Securing B2B Enterprise SaaS Subscription Payments On Time

May 23, 2024How Accounts Receivable Automation Helps with Timely Invoice Processing

July 10, 2024For any company to run its operations effectively, ERP has become a core and integral part of the growth engine. However, the technology alone will be the driver of business growth. Increasing revenue, enhancing customer satisfaction, and reducing expenses are critical pillars of growth and creating shareholder value. When it comes to growth, the importance of cash is unparalleled and so are your customers paying on time. Every dollar of a company’s revenue becomes a receivable that must be managed and collected.

Effective accounts receivables management relies on a balanced approach that combines technology with essential human attributes. While technology drives cost efficiency and effectiveness, success depends more on sound processes, skilled staff, motivation, disciplined work habits, strong supervision, metrics, and incentives. State-of-the-art technology alone is insufficient without these critical elements.

Receivables applications are available in two major forms :

- The module included in the enterprise resource planning (ERP) application that runs the entire company.

- The other major form is the commercially available, specialized credit and collection applications.

Role of ERP like Microsoft Dynamics 365 to improve Accounts Receivable Management

The advantage of the ERP like Microsoft Dynamics 365 or Navision, and others are that they are fully integrated and compatible with the sales, billing, general ledger, and other functional modules serving the company. This is a huge advantage in efficiency, speed, and maintenance cost efficiency.

Microsoft Dynamics 365 provides excellent potential to streamline the line of business, enable increased agility for companies, and reduce costs throughout the organization.

ERP receivables modules and their functionality have improved over the years. While they may not have the functionality, ease of use, and speed of specialized, commercially available credit and collections packages like Kapittx, they can provide many functionalities through customizations and a few standard features if configured properly.

Although ERP systems like Microsoft Dynamics 365 for accounts receivable or the older version Navision with its inbuilt functionalities provide features for tasks like invoice digitization, sending invoices, tracking outstanding amounts, creating accounts receivable reports, applying cash, and closing invoices, their limited accounts receivable functionalities may necessitate custom coding, additional manual efforts or high dependency on spreadsheets.

When organizations adopt an ERP system like Microsoft Dynamics 365, they often rely on implementation partners to tailor the solution to their specific needs. Microsoft Dynamics 365 Accounts receivable automation is a critical aspect of this customization.

ERP customization is essential for efficient ARM Accounts Receivable management, but organizations must weigh the costs against the benefits. While external tools like Power BI enhance reporting, addressing collection teams’ challenges requires a holistic approach. Balancing customization, cost-effectiveness, and operational efficiency remains crucial for successful AR automation within Microsoft Dynamics 365

“Get the most out of Microsoft Dynamics 365 with Kapittx – AI powered Accounts Receivable Automation software“

