10 Game-Changing Trends in Accounts Receivable Automation

April 23, 2024Securing B2B Enterprise SaaS Subscription Payments On Time

May 23, 2024In the intricate dance of financial operations, ARM – accounts receivable management stands out as a particularly demanding performance. Companies set the bar high, expecting over 99.9% of all billings to be collected—a standard of near- perfection that few other departments are called upon to match. Collecting a mere 95% of revenue is deemed insufficient. Businesses will begrudgingly accept bad debt expenses amounting to a few tenths of a percent of revenue, but the threshold for tolerance is razor-thin. The expectation from the arm accounts receivable management team is clear: a significant majority of invoices should be settled promptly, with over 90% paid within 30 to 45 days of the due date. This level of efficiency is expected to be delivered while simultaneously fostering sales growth and ensuring that every customer interaction is marked by promptness, courtesy, and professionalism.

How much control you can have over Accounts Receivable Management?

The accounts receivable asset is often likened to a comprehensive repository of the company’s revenue cycle health. It serves as a mirror, reflecting the efficacy of your entire operational process. From order placement to fulfilment, invoicing, payment application, and customer satisfaction, any discrepancies along this chain will

inevitably surface within the receivables ledger, manifesting as overdue accounts or partial payments.

The integrity of your receivables asset is a testament to the quality of customer service you provide. It acts as a spontaneous gauge of customer satisfaction, offering insights that are both valuable and readily available. While it may be tempting to view this feedback as a cost-free quality control mechanism, it’s important to recognize that addressing the underlying issues does involve certain costs. Nonetheless, this feedback is instrumental in guiding your arm – accounts receivable management team and their continuous improvement efforts, ensuring

that they not only meet but exceed your customers’ expectations.

Optimizing ARM – Accounts Receivable Management with NetSuite or Oracle Fusion

AR teams often grapple with accounts receivable challenges that directly affect a company’s liquidity and expansion. These include:

- Elevated Days Sales Outstanding (DSO)

- Subpar engagement with customers and key stakeholders

- Inefficiencies in payment processing

- Policies that fall short of addressing AR complexities

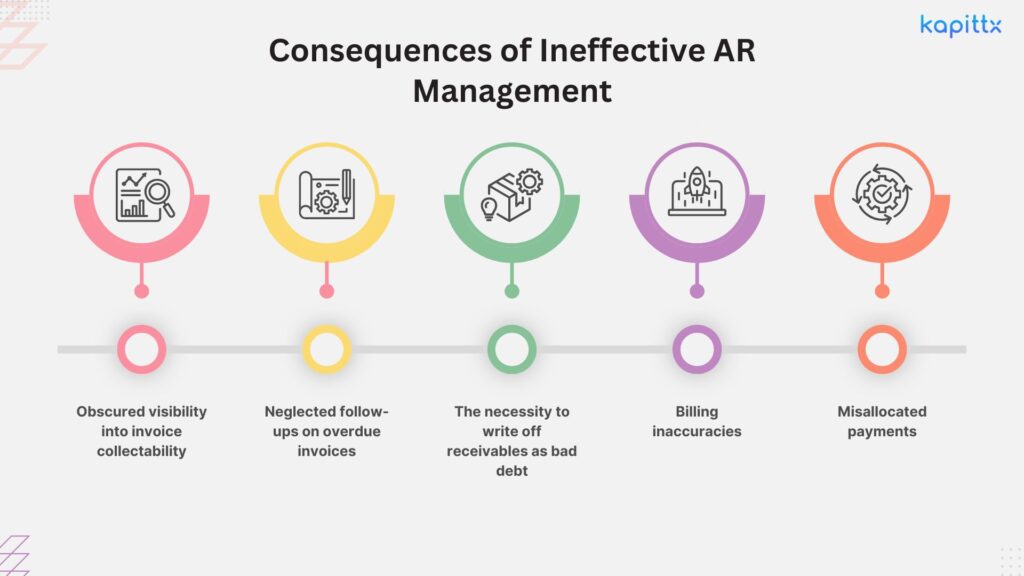

Consequences of Ineffective arm accounts receivable management leading to accounts receivable challenges can be due to an inadequate AR process which can trigger a cascade of issues:

Such pitfalls can constrict cash flow, potentially slowing down operations and hindering growth, while competitors forge ahead.

