phone calls, and negotiating payment plans if necessary.

Dispute Resolution: Addressing and resolving any billing disputes or discrepancies with clients to maintain positive relationships and ensure timely payments.

Reconciliation: Regularly reconciling the AR ledger with the general ledger to ensure accuracy and identify discrepancies.

Reporting and Analysis: Providing detailed reports and analysis on AR status, including aging reports and cash flow projections, to assist in making informed business decisions.

Compliance: Ensuring all financial transactions comply with relevant accounting standards and regulations and maintaining proper documentation for audits and financial reporting.

By effectively managing these functions, the AR department helps IT companies maintain a steady cash flow, reduce the risk of bad debts, and achieve financial stability.

What is a good AR aging percentage in IT industry?

In the IT industry, maintaining an optimal Accounts Receivable (AR) aging percentage is essential for managing cash flow and financial stability. As you've mentioned, AR continues to be a significant asset on the balance sheet. Here are some general benchmarks for past due AR aging:

Product Sales: Ideal past due AR aging ranges from 5% to 10%. This lower range reflects the relatively straightforward nature of product transactions, where payments are expected shortly after delivery.

Products with Services: Ideal past due AR aging ranges from 10% to 15%. The combination of products and services introduces some complexity, which can lead to slightly longer payment cycles.

IT Services: Ideal past due AR aging ranges from 12% to 18%. Pure service offerings often involve longer project timelines and more extended payment terms, leading to a higher acceptable range for past due receivables.

These percentages are influenced by several factors, including the company's credit policy, the quality of its product and service delivery, and its approach to collections. The actual percentage may vary from company to company, and it's essential to regularly monitor and adjust AR strategies to align with the company's financial goals and market conditions.

Maintaining a healthy AR aging percentage helps ensure that the company can meet its financial obligations, invest in growth opportunities, and maintain positive relationships with clients.