How Accounts Receivable Automation Can Improve Customer Relationships and Satisfaction

March 13, 2023Are you ‘Able’ to Receive your Receivables?

March 20, 2023What is Accounts Receivable (AR)?

In today’s fast-paced global economy, competitive pressures and evolving industry standards have made offering goods and services on credit a norm rather than an exception. As a result, businesses frequently operate in environments where cash-on-delivery is no longer standard, leading to the accumulation of accounts receivable—a key asset on the balance sheet.

Accounts Receivable (AR) refers to the unpaid amounts a company is entitled to collect from customers who have received goods or services on credit. Simply put, it’s the money customers owe you—but haven’t paid yet.

Why is Accounts Receivable Critical?

While revenue growth is vital for any business, converting that revenue into cash is what sustains operations. Without efficient cash conversion, even high-revenue companies can face liquidity challenges. This is especially important because:

- Every dollar of revenue becomes a receivable—and must be tracked and collected.

- AR is often one of the largest tangible assets a company holds.

- Cash flow plays a critical role in enabling a company to invest in opportunities, meet obligations to suppliers, and drive sustainable growth.

The team and processes that manage AR:

- Manage and monitor the entirety of your company’s incoming revenue stream.

- Engage with almost every customer—often acting as an extension of customer service.

- Directly influence your working capital, bad debt levels, and interest expenses.

- Can make or break customer satisfaction, loyalty, and repeat business.

The Bottom Line

Efficient AR management isn’t just a financial back-office function—it’s a strategic business driver. The effectiveness of your AR processes can enhance customer experience, reduce operating costs, and improve profitability.

If improving collections, reducing Days Sales Outstanding (DSO), and unlocking cash from operations are part of your goals, investing in a robust AR strategy should be high on your list.

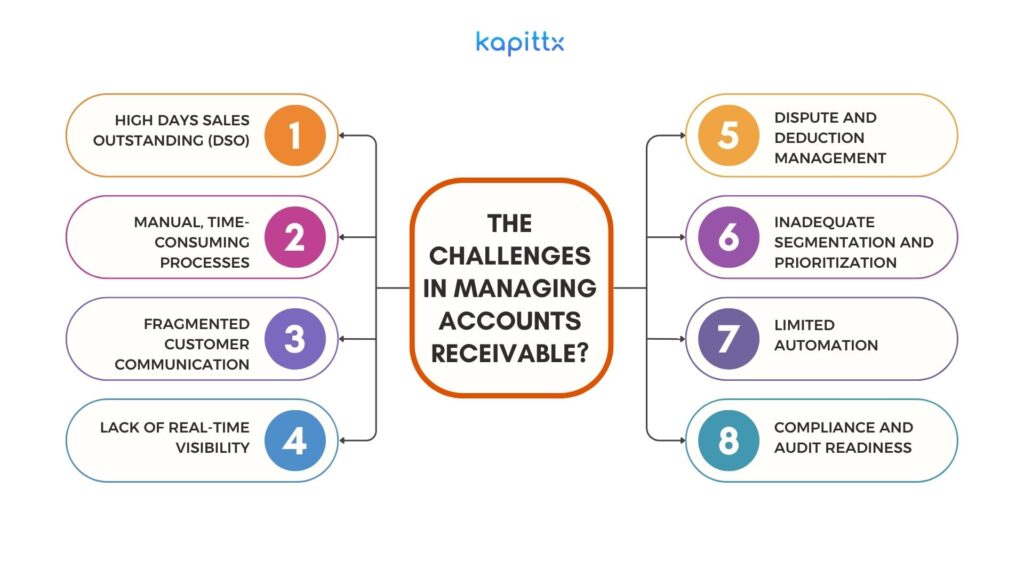

What are the challenges in managing Accounts Receivable?

Managing Accounts Receivable (AR) is far more than just tracking unpaid invoices—it’s a complex, high-stakes process that directly impacts a company’s cash flow, customer relationships, and financial agility. Based on insights from Kapittx and broader industry research, here are the key challenges businesses face:

1. High Days Sales Outstanding (DSO)

A persistently high DSO means customers are taking too long to pay, which strains working capital and disrupts cash flow. This is often a result of inconsistent follow-ups, lack of visibility into invoice status, or inefficient collection processes.

