Accounts Receivables Portfolio Strategy: The Modern Approach To Accounts Receivable Management

September 9, 2024What is Cash Application and How AI is Revolutionizing Cash Application Management?

October 17, 2024The technology and IT services industry is a dynamic and rapidly evolving sector that encompasses a wide range of services and products aimed at managing and optimizing information and business processes.

The Technology and IT Services industry is driven by several key factors that are shaping its growth and evolution. While AI is going to bring in a paradigm shift in the industry and its offering, some of the primary drivers of this industry are Digital Transformation, Cloud Computing, Big Data and Analytics, Internet of Things, Technology innovations like 5G, Blockchain, SaaS etc.

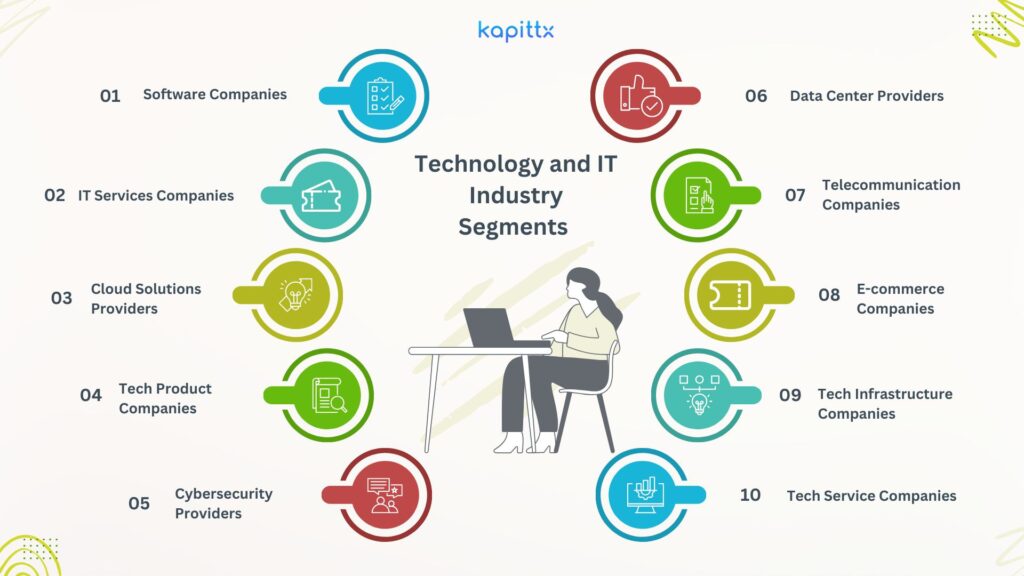

Technology and IT Industry Segments :

The Technology and IT Services industry is broadly segmented into several key areas, each playing a crucial role in the overall ecosystem. Here’s a brief summary of the main segments:

1. Software Companies

- Independent Software Vendors (ISVs): These companies develop and sell custom made software solutions that can be used by different industries.

- Software as a Service (SaaS): These companies provide software applications over the internet and have high dependence on subscription management.

2. IT Services Companies

- System Integrators or Value Added Resellers: These firms are solution providers and play the role of an aggregator by incorporating various hardware and software offerings from OEMs as part of their solution.

- Managed Service Providers (MSPs): These companies manage a customer’s IT infrastructure and end-user systems on a proactive basis.

- IT Consulting Services: These firms offer expert advice to help organizations assess and implement advanced IT solutions.

3. Cloud Solutions Providers

- Infrastructure as a Service (IaaS): These companies provide virtualized computing resources over the internet.

- Platform as a Service (PaaS): For application development, hardware and software tools over the internet are the primary focus of PaaS providers

4. Tech Product Companies

- Hardware Manufacturers: These companies produce physical devices such as computers, smartphones, and networking equipment.

- Semiconductor Companies: These firms design and manufacture semiconductor chips used in electronic devices.

5. Cybersecurity Providers

- These companies offer products and services to protect systems, networks, and data from cyber attacks.

6. Data Center Providers

- These companies offer facilities and services for housing and managing data storage systems.

