Driving Financial Efficiency in the Transportation Sector

At Kapittx, we understand the critical role that efficient financial management plays in the transportation industry. Our AI Powered Accounts Receivable Automation software is designed to help you increase cash flow, reduce DSO, and maintain strong customer relationships, ensuring your business stays on the road to success.

Why the Transportation Sector Trusts Kapittx

Developing a Robust Accounts Receivable Management Strategy for Transportation Companies

Transportation companies operate in a fast-paced, competitive environment where efficient cash flow is critical for maintaining operations, managing fleet costs, and investing in growth. Late payments from customers, diverse billing arrangements, and complex contracts can make Accounts Receivable (AR) management a challenge. This guide explores how automated payment reminders, AR analytics, and AI-powered tools can streamline AR processes for transportation and logistics providers.

A tailored AR management strategy helps transportation businesses maintain financial stability while fostering strong customer relationships.

Transparent Contracts

Clearly define payment terms, late payment penalties, and service-level agreements (SLAs) in contracts.

Customer-Specific Invoicing

Use customized invoicing to match the requirements of freight brokers, shippers, and corporate clients.

Automation for Efficiency

Leverage ERP systems to automate invoicing, track payments, and manage outstanding receivables.

Credit Risk Assessment

Evaluate the creditworthiness of clients to minimize bad debts.

Case Study: Optimizing AR for a Regional Freight Carrier

Background

A prominent freight carrier serving a diverse client base, including small businesses, large corporations, and international clients offering comprehensive freight and transportation services. Despite its reputation for reliable service, the company faced significant challenges with delayed payments from small businesses and recurring disputes over service charges.

Solution

By implementing AR analytics and automated reminders, the company identified high-risk accounts and prioritized collections. Leveraging advanced AR analytics, the tools allowed the company to segment its receivables based on various risk factors, such as payment history, creditworthiness, and outstanding balances.

Outcome

- Reduced payment delays by 30%.

- Streamlined the invoicing process, leading to faster dispute resolution.

- Improved cash flow, enabling timely fleet upgrades.

Key Components of an Effective AR Management Strategy for Transportation Companies

- Dynamic Payment Terms

Offer flexible payment options for clients with varying cash flow cycles, such as shippers and logistics companies. - AI-Driven Cash Application

Automate payment reconciliation to manage high transaction volumes from corporate clients and individual customers. - Dispute Resolution Workflow

Implement clear processes for resolving invoice disputes, often common in freight and logistics services. - Data-Driven Insights

Leverage analytics to monitor payment trends and proactively address issues.

Automated Payment Reminders: A Must-Have for Transportation Companies

Delayed payments can disrupt cash flow, affecting operations such as fuel purchases, driver payouts, and vehicle maintenance. Automated payment reminders can help transportation companies improve collection rates without straining customer relationships.

Benefits of Automated Payment Reminders

Case Study: Payment Reminder Automation for a Logistics Provider

Background

A leading logistics provider faced significant challenges with payment delays from clients who had complex invoicing and documentation requirements. The company’s invoice submission involved a detailed billing statement, leading to frequent discrepancies and delays in payment. These delays created cash flow disruptions.

Solution

Kapittx electronic distribution of invoices with supporting documents, ensuring timely submission. Supported by AI-powered, intelligent automated reminders and follow-up systems ensured timely payments and improved customer relationships.

Outcome

- Payment collection times improved by 25%.

- Enhanced client satisfaction with personalized, professional communication.

- Reduced overdue invoices without increasing manual effort.

AR Analytics: Unlocking Actionable Insights for Transportation Companies

AR analytics can transform how transportation companies manage receivables by providing deep insights into payment behaviors and collection trends.

Key Advantages of AR Analytics

- Payment Behavior Tracking

Identify late-paying clients and adjust terms or collection strategies accordingly. - Risk Assessment

Segment clients by credit risk to prioritize collections effectively. - Operational Efficiency

Analyze invoice aging reports to identify bottlenecks and streamline collections.