2. Manual, Time-Consuming Processes

Many finance teams still rely on spreadsheets and email threads to manage collections. This not only consumes valuable time but also increases the risk of errors and missed follow-ups. According to Kapittx, inefficient AR processes divert management attention from strategic planning to operational firefighting.

3. Fragmented Customer Communication

Without centralized systems, communication with customers about payments, disputes, or clarifications becomes scattered. This leads to delays, misunderstandings, and a poor customer experience.

4. Lack of Real-Time Visibility

Traditional ERP systems often lack real-time dashboards or predictive insights into receivables. This makes it difficult to forecast cash inflows, assess credit risk, or prioritize collections effectively.

5. Dispute and Deduction Management

Unresolved disputes—whether due to pricing errors, delivery issues, or missing documentation—can delay payments indefinitely. Without a structured workflow to track and resolve these, AR teams struggle to close the loop.

6. Inadequate Segmentation and Prioritization

Kapittx highlights the importance of treating receivables like a portfolio—segmenting customers based on payment behavior and risk. Without this, companies apply a one-size-fits-all approach, wasting effort on low-risk accounts while neglecting high-risk ones.

7. Limited Automation

From sending reminders to reconciling payments, automation is key to scaling AR operations. Yet many businesses lack tools that integrate seamlessly with their ERP systems to automate these tasks end-to-end.

8. Compliance and Audit Readiness

Maintaining audit trails, ensuring data accuracy, and complying with financial regulations becomes challenging when AR data is scattered across systems or manually updated.

Why Accounts Receivable Matters: Accounts receivable typically represents the most significant current asset on a company’s balance sheet, directly influencing liquidity, financial health, and operational flexibility. Poor AR management can lead to cash crunches, increased borrowing, and even missed growth opportunities. Tools like Kapittx help modernize AR by offering AI-driven automation, behavioral segmentation, and real-time analytics—empowering finance teams to operate with greater precision and foresight

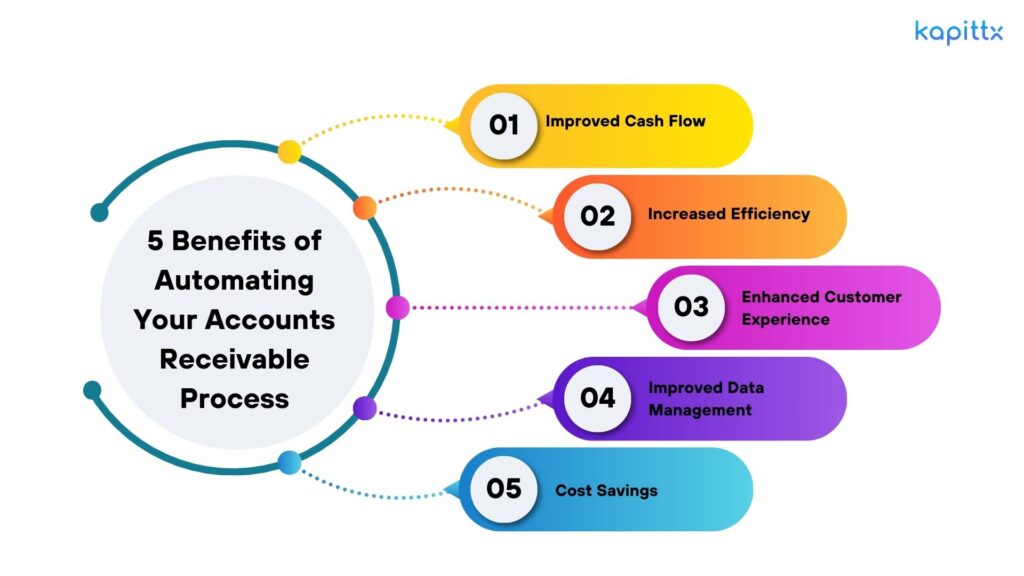

What are the Five Benefits of Automating Accounts Receivable

Accounts Receivable (AR) is a critical function of any business that wants to maintain a healthy cash flow. However, traditional AR processes can be time-consuming, error-prone, and frustrating for both the business and its customers. This is where accounts receivable automation comes in. By automating the AR process, businesses can streamline their operations, reduce errors, and improve efficiency. In this blog, we will discuss five benefits of automating your accounts receivable process.