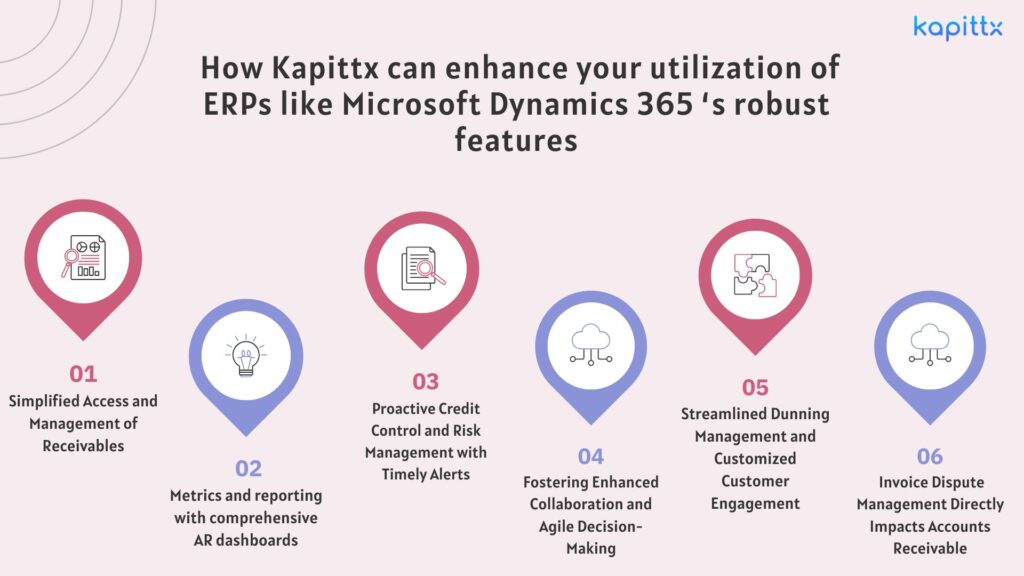

In the following sections, we will explore how Kapittx, an AI powered accounts receivable automation platform, can enhance your utilization of ERPs like Microsoft Dynamics 365 ‘s robust features.

1. Simplified Access and Management of Receivables:

A staggering 40% of the time dedicated to accounts receivable reviews is consumed in sorting AR data or facilitating communication among internal stakeholders. The daily operation of receivables management ERPs can be daunting and time-intensive, often requiring users to invest considerable time in mastering the intricacies of application workflows. Kapittx, with its AI powered accounts receivable platform, seamlessly integrates with the receivables management ERPs like Microsoft Dynamics 365 or Navision, ensuring that any actions related to arm accounts receivable management are streamlined to a user-friendly experience. The goal is to reduce navigation to no more than a few clicks. By embracing AI in accounts receivable, Kapittx an accounts receivable automation software incorporates industry-specific invoice update codes and configurable user flows that enhances the receivables management ERPs like Microsoft Dynamics 365 to meet your unique business needs, making it an indispensable tool for your financial operations.

2. Metrics and reporting with comprehensive AR dashboards

ARM – Accounts receivable management stands out as one of the most quantifiable aspects of business operations. Key metrics such as cash collection totals, write-offs, and aging category breakdowns are just a few of the finite and easily calculable figures within the receivables domain. These metrics are not only measurable but also critical for the effective management of receivables assets.

Download A Guide To Accounts Receivable Strategy Ebook

While everyone aims for enhanced outcomes, it’s important to remember that excessive time spent on reporting can detract from efforts to improve these very results. The ultimate goal is always to elevate performance.

Navigating receivables management ERP systems to extract necessary reports can often be a complex and lengthy process. However, integrating accounts receivable automation software like Kapittx with Microsoft Dynamics 365 Accounts Receivable transforms this challenge into a streamlined experience. Kapittx’s integration automates the laborious tasks of data organization and report generation. Utilizing advanced machine learning algorithms, Kapittx an AI powered accounts receivable platform is adept at forecasting payment trends, pinpointing potential late payments, and providing actionable insights—all within the intuitive interface of your existing ERP system.

3. Proactive Credit Control and Risk Management with Timely Alerts:

Credit limits are a critical measure of the financial risk a company is prepared to accept for each customer. In today’s fast-paced business environment, where transactions occur rapidly and staffing may be lean, it’s all too common for credit controls to be bypassed or applied ineffectively. To mitigate these risks, adherence to two key principles is essential:

- System-Enforced Controls: Certain controls must be non-negotiable and automatically enforced by the system to prevent any oversight.

- Manual Control Evaluation: Controls that require manual intervention should be regularly reviewed to confirm that the time invested by staff is justified by the value they provide.

Integrating accounts receivable automation software like Kapittx with your receivables management ERP systems, such as Microsoft Dynamics 365 or Navision, empowers you to take a proactive stance in overseeing the financial health of your clients. This is particularly vital for those with substantial outstanding balances. The platform’s early alert system notifies you when net outstanding amounts exceed set credit limits, or when aged outstanding balances need attention. These alerts are pivotal for maintaining effective arm – accounts receivable management and ensuring that credit risk is kept within acceptable bounds.

4. Fostering Enhanced Collaboration and Agile Decision-Making:

It’s a common misconception that late payments are solely due to customers’ reluctance or inability to pay. In reality, 70% of delayed collections are attributed to internal inefficiencies within a company. The state of accounts receivable is a mirror reflecting the operational efficiency of a company—the more streamlined the operations, the more effective the arm – accounts receivable management will be.