7. Telecommunication Companies

- These firms provide communication services such as internet, phone, and television.

8. E-commerce Companies

- These companies operate online platforms for buying and selling goods and services.

9. Tech Infrastructure Companies

- These companies provide the systems and facilities that enable web-based communications and commerce.

10. Tech Service Companies

- These companies offer experienced and technical personnel to help businesses leverage technology.

Irrespective of the segment you operate, in the dynamic landscape of Technology and IT services sector, accounts receivable management and ensuring smooth cash flow are critical for sustaining growth and operational efficiency. However, these companies often face significant challenges that can impede their financial health. This blog post delves into the primary reasons behind accounts receivable challenges and offers insights into how they can be addressed to reduce DSO and increase cash flow.

1. High Days Sales Outstanding (DSO)

One of the most pressing issues is the high Days Sales Outstanding (DSO), which measures the average number of days it takes for a company to collect payment after a sale. A high DSO means the time taken by customers to pay the invoices is longer and exceeding the credit perion offered. This can severely impact cash flow and several factors contribute to this:

- Complex Billing Cycles: Technology and IT services often involve complex billing structures, including milestone-based payments, subscription management models, and time-and-materials contracts. These complexities can contribute to the delays in invoicing and collections.

- Client Negotiations: Clients, especially large enterprises, may negotiate extended payment terms, further elongating the DSO.

2. Inefficient Accounts Receivable Processes

Inefficient accounts receivable processes can lead to delays and errors in invoicing and payment collection. Common inefficiencies include:

- Manual Processes: Reliance on manual processes for invoicing and payment tracking can result in errors and delays.

- Lack of Automation: Without automation, accounts receivable teams spend excessive time on routine tasks, leaving less time for strategic activities like follow-ups and dispute resolution.

3. Disorganized Ledger Management

Disorganized ledger management can cause significant issues in tracking and reconciling payments. This disorganization can stem from:

- Inconsistent Record-Keeping: Inconsistent or inaccurate record-keeping can lead to discrepancies between the amounts billed and the amounts received.

- Poor Communication: Lack of communication between departments can result in incomplete or incorrect information being recorded in the ledger.

4. Customer Disputes and Payment Delays

Customer disputes over invoices can lead to payment delays and strained relationships. Common causes of disputes include:

- Billing Errors: Errors in invoices, such as incorrect amounts or missing details, can contribute to payment delays and disputes.

- Service Issues: Disputes may also arise from perceived issues with the services provided, leading customers to withhold payment until the issues are resolved.

5. Economic Uncertainty

Economic uncertainty can exacerbate AR and cash flow challenges. Factors contributing to this include:

- Market Volatility: Economic downturns or market volatility can lead to reduced spending by clients, resulting in delayed or missed payments.

- Budget Constraints: Clients facing their own financial challenges may delay payments to manage their cash flow, impacting the AR of technology and IT services companies.

6. Regulatory Compliance

Compliance with various regulations can add complexity to the AR process. For example:

- Data Privacy Regulations: Ensuring compliance with data privacy regulations like GDPR and CCPA can require additional resources and processes, potentially slowing down AR activities.

- Financial Reporting Standards: Adhering to financial reporting standards can necessitate detailed documentation and verification, adding to the administrative burden.

7. Supply Chain Disruptions

Supply chain disruptions can impact the delivery of products and services, leading to delays in invoicing and payment collection. These disruptions can be caused by:

- Geopolitical Tensions: Geopolitical tensions can disrupt supply chains, leading to delays in project completion and invoicing.

- Raw Material Shortages: Shortages of essential raw materials can delay production and delivery, impacting the timing of invoicing and payment collection.

8. Technological Challenges

While technology is a key enabler for IT services companies, it can also pose challenges:

- Integration Issues: Integrating new technologies with existing systems can be complex and time-consuming, potentially leading to delays in AR processes.

Cybersecurity Threats: Cybersecurity threats can disrupt operations and lead to delays in invoicing and payment collection.