1. Improved Cash Flow

The primary benefit of automating your accounts receivable process is improved cash flow. Automated AR systems can help businesses collect payments faster and reduce the number of overdue invoices. This can have a significant impact on a business’s bottom line and ensure that it has the cash flow it needs to operate and grow.

2. Increased Efficiency

Automating your AR process can also increase efficiency. Automated systems can generate invoices, process payments, and send reminders without any human intervention. This not only saves time but also reduces the likelihood of errors, which can be costly to correct. Additionally, automated systems can route customer inquiries to the appropriate person or team, reducing response time and improving the customer experience.

3. Enhanced Customer Experience

Automated AR systems can also enhance the customer experience. Automated systems can send reminders and follow-up emails automatically, reducing the need for manual follow-up. This can improve communication with customers and reduce the likelihood of late payments. Additionally, self-service options such as online payment portals can allow customers to view their account status, pay their invoices online, and track payment history, improving their experience and reducing the workload on the accounts receivable team.

4. Improved Data Management

Automated AR systems can help businesses track customer payment patterns, identify potential payment issues, and store customer payment history. This information can be accessed quickly and easily, allowing the collections team to focus their efforts on high-risk customers and avoid wasting time on customers who are unlikely to default.

5. Cost Savings

Automating your AR process can also result in cost savings. By automating many of the manual tasks associated with collections, businesses can reduce the need for additional staff or resources. Additionally, automated systems can help minimize errors and disputes, reducing the need for costly and time-consuming collections efforts.

Role of AI in managing and automating Accounts Receivable

AI is rapidly transforming the way businesses manage and automate Accounts Receivable (AR), and Kapittx is at the forefront of this evolution. According to Kapittx, AI is not just a tool—it’s a strategic enabler that addresses long-standing inefficiencies in the invoice-to-cash cycle.

Here’s how AI plays a pivotal role in AR automation:

1. Predictive Intelligence for Smarter Collections

Kapittx leverages AI to analyze historical payment behavior and customer patterns, enabling finance teams to forecast payment timelines and prioritize follow-ups. This predictive capability helps reduce Days Sales Outstanding (DSO) and improves cash flow reliability.

2. Automated Workflows That Scale

Manual tasks like sending reminders, reconciling payments, and updating records are time-consuming and error-prone. Kapittx uses AI to automate these processes end-to-end, freeing up teams to focus on strategic decision-making rather than operational firefighting.

3. Behavioral Segmentation

Not all customers are the same. Kapittx uses AI to segment customers based on payment behavior, risk profile, and responsiveness. This enables tailored dunning strategies, delivering the most relevant message to each customer exactly when it matters most.

4. Real-Time Visibility and Insights

AI-powered dashboards provide real-time visibility into receivables, helping CFOs and finance leaders make informed decisions. With Kapittx, companies can track collection performance, identify bottlenecks, and adjust strategies on the fly.

5. Enhanced Customer Experience

By automating routine communication and offering self-service portals, Kapittx ensures that customers have easy access to invoices, payment status, and supporting documents—reducing friction and improving satisfaction.

6. Continuous Learning and Optimization

Kapittx’s AI models continuously learn from new data, improving over time. This means your AR processes become smarter, more efficient, and more aligned with your business goals as the system evolves.

In essence, AI in AR isn’t just about automation—it’s about intelligence, adaptability, and scale. Kapittx brings these capabilities together to help businesses unlock working capital, reduce bad debt, and build stronger customer relationships.