Traditionally, ERPs served as sophisticated bookkeeping systems, not as platforms for collaboration. Yet, the essence of proficient accounts receivable management lies in the ability to collaborate internally.

Integration of accounts receivable automation software like Kapittx’s with Microsoft Dynamics 365 or Navision’s accounts receivable modules revolutionizes this aspect by enhancing collaboration through the provision of real-time data and analytics. This empowers teams to make quick, informed decisions without the drag of protracted discussions or the burden of manual data crunching. As a result, productivity soars and the time from analysis to action is significantly reduced.

5. Streamlined Dunning Management and Customized Customer Engagement:

Timely payment reminders are pivotal for on-time payments, with statistics showing that 65% of customers settle their invoices promptly when reminded appropriately. To ensure the effectiveness of these payment reminders, it’s essential to be consistent, persistent, and courteous, while also personalizing the communication to each customer’s unique needs. Each customer’s accounts payable process is distinct, often requiring specific documentation to accompany the invoice which need to factor in your payment reminders.

By infusing ai in accounts receivable with ar automation like Kapittx’s, the payment reminder process becomes fully automated, spanning from the initial invoice to the issuance of a legal notice.

“This AI-driven accounts receivable automation software is adept at aligning with each customer’s specific payment processing requirements, saving your collections team at least 5 hours weekly.“

Furthermore, for invoices that are in dispute or provisioned, you maintain complete control over the dunning communications. With a simple click, you can halt these communications as needed, providing flexibility and responsiveness in your accounts receivable management.

Expanding on Dunning Management:

- Customizable Payment Reminder Software: Set up reminders that adapt to the individual payment behaviors of customers, ensuring timely and effective prompts.

- Automated Documentation Attachment: Automatically include necessary supporting documents with each reminder, tailored to the customer’s payment process requirements.

- Intelligent Dunning Workflows: Employ Kapittx’s AI to intelligently manage the dunning process, from gentle reminders to more assertive notices, based on customer response and payment history.

- Control at Your Fingertips: Easily manage the dunning process with user-friendly controls that allow for immediate adjustments to communication strategies.

By leveraging these sophisticated dunning management features, you can ensure that your accounts receivable operations are both efficient and customer-centric.

6. Invoice Dispute Management Directly Impacts Accounts Receivable :

When two organizations come together to do business with multiple people getting involved, invoice disputes, rejection or delays in payments are going to be part and parcel of business. One cannot eliminate disputes, but one need to have the process to handle them more efficiently and elegantly ensuring they do not become a bottleneck to the timely release of payments.

Remember, receivables portfolio or aging is a great indicator of an organisation’s efficiency. Invoice Dispute management will have a direct impact on accounts receivable team productivity as well as customer satisfaction.

Leveraging the credit period offered to customers to get early visibility on invoice disputes as against the end of the credit period can have a significant impact on receivables and the cash. A common mistake made by the collection team or sales is when they follow for payments almost at the end of the credit period and that’s when customers indicate disputes. Being on same page with customers on invoice disputes early in the credit period is core to minimising the damage it can do to cash ow or customer satisfaction. Identifying which invoices are disputed, knowing the reasons for the dispute, what it takes to resolve and most important having an owner to execute the dispute resolution plan is critical to addressing disputes and getting paid on time.

Recognizing the diverse needs of different industries, Kapittx offers customizable workflows that align with specific sector requirements. It uses ready-to-integrate APIs for leading receivables management ERPs like, Microsoft Dynamics 365, Navision, SAP, Oracle NetSuite, Tally, Quickbooks, Zoho and others. This tailored approach ensures that businesses can optimize your accounts receivable processes in a manner that best suits their operational model.

At the heart of Kapittx AR automation software integration with receivables management ERP is a commitment to user-centric design. The platform’s intuitive interface and simplified processes are designed to enhance user satisfaction and adoption, making financial management a seamless aspect of your business routine.

Click here to see a case study from Kapittx.

Check out Kapittx’s LinkedIn here.