Best Practices for AR Analytics in Transportation Companies

- Integrate AR analytics tools with dispatch and ERP systems for real-time tracking.

- Monitor key metrics such as Days Sales Outstanding (DSO) to maintain healthy cash flow.

- Use predictive analytics to anticipate and mitigate potential payment risks.

Efficient Cash Application: Simplifying Payment Reconciliation for Transportation Companies

Transportation companies often deal with multiple payment methods, including ACH transfers, checks, and credit cards. Efficient cash application ensures faster reconciliation and reduces errors.

Steps to Optimize Cash Application

- Automated Matching

Leverage AI tools to match incoming payments with invoices, especially for high-volume clients. - Error Reduction

Minimize reconciliation errors by automating manual processes. - Real-Time Updates

Provide accurate, real-time cash flow visibility to operational teams.

Case Study: AI-Powered Cash Application for a Fleet Management Company

Background

A fleet management company struggled with reconciling payments from various corporate clients with differing payment methods.

Solution

AI-driven cash application software automated payment matching and accelerated reconciliation processes.

Outcome

- Reduced unapplied cash by 35%.

- Achieved 95% reconciliation accuracy within 24 hours.

- Improved AR team productivity by 40%.

Dispute Management: A Proactive Approach for Transportation Companies

Disputes are common in transportation due to billing errors, rate discrepancies, or missed delivery deadlines. A streamlined dispute management process is vital for maintaining client trust and ensuring timely resolution.

Best Practices for Dispute Management

- Centralized Tracking

Use software to log and monitor disputes from initiation to resolution. - Collaborative Problem-Solving

Maintain open communication with clients to resolve disputes amicably. - Proactive Issue Prevention

Address recurring billing errors or service discrepancies to prevent future disputes.

KPIs to Measure AR Success for Transportation Companies

- Days Sales Outstanding (DSO):

Track the average number of days it takes to collect payment. - Dispute Resolution Time:

Measure how quickly disputes are resolved to minimize payment delays. - Overdue Payments Ratio:

Monitor overdue payments as a percentage of total receivables to identify problem areas.

Why Kapittx is the Ideal AR Partner for Transportation Companies

Kapittx offers tailored solutions for transportation companies to optimize AR processes:

AI-powered cash application tools for faster, accurate payment reconciliation.

Automated payment reminders to reduce overdue invoices.

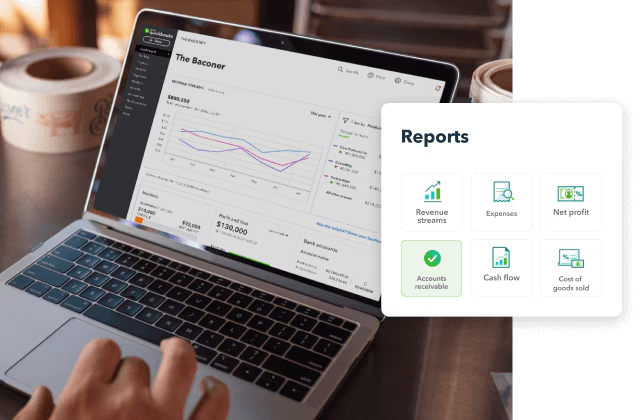

AR analytics dashboards for actionable financial insights.

Dispute management systems to resolve issues quickly and professionally.

- With Kapittx, transportation companies can maintain healthy cash flow, reduce operational inefficiencies, and build stronger client relationships.

Transforming AR Management for Transportation Companies

In the dynamic transportation industry, efficient AR management is essential for sustaining operations, managing costs, and scaling the business. By adopting tools like automated payment reminders, AI-driven cash application, and AR analytics, transportation companies can overcome AR challenges and achieve financial excellence.

Ready to streamline your AR processes? Discover how Kapittx can help your transportation business thrive!

Benefits of using Kapittx AI Powered Accounts Receivable Automation Software

- Seamless Integration with Your Ecosystem: Kapittx integrates seamlessly with your existing ERP, CRM, and financial systems.