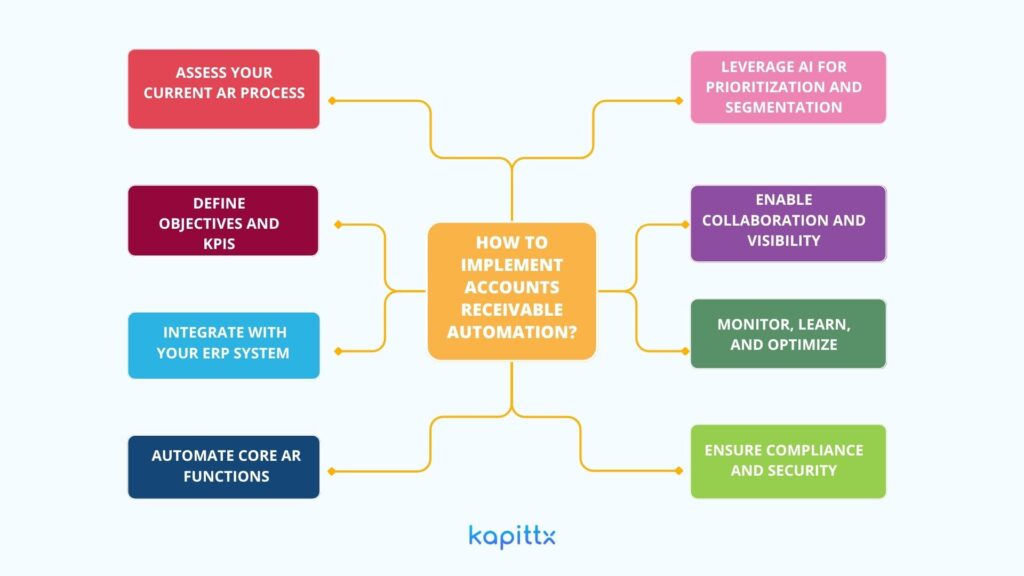

How to Implement Accounts Receivable Automation?

Implementing Accounts Receivable (AR) automation is a strategic move that can significantly improve cash flow, reduce manual effort, and enhance customer experience. With Kapittx, the process is streamlined through intelligent automation, behavioral insights, and seamless ERP integration. Here’s a step-by-step guide to implementing AR automation using Kapittx:

1. Assess Your Current AR Process

Begin by mapping out your existing AR workflow—identify bottlenecks, manual touchpoints, and areas prone to delays or errors. Kapittx helps you benchmark your current “Collection Follow-up Matrix” against industry best practices to uncover gaps and opportunities.

2. Define Objectives and KPIs

Set clear goals such as reducing Days Sales Outstanding (DSO), improving collection efficiency, or enhancing customer communication. Kapittx enables real-time tracking of these KPIs through configurable dashboards and analytics.

3. Integrate with Your ERP System

Kapittx offers seamless integration with leading ERP platforms like SAP, Oracle, and Microsoft D365. This ensures that invoice data, payment status, and customer information flow automatically—eliminating the need for duplicate entries or manual reconciliation.

4. Automate Core AR Functions

With Kapittx, you can automate:

- Invoice delivery and supporting documents

- Personalized payment reminders (customized by customer segment or business unit)

- Dispute resolution workflows

- Cash application and bank reconciliation

- Interest and DSP calculations

This reduces manual workload and ensures consistency across the AR lifecycle.

5. Leverage AI for Prioritization and Segmentation

Kapittx uses AI to analyze historical payment behavior and segment customers based on risk and responsiveness. This allows your team to focus on high-impact accounts and tailor follow-ups accordingly.

6. Enable Collaboration and Visibility

Assign tasks to internal stakeholders (sales, collections, finance) and ensure everyone has a unified view of invoice status. Kapittx also allows customers to accept, reject, or dispute invoices without logging into the system—streamlining communication.

7. Monitor, Learn, and Optimize

Use Kapittx’s real-time dashboards to monitor collection performance, track team efficiency, and identify trends. The platform continuously learns from new data, helping you refine your strategy over time.

8. Ensure Compliance and Security

Kapittx is built with enterprise-grade security and audit-readiness in mind. It maintains detailed logs, supports role-based access, and ensures your AR data is protected and compliant.

By following these steps, businesses can transform AR from a reactive function into a proactive growth enabler. If you’d like, I can help you turn this into a presentation or onboarding guide for your team!

