How Can Gen AI Revolutionize Your Accounts Receivable Process?

March 5, 202410 Reasons Why AI powered Accounts Receivable Automation Is a Game Changer

March 21, 2024As your business evolves, having a robust underlying foundation becomes crucial. Enterprise Resource Planning (ERP) systems play a central role in ensuring that your operations remain scalable and resilient. These integrated software solutions streamline various business processes, including finance, human resources, supply chain management, and customer relationship management. By providing real-time data, automating tasks, and enhancing collaboration, ERPs empower organizations to adapt to changing market dynamics and maintain operational efficiency.

Remember, a well-implemented ERP system acts as the backbone of your business, supporting growth and agility. Whether you’re a small startup or a large enterprise, investing in the right ERP solution can significantly impact your long-term success.

SAP Business One for accounting is a popular ERP solution designed primarily for small and medium- sized enterprises (SMEs)

As of 2020, SAP Business One for accounting has made significant strides globally. Let’s delve into the impressive statistics:

- 70,000+ customers rely on SAP Business One for accounting for their business needs.

- The software is available in 50 country localizations and supports 28 languages.

- A network of approximately 300 Software Solution Partners offers 500+ solutions built on SAP Business One.

- Notably, 360+ large enterprises manage their operations using SAP Business One for accounting across 5,600+ subsidiaries.

- The comprehensive suite covers various modules, including:

- Management & Administration

- Sales & Service

- Purchasing & Operations

- Inventory & Distribution

- Production & MRP (Material Requirements Planning)

- Project & Resource Management

- Solution Customization

SAP Business One ( SAP B1) for accounting continues to be a powerful choice for businesses seeking streamlined processes, scalability, and global reach. While SAP B1 for accounting offers a wide range of features for managing various aspects of business operations, including accounts receivable management, some users may find certain aspects of its interface or functionality less user-friendly for this specific task. Here are a few reasons

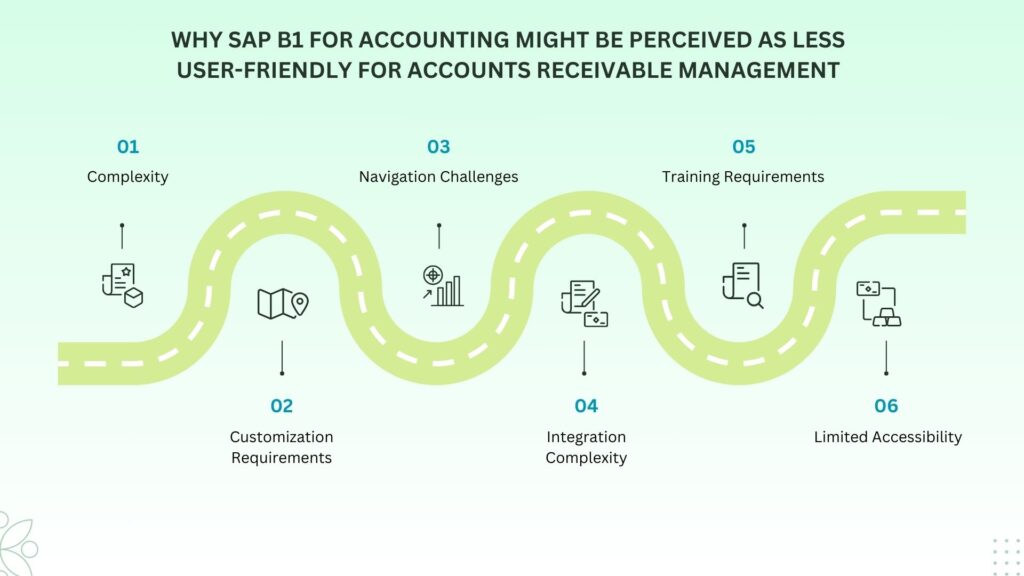

Why SAP B1 for accounting might be perceived as less user-friendly for accounts receivable management:

1. Complexity: SAP B1 is a comprehensive ERP system with extensive functionality, which can make it complex for users who are not familiar with ERP systems or accounting principles. Accounts receivable management involves various processes such as invoice creation, payment processing, and collections, which may require navigating through multiple screens and modules within SAP B1 for accounting.