- Enhanced Customer Relationships: Set up automated reminders, and provide a transparent billing and AR process, enhancing customer satisfaction and retention.

- Insights to Actions: Gain instant access to key metrics and insights with well designed dashboards that keep you informed of your financial health.

- Integrated Document Management: Never miss sending a list supporting documents along with the invoice to expedite payment approvals.

- Proactive Dunning Strategies: Automate follow-ups, reminders, and dunning processes to ensure timely payments and reduce bad debt.

Talk To Expert

FAQ

1. What is Accounts Receivable Management Strategy for Transportation industry?

In the fast-paced transportation industry, where time is money, managing accounts receivable (AR) effectively is critical to maintaining operational efficiency and ensuring business growth. From complex billing cycles to high transaction volumes, the industry faces unique challenges that demand innovative solutions. By adopting AI-powered tools and automation, transportation companies can streamline their AR processes, improve cash flow, and overcome these challenges with ease.

Challenges in Accounts Receivable Management for Transportation

The transportation industry operates on intricate financial models, which often lead to AR complexities. Key challenges include:

Complex Pricing Structures: Billing involves variable rates, fuel surcharges, and contract-specific payment terms, making invoicing a complicated process.

High Transaction Volumes: Managing large numbers of invoices and payments across multiple customers and channels can overwhelm traditional systems.

Cash Flow Gaps: Delayed payments can disrupt fleet operations, maintenance schedules, and fuel procurement, impacting overall efficiency.

Dispute Resolution: Discrepancies in billing, such as mismatched delivery records or service charges, often lead to payment delays.

Dynamic Cost Management: Variable costs like detention fees, demurrage charges, and special handling requirements add to the complexity of AR management.

To thrive in a competitive landscape, transportation companies must adopt a comprehensive AR management strategy that combines people, processes, and technology. Key steps include:

Establishing Clear Payment Terms: Transparent communication with customers about payment expectations reduces disputes and delays.

Leveraging AI and Automation: Automate repetitive tasks, track payments in real-time, and use predictive analytics to stay ahead of potential challenges.

Monitoring AR Metrics: Regularly review key performance indicators (KPIs) such as Days Sales Outstanding (DSO) to identify areas for improvement.

What are Accounts Receivable Key points in transportation industry?

In the transportation industry, where operational efficiency and timely cash flow are paramount, managing accounts receivable (AR) effectively is critical. With complex billing cycles, high transaction volumes, and dynamic cost structures, transportation companies face unique AR challenges. By focusing on key AR management strategies and leveraging advanced technologies like AI and automation, businesses can streamline their processes and ensure financial stability.

Key Points in Accounts Receivable for Transportation

Complex Billing Cycles The transportation sector often deals with intricate billing arrangements, including variable rates, fuel surcharges, and contract-specific payment terms. Managing these complexities requires a robust AR system that ensures accuracy and compliance.

High Transaction Volumes Transportation companies handle a large number of invoices and payments daily. Without efficient systems in place, tracking and reconciling these transactions can become overwhelming, leading to delays and errors.

Dynamic Cost Management Costs such as detention fees, demurrage charges, and special handling requirements add layers of complexity to AR management. Ensuring these costs are accurately billed and collected is essential for maintaining profitability.

Cash Flow Gaps Delayed payments can disrupt fleet operations, maintenance schedules, and fuel procurement, impacting overall efficiency. A proactive approach to collections is necessary to bridge these cash flow gaps.

Dispute Resolution Discrepancies in billing, such as mismatched delivery records or service charges, often lead to disputes. Resolving these disputes promptly is crucial to avoid payment delays and maintain strong customer relationships.

Leveraging AI and Automation for AR Management

The future of AR in the transportation industry lies in adopting AI-powered tools and automation to address these challenges. Here’s how technology can make a difference:

Automated Invoicing and Payment Tracking: AI-driven solutions like Kapittx automate invoice generation and payment tracking, reducing manual effort and ensuring accuracy.