Conclusion

Automating the accounts receivable (AR) process is a game-changer for businesses aiming to improve cash flow, reduce operational inefficiencies, and enhance customer relationships. Kapittx, a leading AR automation platform, is designed to address the challenges of traditional, manual AR processes that are often time-consuming, error-prone, and difficult to scale. By digitizing and streamlining the invoice-to-cash cycle, Kapittx enables companies to accelerate collections, reduce Days Sales Outstanding (DSO), and unlock trapped cash from the balance sheet.

One of the most significant benefits of AR automation with Kapittx is the improvement in cash flow. Automated reminders, intelligent prioritization, and real-time tracking ensure that payments are collected faster and more consistently. This directly impacts a company’s liquidity and financial agility. Additionally, automation reduces the dependency on spreadsheets and manual follow-ups, freeing up finance teams to focus on strategic tasks rather than chasing overdue invoices.

Kapittx also enhances the customer experience by offering personalized communication and self-service portals, allowing customers to access invoices, payment history, and supporting documents with ease. This transparency fosters trust and reduces disputes. Furthermore, the platform provides deep insights into customer payment behavior, enabling businesses to proactively manage credit risk and tailor collection strategies.

As businesses grow, Kapittx ensures scalability without a proportional increase in headcount. Its seamless ERP integration, AI-driven workflows, and behavioral segmentation make it a powerful tool for CFOs looking to modernize their AR operations. In essence, Kapittx transforms AR from a back-office function into a strategic driver of growth and efficiency.

Click here to see a case study from Kapittx.

Check out Kapittx’s LinkedIn here.

FAQ

What are the five steps to managing accounts receivable?

Managing accounts receivable effectively requires a structured, strategic approach, and Kapittx outlines five key steps that help businesses streamline collections and improve cash flow:

- Understand Customer Creditworthiness Before extending credit, assess the financial health and payment behavior of your customers. This helps minimize default risk and ensures that your receivables are built on a solid foundation.

- Align Sales and Finance Teams A disconnect between sales and finance can lead to miscommunication, delayed invoicing, and disputes. Kapittx emphasizes the importance of cross-functional alignment to ensure that credit terms, payment expectations, and documentation are clearly communicated and enforced.

- Streamline AR Processes Automating invoicing, reminders, and reconciliation reduces manual errors and accelerates collections. Kapittx enables businesses to digitize the entire invoice-to-cash cycle, improving efficiency and visibility.

- Establish Ownership and Accountability Assign clear responsibilities for each stage of the AR process—from invoice generation to follow-ups and dispute resolution. Kapittx supports this with role-based access and task management features that keep teams accountable.

- Monitor and Optimize Continuously Use real-time dashboards and analytics to track performance, identify bottlenecks, and refine your strategy. Kapittx provides actionable insights that help finance leaders make data-driven decisions and continuously improve AR outcomes.

Together, these steps form a proactive AR management framework that not only improves collections but also strengthens customer relationships and financial resilience.

What is accounts receivable workflow?

An accounts receivable (AR) workflow is the end-to-end process a business follows to manage the money it’s owed by customers for goods or services sold on credit. This workflow spans from invoice generation to final payment reconciliation, and when automated, it becomes a powerful engine for improving cash flow and operational efficiency.

In a traditional setup, the AR workflow includes generating invoices, sending them to customers, tracking due dates, following up on unpaid invoices, resolving disputes, applying payments, and reconciling accounts. However, manual handling of these steps often leads to delays, errors, and missed opportunities.

Kapittx transforms this workflow by automating each stage. It starts with automated invoice presentment, ensuring timely and accurate delivery of invoices along with supporting documents. The platform then enables personalized follow-ups using AI-driven segmentation, so reminders are tailored to customer behavior and risk profiles. If disputes arise, Kapittx facilitates collaborative resolution workflows, allowing internal teams and customers to communicate seamlessly.

Once payments are made, Kapittx automates cash application and reconciliation, matching payments to invoices and updating records in real time. Throughout the process, real-time dashboards provide visibility into outstanding receivables, collection performance, and customer engagement—empowering finance teams to act proactively.

