Transforming Accounts Receivable: A Deep Dive into Modern Solutions with Kapittx

September 6, 2023How to fix the Accounts Receivable Mistakes

September 12, 2023Accounts receivable refers to the money that a business is owed by its customers for goods or services that have been delivered but have yet to be paid for. Managing accounts receivable is a crucial aspect of running a business, as it directly impacts the cash flow and financial stability of the company. However, accounts receivable challenges can be overwhelming and take a toll on resources, and customer satisfaction. In this blog post, we will discuss some of the common issues in accounts receivable and how to resolve them.

Why Accounts Receivable is challenging and what we can do about it?

It has been proven that businesses experience difficulties with the collection process of accounts receivable, leading to delays in payments or short payments. There are different views on the underlying reason for this problem and how management should address the accounts receivable challenges.

Accounts receivable is one of the largest tangible assets that a business holds. Therefore, managerial attention, connected to the dependence on the resources to manage the asset is necessary to consider. Management of the internal business process and factoring the external environment involving customer payable process and the macro factors they operate has shown to be a key aspect in collecting accounts receivable on time.

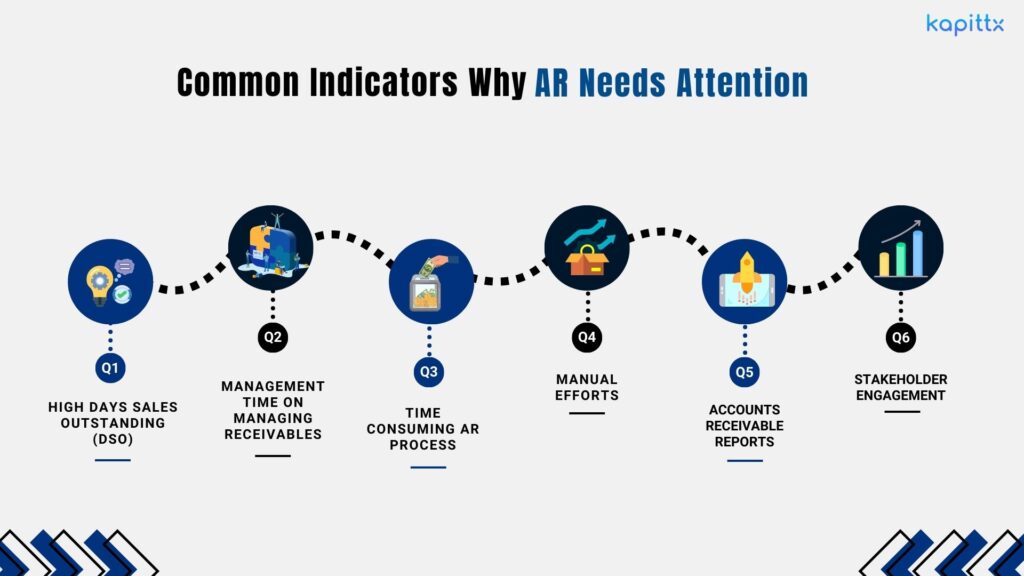

We conducted a survey with more than 500 Finance professionals across 300 companies in various industries and regions. They shared their insights on accounts receivable challenges. Here are some of the common indicators that AR needs attention and improvement:

- High Days Sales Outstanding (DSO): One of the most significant problems in accounts receivable management is slow payment from customers. Many businesses rely on a steady stream of cash flow to cover expenses, and when payments are delayed, it can create a financial strain on the company. DSO as a metric measures the average number of days it takes to collect payment from customers after a sale. A high DSO indicates that customers are paying slowly or not at all, which affects the cash flow and profitability of the business.

- Management time on managing receivables: Significant management time is involved in managing receivables: When AR processes are inefficient or manual, they require a lot of time and attention from the finance team and the management. This reduces the time available for strategic planning, analysis, and decision-making.

- Time consuming AR process: To provide information and/or documentation to both internal and external clients can be time consuming. Accounts receivable management involves a lot of data and documents, such as invoices, contracts, receipts, credit notes, etc. These need to be accurate, consistent, and accessible to both the internal stakeholders (such as sales, operations, and accounting) and the external clients (such as customers, auditors, and regulators). However, many businesses still rely on spreadsheets and paper-based systems to track and manage AR, which are prone to errors, duplication, and loss. This makes it difficult and time consuming to provide the required information and/or documentation to the relevant parties, which can lead to disputes, delays, and dissatisfaction.

- Manual efforts: A lot of manual effort goes into sending emails and updating multiple spreadsheets: Contacting clients via verbal and written communication for payment of past due invoices can be a daunting task when the number of clients and invoice volumes are high. It requires a lot of effort to send personalized and timely reminders, update the payment status, and record the communication history. Moreover, using multiple spreadsheets to track and manage AR can create confusion, inconsistency, and inefficiency, as different versions of the data may exist across different files and users.

- Accounts receivable reports: Reports generation is time-consuming and does not give an accurate picture of cash flow: AR reports are essential for monitoring the performance and health of the business, as they provide information on the outstanding balances, aging analysis, collection efficiency, and cash flow projections. However, generating these reports manually from multiple sources of data can be time-consuming and error-prone, resulting in inaccurate and outdated information. This can affect the quality of the financial reporting and analysis, as well as the decision-making and planning of the business.