Predictive Analytics: AI-powered analytics provide insights into payment trends and customer behavior, enabling businesses to forecast cash flow and prioritize collections.

Real-Time Dashboards: Deep tech solutions offer real-time visibility into AR performance, empowering transportation companies to make data-driven decisions.

Proactive Dunning Strategies: Automated follow-ups and reminders ensure timely payments, reducing overdue invoices and bad debt risks.

Dispute Management: AI-powered workflows streamline the resolution of billing discrepancies, ensuring faster collections and improved customer satisfaction.

Building a Resilient AR Process

To thrive in a competitive landscape, transportation companies must adopt a comprehensive AR management strategy that combines people, processes, and technology. By focusing on key AR points and leveraging advanced tools like Kapittx, businesses can optimize their AR processes, improve cash flow, and maintain operational efficiency.

Kapittx’s AI-powered AR automation solutions are tailored to meet the unique demands of the transportation industry. From reducing Days Sales Outstanding (DSO) to enhancing customer relationships, Kapittx empowers businesses to stay on the road to success. Ready to transform your AR process? Let Kapittx guide your journey toward smarter, faster, and more efficient receivables management.

2. What KPIs to Measure Accounts Receivable Success for Transportation Companies?

Accounts Receivable (AR) is one of the few business processes that can be measured quantitatively, offering critical insights into financial performance and efficiency. For the transportation industry, where cash flow drives operations, monitoring AR success is essential to prevent becoming an "invisible bank" to your customers due to delayed collections. Tracking the right Key Performance Indicators (KPIs) ensures timely payments, optimizes cash flow, and highlights areas for improvement.

Here are the top KPIs to measure AR success for transportation companies:

1. Days Sales Outstanding (DSO)

DSO measures the average number of days it takes to collect payment after a sale is made. A lower DSO indicates faster collections and healthier cash flow. For transportation companies, where fleet maintenance and fuel costs are ongoing expenses, reducing DSO ensures liquidity and operational stability.

2. Collections Effectiveness Index (CEI)

The CEI calculates the effectiveness of the collections process by comparing the amount collected to the total receivables due. A high CEI indicates efficient collections and a well-functioning AR team. This metric helps transportation companies optimize their follow-up strategies and maintain strong cash flow.

3. Accounts Receivable Turnover

This KPI measures how often a company collects its average receivables within a specific period. A higher turnover ratio reflects efficient collections and stricter credit policies. Transportation businesses can use this metric to assess whether their credit terms align with payment behaviors and operational needs.

4. Average Days Delinquent (ADD)

ADD provides insights into how many days invoices are overdue, on average. Monitoring this metric helps transportation companies identify late-paying customers and take corrective actions to minimize payment delays.

5. Aging of Receivables

An AR aging report categorizes receivables by their age (e.g., 0-30 days, 31-60 days, etc.). This report helps transportation companies identify overdue accounts and prioritize collections efforts, ensuring that older invoices are addressed promptly to avoid bad debts.

6. Bad Debt to Sales Ratio

This KPI measures the percentage of receivables written off as bad debt compared to total sales. A lower ratio indicates better credit risk management and effective collections. Transportation companies should aim to minimize this ratio to protect their profitability.

7. Loss Due to Interest on Delayed Collections

Delayed collections can lead to opportunity costs, especially when businesses need to borrow to cover cash flow gaps. Measuring the financial impact of interest due to late payments highlights the importance of timely collections in minimizing losses.

8. Average Invoice to Cash Days

This KPI tracks the time it takes for an invoice to be converted into cash, including delays caused by disputes or processing inefficiencies. A shorter cycle indicates a streamlined AR process, crucial for transportation businesses with high operating costs.

9. Unbilled to Cash Days

This metric measures the time taken to move from unbilled revenue (e.g., services rendered but not yet invoiced) to cash collections. Optimizing this timeline ensures quicker access to working capital, keeping operations smooth and uninterrupted.

Leveraging AI and Automation for AR Excellence

Modern tools like Kapittx revolutionize AR management by automating processes and providing real-time insights into these KPIs. Here's how AI and automation elevate AR success:

Predictive Analytics: Forecast payment behaviors and prioritize follow-ups using AI-powered insights.