In essence, the Kapittx AR workflow replaces fragmented, manual tasks with a unified, intelligent system that helps businesses get paid faster, reduce Days Sales Outstanding (DSO), and improve customer satisfaction.

What are some accounts receivable best practices?

Adopting best practices in accounts receivable (AR) management is essential for maintaining healthy cash flow, reducing risk, and improving customer satisfaction. Here are some of the key practices they recommend:

First, maximize the value of your ERP system by keeping customer and sales contact information up to date. This ensures accurate invoicing and minimizes delays or disputes. However, Kapittx notes that while ERP systems are foundational, they often lack the specialized tools needed for proactive collections and customer communication.

Second, monitor unapplied payments closely. Payments that aren’t matched to invoices can lead to confusion, repeated reminders to customers who’ve already paid, and inaccurate financial reporting. Kapittx helps automate this reconciliation process to avoid such issues.

Third, understand the limitations of your ERP. Many ERPs aren’t designed for personalized follow-ups, behavioral segmentation, or real-time analytics. Kapittx fills these gaps by offering AI-powered automation, customer portals, and intelligent dashboards that enhance visibility and control.

Finally, embrace automation and analytics. Automating reminders, dispute resolution, and cash application not only improves efficiency but also reduces errors and accelerates collections. With Kapittx, finance teams can shift from reactive to strategic AR management—reducing Days Sales Outstanding (DSO) and unlocking working capital.

These best practices help businesses transform AR from a back-office function into a growth enabler.

How do accounts receivable automation work with ERP systems?

Accounts receivable (AR) automation works seamlessly with ERP systems by enhancing their core capabilities and filling critical functionality gaps—something Kapittx specializes in. While ERP platforms like SAP, Oracle, and Microsoft D365 are essential for managing financial data, they often lack the tools needed for proactive collections, personalized communication, and real-time insights.

Kapittx bridges this gap by integrating directly with your ERP system to pull invoice data, customer information, and payment status in real time. Once connected, Kapittx automates the entire invoice-to-cash cycle—from invoice presentment and personalized payment reminders to dispute resolution, cash application, and reconciliation. This eliminates the need for manual data entry or toggling between systems, reducing errors and saving time.

The platform also enhances ERP functionality by offering AI-driven segmentation, behavioral analytics, and real-time dashboards. These features allow finance teams to prioritize high-risk accounts, track collection performance, and make data-driven decisions—all without disrupting existing ERP workflows.

In short, Kapittx doesn’t replace your ERP—it supercharges it. By layering intelligent automation on top of your existing system, it transforms AR from a manual, reactive process into a streamlined, strategic function that improves cash flow and customer experience.

What are the benefits of utilizing artificial intelligence in AR collections?

Utilizing artificial intelligence (AI) in accounts receivable (AR) collections offers transformative benefits, and Kapittx is leading the charge in applying AI to streamline and optimize the entire invoice-to-cash process.

AI enhances efficiency by automating repetitive tasks such as invoice generation, payment reminders, and reconciliation. With Kapittx, businesses can ensure invoices are delivered promptly and follow-ups are consistent, personalized, and timely—reducing Days Sales Outstanding (DSO) and improving cash flow.

Another major advantage is intelligent customer engagement. The Kapittx AI Agent can read and interpret client emails, generate relevant responses, and even escalate issues or create internal tasks when needed. This reduces manual workload while improving responsiveness and customer satisfaction.

AI also supports dispute management by identifying and addressing issues in real time, helping resolve them faster and preventing payment delays. Additionally, Kapittx uses AI to analyze customer behavior and segment accounts based on risk and payment patterns, enabling finance teams to prioritize collections more strategically.

Perhaps most importantly, AI in AR collections provides real-time insights and predictive analytics. With Kapittx, finance leaders gain visibility into collection performance, risk exposure, and customer trends—empowering them to make data-driven decisions and continuously refine their strategies.

In short, AI transforms AR from a reactive, manual process into a proactive, intelligent system that boosts productivity, strengthens customer relationships, and unlocks working capital.