Addressing the Challenges

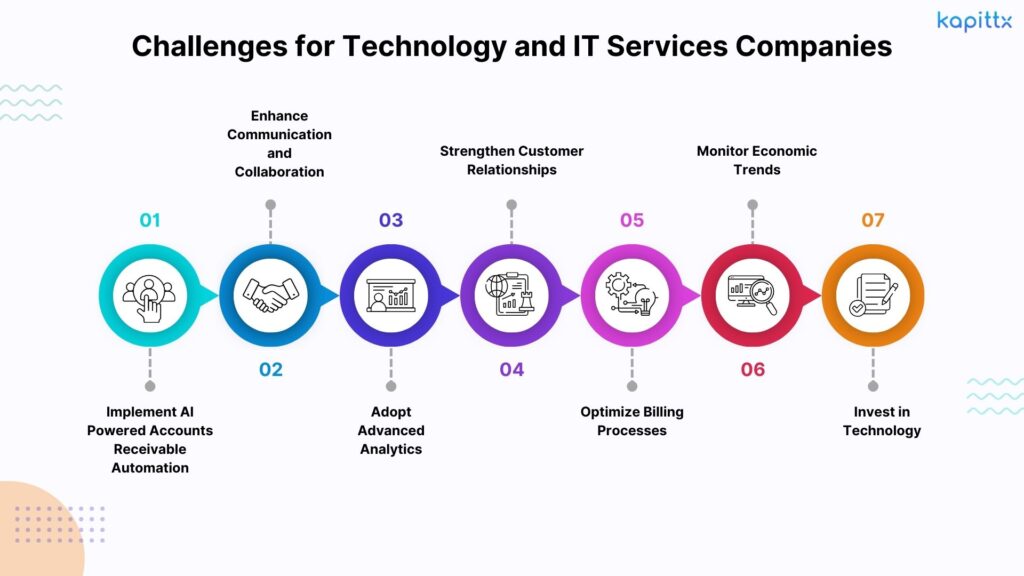

To overcome these challenges, technology and IT services companies can adopt several strategies:

1. Implement AI Powered Accounts Receivable Automation

Automating accounts receivable processes can significantly improve efficiency and accuracy. Automation tools can handle routine tasks like invoicing, payment tracking, and reminders, freeing up AR teams to focus on strategic activities. Automation can also reduce errors and speed up the payment collection process.

2. Enhance Communication and Collaboration

Improving communication and collaboration between departments can help ensure accurate and consistent record-keeping. Regular meetings and updates can help identify and resolve issues quickly, reducing the risk of disputes and delays.

3. Adopt Advanced Analytics

Leveraging advanced analytics can provide valuable insights into payment behaviors, customer creditworthiness, and collection effectiveness. Predictive analytics can help forecast cash inflows and identify high-risk accounts, enabling proactive management of AR.

4. Strengthen Customer Relationships

Building strong relationships with customers can help reduce disputes and payment delays. Regular communication and prompt resolution of issues can enhance customer satisfaction and encourage timely payments.

5. Optimize Billing Processes

Streamlining billing processes can help reduce errors and delays. This can include adopting standardized billing templates, conducting regular audits, and ensuring timely and accurate invoicing.

6. Monitor Economic Trends

Keeping a close eye on economic trends can help companies anticipate and prepare for potential challenges. This can include diversifying the customer base, offering flexible payment terms, and maintaining a healthy cash reserve.

7. Invest in Technology

Investing in technology can help address integration and cybersecurity challenges. This can include adopting cloud-based solutions, implementing robust cybersecurity measures, and ensuring seamless integration of new technologies with existing systems.

Conclusion

Accounts receivable and cash flow challenges are significant hurdles for technology and IT services companies. However, by adopting strategic measures such as AI powered accounts receivable automation, advanced analytics, and improved communication, these companies can overcome these challenges and ensure sustained growth and financial stability. At Kapittx, we are committed to helping businesses streamline their AR processes and optimize cash flow through innovative AI-powered accounts receivable solutions. By addressing these challenges head-on, companies can focus on what they do best – delivering cutting-edge technology and IT services to their clients.