Automated Workflows: Streamline invoicing, reminders, and dispute resolution, reducing manual effort and errors.

Real-Time Dashboards: Track KPIs at a glance, empowering transportation companies to make data-driven decisions and optimize their AR strategy.

By focusing on these KPIs and leveraging the power of advanced technology like Kapittx, transportation companies can transform their AR processes, reduce inefficiencies, and enhance cash flow. Measuring success isn't just about tracking numbers—it's about using them to drive smarter, faster, and more proactive decisions. Ready to take control of your accounts receivable? Let Kapittx guide the way to AR excellence.

3. What is used for measuring AR performance?

Accounts Receivable (AR) performance is a critical indicator of a company’s financial health and operational efficiency. For businesses across industries, including manufacturing, transportation, and healthcare, measuring AR performance ensures timely collections, optimized cash flow, and reduced financial risks. But what exactly is used to measure AR performance? Let’s explore the essential metrics and tools that drive success.

Key Metrics for Measuring AR Performance

Days Sales Outstanding (DSO): DSO measures the average number of days it takes to collect payment after a sale. A lower DSO indicates faster collections and healthier cash flow. Businesses can track this metric to identify inefficiencies in their collections process and take corrective actions.

Collections Effectiveness Index (CEI): CEI evaluates the efficiency of the collections process by comparing the amount collected to the total receivables due. A high CEI reflects a well-functioning AR team and effective follow-up strategies.

Accounts Receivable Turnover Ratio: This metric measures how often a company collects its average receivables within a specific period. A higher turnover ratio indicates efficient credit policies and faster collections.

Average Days Delinquent (ADD): ADD tracks the average number of days invoices are overdue. Monitoring this metric helps businesses identify late-paying customers and implement strategies to minimize delays.

Aging of Receivables: An AR aging report categorizes receivables based on their age (e.g., 0-30 days, 31-60 days). This report helps prioritize collections efforts and address overdue accounts promptly.

Bad Debt to Sales Ratio: This ratio measures the percentage of receivables written off as bad debt compared to total sales. A lower ratio indicates better credit risk management and effective collections.

Modern AR management tools, like Kapittx, empower businesses to measure and improve AR performance with advanced features:

Real-Time Dashboards: Kapittx provides real-time insights into key metrics, enabling businesses to monitor AR performance at a glance and make data-driven decisions.

Predictive Analytics: AI-powered analytics forecast payment behaviors and identify potential risks, helping businesses prioritize follow-ups and optimize collections strategies.

Automated Reporting: Kapittx automates the generation of AR reports, saving time and reducing manual effort. Customizable views allow businesses to analyze data based on parameters like customer type, region, or collector.

Dispute Management: Automated workflows streamline the resolution of billing discrepancies, ensuring faster collections and improved customer satisfaction.

4. What is the Role of AI in AR Performance

AI is revolutionizing AR management by automating routine tasks and providing actionable insights. Here’s how AI enhances AR performance measurement:

Enhanced Accuracy: AI minimizes errors in data tracking and reconciliation, ensuring reliable metrics.

Proactive Decision-Making: AI-driven tools identify trends and anomalies, enabling businesses to address issues before they escalate.

Improved Efficiency: Automation reduces manual effort, allowing AR teams to focus on strategic activities.

Why Measuring AR Performance Matters?

Measuring AR performance is not just about tracking numbers—it’s about using those insights to drive improvement. By monitoring key metrics and leveraging advanced tools like Kapittx, businesses can:

Reduce Days Sales Outstanding (DSO)

Improve cash flow and liquidity

Minimize bad debts and financial risks

Enhance customer relationships through efficient collections

Kapittx’s AI-powered AR automation solutions are designed to help businesses measure, analyze, and optimize their AR performance. Ready to take control of your receivables? Let Kapittx guide your journey toward smarter, faster, and more efficient AR management. The future of AR success starts here!