ERPS like Oracle Fusion or NetSuite’s or other cloud accounting software revolutionizes financial management by streamlining transaction recording, managing payables and receivables, ensuring accurate tax collection, and facilitating seamless book closures. This leads to precise reporting and fortified control over financial assets.

Oracle Fusion Accounts Receivable or NetSuite Accounts Receivable modules are designed to empower businesses with efficient invoice and payment management. It offers a unified platform for monitoring receivables, automating billing, and securing prompt collections. The real-time insights into financial dealings enable businesses to make well informed decisions, bolster customer relations, and enhance overall financial well-being.

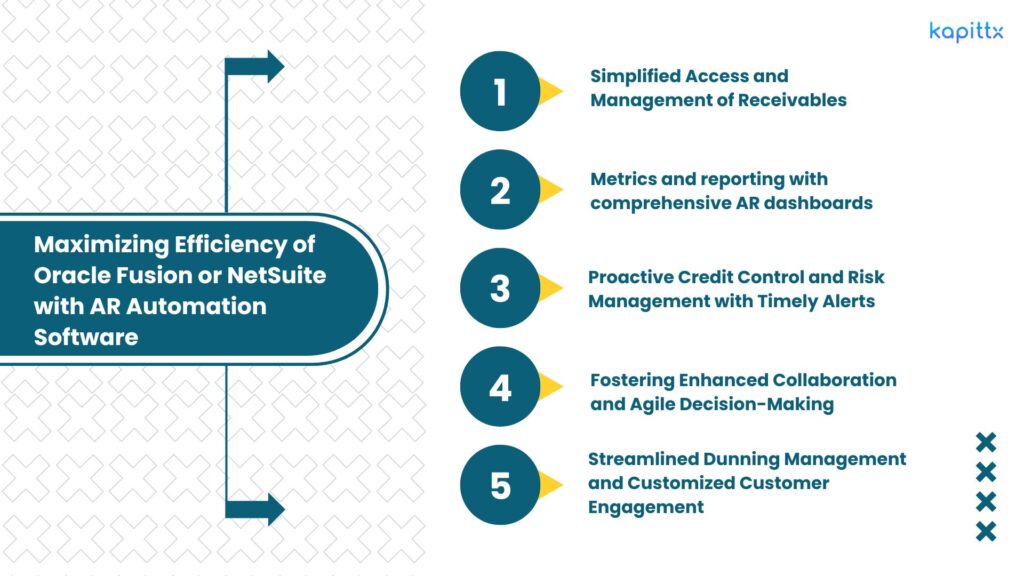

Maximizing Efficiency of Oracle Fusion or NetSuite with AR Automation Software:

In the following sections, we will explore how Kapittx, an AI powered accounts receivable automation platform, can enhance your utilization of ERPs like Oracle Fusion, and NetSuite’s robust features.

Simplified Access and Management of Receivables:

“A staggering 40% of the time dedicated to accounts receivable reviews is consumed in sorting AR data or facilitating communication among internal stakeholders. “

The daily operation of receivables management ERPs can be daunting and time-intensive, often requiring users to invest considerable time in mastering the intricacies of application workflows. Kapittx, with its AI powered accounts receivable platform, seamlessly integrates with the receivables management ERPs like Oracle Fusion or NetSuite, ensuring that any actions related to arm accounts receivable management are streamlined to a user- friendly experience. The goal is to reduce navigation to no more than a few clicks. By embracing AI in accounts receivable, Kapittx an AR automation software incorporates industry-specific invoice update codes and configurable user flows that enhances the receivables management ERPs like Oracle Fusion and NetSuite to meet your unique business needs, making it an indispensable tool for your financial operations.

Metrics and reporting with comprehensive AR dashboards

ARM – Accounts receivable management stands out as one of the most quantifiable aspects of business operations. Key metrics such as cash collection totals, write-offs, and aging category breakdowns are just a few of the finite and easily calculable figures within the receivables domain. These metrics are not only measurable but also critical for the effective management of receivables assets.

While everyone aims for enhanced outcomes, it’s important to remember that excessive time spent on reporting can detract from efforts to improve these very results. The ultimate goal is always to elevate performance. Navigating receivables management ERP systems to extract necessary reports can often be a complex and lengthy process. However, integrating AR automation software like Kapittx with Oracle Fusion Accounts Receivable or

NetSuite Accounts Receivable transforms this challenge into a streamlined experience. Kapittx’s integration automates the laborious tasks of data organization and report generation. Utilizing advanced machine learning

algorithms, Kapittx an AI powered accounts receivable platform is adept at forecasting payment trends, pinpointing potential late payments, and providing actionable insights—all within the intuitive interface of your existing ERP system.