- Stakeholder engagement: Interaction with the internal stakeholders and colleagues like Collection Manager, Operation Designees, Business Controllers, Project Managers, Account Executives and/or Executive Director of Sales to resolve client issues is frustrating and drains energy: AR is not only a finance function, but also a cross-functional process that involves collaboration and coordination with various internal and external parties. However, when AR processes are inefficient or ineffective, they can create a lot of issues and conflicts that need to be resolved. For instance, there may be discrepancies between the invoice and the contract, disputes over the quality or delivery of the goods or services, or complaints about the payment terms or methods. These issues can cause frustration and stress for the finance team and the other stakeholders, as they have to spend a lot of time and energy to communicate, negotiate, and resolve them.

What should be the approach to deal with the internal challenges?

A. Definition and Components of a Global Accounts Receivable Strategy:

External challenges you may not be able to control, however, one can definitely address the internal challenges leading to delayed payments. Let us pick each one of them –

1. Leadership focus: They always say – what you focus on will grow. It is key for the leaders to set the tone on why collecting receivables on time is critical to the company’s success. This focus should be reflected in the day-to-day execution as well as weekly reviews. Introducing an accounts receivable automation software to address accounts receivable challenges can address many difficulties faced by the team on a day-to-day basis.

2. Ignored processes: What worked for you in the past may not work for you in the future. It is critical to map the pre-invoicing to invoice-to-cash process and assess which part of your process is contributing to accounts receivable challenges. By embracing an AR collection software one can significantly address the accounts receivable challenges and redefine cash flow management strategies.

3. Lack of proper KPI and measurement: What you measure gets better. Define the key metrics to measure your collection team’s performance. To execute your cash flow management strategies, one needs have a robust measurement system. An accounts receivable automation software will help you map your key KPIs and effectively measure you performance.

4. Disorganized data : Receivables is all about segmenting and creating portfolio buckets to manage it better. Collectors while engaging with customers or managers during AR reviews should spend the least time to the visibility of data that matters. Organizing your accounts receivable portfolio using spreadsheets can be challenging and you may want to use AR collection software to get your team organized for better execution.

5. Quality of people : Like any other business function, receivables productivity also depend of quality and experience of people. Also people can do wonders if they are supported with accounts receivable automation software.

6. Poor reminder system: Based on the AR portfolio, leverage accounts receivable automation software to send timely reminders that are consistent, persistent, polite and personalized. By sending periodic reminders and documenting it, you are making your case stronger in the event you need to go legal.

7. Delays in invoice submission time: At your customer’s end, your payment will only get cleared on time if the invoices are send on time. Identify the bottlenecks that are impacting invoice submission on time. Go digital and use accounts receivable automation to submit your invoice and eliminate manual dependency.

9. Poor credit management: Set credit limits for each customer. This will help minimize the exposure in the event of a customer’s business going down south.

10. Frequent changes in people managing AR: People change can be minimized but not eliminated. Use automation to mitigate the risk of people change.

11. Delivery of what you promise: Gaps in product or service delivery create disputes and lead to non payments: Work towards delivering what you promise. Happy customers will pay you on time.

12. ERP customization challenges: Making customizations in the ERP can be time-consuming and expensive. Leverage ready-to-use accounts receivable automation software to address gaps in ERP to manage receivables.

There are many external factors that can affect the efficiency and effectiveness of AR management. Some of these factors are:

- Macro economic indicator: The macro economic indicator refers to the overall state and performance of the economy, such as GDP, inflation, unemployment, interest rates, etc. These factors can influence the demand and supply of goods and services, as well as the ability and willingness of customers to pay their invoices on time. For example, during a recession, customers may face financial difficulties or uncertainty, and may delay or default on their payments. This can increase the risk of bad debts and reduce the cash flow of the business.

- Unorganised Customer payable process: The customer payable process is the system and procedure that customers use to manage and pay their invoices. If this process is unorganised, inefficient, or inconsistent, it can create problems for AR management. For example, customers may have different payment terms, methods, or cycles, which can make it difficult to track and reconcile payments. Customers may also have poor record-keeping, communication, or dispute resolution practices, which can lead to errors, delays, or conflicts in the payment process.

- Lack of visibility on approval process and TATs: The approval process and TATs (turnaround times) are the steps and time frames that customers follow to review, verify, and approve invoices before making payments. If there is a lack of visibility or transparency on these aspects, it can affect the efficiency and accuracy of AR management. For example, customers may not inform the business about the status or progress of the invoice approval, or may change or delay the approval without notice. This can create uncertainty and confusion for the business, and may result in late or missed payments.

- Disputes highlighted by customers after the due date: Disputes are disagreements or conflicts that arise between the business and the customers over the invoice amount, quality, or delivery of the goods or services. Disputes can negatively impact the AR management, as they can delay or prevent the payment of the invoices. Moreover, if customers highlight or raise disputes after the due date of the invoice, it can create further complications and challenges for the business. For example, customers may use disputes as an excuse or tactic to avoid or postpone payments, or may demand refunds or discounts that are not justified or agreed upon.

- Customers mindset to use supplier money as an invisible bank: Some customers may have a mindset or attitude to use the supplier money as an invisible bank, meaning that they treat the unpaid invoices as a source of interest-free credit or financing. This can affect the AR management, as customers may intentionally or habitually pay their invoices late or partially, or may request for longer payment terms or extensions. This can reduce the cash flow and profitability of the business, and may increase the cost and risk of AR collection.

To conclude, accounts receivable management is vital but difficult for any business. AR problems include delayed or unpaid invoices, errors or gaps in billing, bad debts, poor organization and tracking, and currency issues. Monitoring the external factors and addressing the internal challenges that affect receivables can greatly improve the AR process and cash flow.

Click here to see a case study from Kapittx.

Check out Kapittx’s LinkedIn here.