Proactive Credit Control and Risk Management with Timely Alerts

Credit limits are a critical measure of the financial risk a company is prepared to accept for each customer. In today’s fast-paced business environment, where transactions occur rapidly and staffing may be lean, it’s all too common for credit controls to be bypassed or applied ineffectively. To mitigate these risks, adherence to two key principles is essential:

- System-Enforced Controls: Certain controls must be non-negotiable and automatically enforced by the system to prevent any oversight.

- Manual Control Evaluation: Controls that require manual intervention should be regularly reviewed to confirm that the time invested by staff is justified by the value they provide.

Integrating AR automation software like Kapittx with your receivables management ERP systems, such as Oracle Fusion or NetSuite, empowers you to take a proactive stance in overseeing the financial health of your clients. This is particularly vital for those with substantial outstanding balances. The platform’s early alert system notifies you when net outstanding amounts exceed set credit limits, or when aged outstanding balances need attention. These alerts are pivotal for maintaining effective arm – accounts receivable management and ensuring that credit risk is kept within acceptable bounds.

Fostering Enhanced Collaboration and Agile Decision-Making:

It’s a common misconception that late payments are solely due to customers’ reluctance or inability to pay. In

“Reality, 70% of delayed caollections are attributed to internal inefficiencies within a company. “

The state of accounts receivable is a mirror reflecting the operational efficiency of a company—the more streamlined the operations, the more effective the arm – accounts receivable management will be.

Traditionally, ERPs served as sophisticated bookkeeping systems, not as platforms for collaboration. Yet, the essence of proficient accounts receivable management lies in the ability to collaborate internally. Integration of AR automation software like Kapittx’s with NetSuite or Oracle Fusion accounts receivable modules revolutionizes this aspect by enhancing collaboration through the provision of real-time data and analytics. This empowers teams to make quick, informed decisions without the drag of protracted discussions or the burden of manual data crunching. As a result, productivity soars and the time from analysis to action is significantly reduced.

Streamlined Dunning Management and Customized Customer Engagement

Timely payment reminders are pivotal for on-time payments, with statistics showing that 65% of customers settle their invoices promptly when reminded appropriately. To ensure the effectiveness of these payment reminders, it’s essential to be consistent, persistent, and courteous, while also personalizing the communication to each customer’s unique needs. Each customer’s accounts payable process is distinct, often requiring specific documentation to accompany

the invoice which need to factor in your payment reminders.

By infusing ai in accounts receivable with ar automation like Kapittx’s, the payment reminder process becomes fully automated, spanning from the initial invoice to the issuance of a legal notice.

“This AI-driven AR automation software is adept at aligning with each customer’s specific payment processing requirements, saving your collections team at least 5 hours weekly.“

Furthermore, for invoices that are in dispute or provisioned, you maintain complete control over the dunning communications. With a simple click, you can halt these communications as needed, providing flexibility and responsiveness in your accounts receivable management.

Expanding on Dunning Management

- Customizable Payment Reminder Software: Set up reminders that adapt to the individual payment behaviors of customers, ensuring timely and effective prompts.

- Automated Documentation Attachment: Automatically include necessary supporting documents with each reminder, tailored to the customer’s payment process requirements.

- Intelligent Dunning Workflows: Employ Kapittx’s AI to intelligently manage the dunning process, from gentle reminders to more assertive notices, based on customer response and payment history.

- Control at Your Fingertips: Easily manage the dunning process with user- friendly controls that allow for immediate adjustments to communication strategies.

By leveraging these sophisticated dunning management features, you can ensure that your accounts receivable operations are both efficient and customer-centric.

Recognizing the diverse needs of different industries, Kapittx offers customizable workflows that align with specific sector requirements. It uses ready to integrate APIs for leading receivables management ERPs like SAP, Microsoft Business Central, Oracle NetSuite, Tally, Quickbooks, Zoho and others. This tailored approach ensures that businesses can optimize your accounts receivable processes in a manner that best suits their operational model.

At the heart of Kapittx AR automation software integration with receivables management ERP is a commitment to user-centric design. The platform’s intuitive interface and simplified processes are designed to enhance user satisfaction and adoption, making financial management a seamless aspect of your business routine.

Click here to see a case study from Kapittx.

Check out Kapittx’s LinkedIn here.