2. Customization Requirements: While SAP B1 for accounting offers a high degree of customization to meet the specific needs of businesses, setting up and configuring the system for accounts receivable management can require technical expertise and administrative permissions. Users may find it challenging to configure the system according to their specific business processes and requirements.

3. Navigation Challenges: SAP B1’s interface may not always be intuitive for users accustomed to simpler software interfaces or traditional accounting software. Navigating through different modules, screens, and menus to access accounts receivable functions and reports may require training and familiarity with the system.

4. Integration Complexity: Integrating SAP B1 for accounting with other systems or external data sources for accounts receivable management purposes may require additional technical expertise and effort. Users may encounter challenges in synchronizing data between SAP B1 and other software applications or databases used for accounts receivable activities.

5. Training Requirements: Due to its complexity and extensive functionality, users often require comprehensive training to effectively use SAP B1 for accounts receivable management. Without adequate training and support, users may struggle to perform tasks efficiently and accurately within the system.

6. Limited Accessibility: SAP B1 is primarily designed for desktop use, which may limit accessibility for users who require mobile access or remote functionality for accounts receivable management tasks.

Overall, while SAP B1 for accounting offers robust capabilities for managing accounts receivable and other business processes, users may perceive it as less user-friendly due to its complexity, customization requirements, navigation challenges, integration complexity, training requirements, and limited accessibility.

By leveraging the capabilities of SAP B1 for accounting with the Kapittx accounts receivable SaaS platform, businesses can get full control of the receivables and improve cash flow.

Integration between SAP Business One and accounts receivable automation software :

With the evolution of AI in accounts receivables, integrating an AI powered accounts receivable automation software like Kapittx with your SAP B1 can have a significant positive impact on improving the efficiency of the AR process and the productivity of your people managing receivables. While choosing the right accounts receivable software for your organisation, one needs to understand that the AI powered accounts receivable software should be the exact replica of

receivables data in SAP B1. Any gaps in numbers could negate the benefits of receivable automation.

Integrating an accounts receivable automation software with SAP Business One requires thoughtful planning and consideration. Here are some essential factors to keep in mind:

1. Integration API Compatibility and Technology Stack:

- Ensure that the AI powered accounts receivable software aligns with your existing technology stack and future roadmaps.

- Consider compatibility with SAP Business One and other systems like sales CRM or other critical application you use.

2. Depth in feature functionalities:

- Your accounts receivables process is unique to your own business and any AI powered accounts receivable software you look for should enable you to adopt with least change and will all the functionalities your business and customers demands.

3. Scalability and Performance:

- Scalability is crucial for your business to grow. Evaluate the integration platform’s ability to handle large volumes of data and transactions without compromising performance.

4. Communication Protocols and Data Formats:

- Look for support for multiple communication protocols (e.g., AS2, SFTP, HTTP) and data formats (XML, JSON, EDI).

- Industry standards compliance is essential for seamless data exchange.

5. Security and Compliance:

- Ensure robust security features, including encryption, certificate management, and adherence to modern ciphers and algorithms.

- Compliance with data privacy regulations (e.g., SOC 1 or SOC 2 type 2 ) is critical.

6. Integration Testing and Validation:

- Plan for thorough integration testing to identify and address any issues early.

- Validate data accuracy and consistency during the integration process.

7. Visibility and Reporting:

- Choose an integration solution that provides real-time visibility into data flows, errors, and performance.

- Centralized dashboards help monitor and manage the integration effectively.

8. Adaptability and Future-Proofing:

- Consider how well the integration platform can adapt to changing business needs.

- Future-proof your integration by choosing flexible solutions.

Remember that successful B2B AR software integration enhances efficiency, reduces errors, and enables seamless collaboration with partners. Choose wisely to achieve your integration goals!

Kapittx, an AI powered accounts receivable platform and SAP Business One :

Championing the digital transformation objectives of CFOs, Kapittx stands as an AI-powered, cloud-based platform specializing in invoice-to-cash accounts receivable automation and reconciliation. Seamlessly integrated with B2B Payments and a sophisticated document management system, Kapittx empowers enterprises to reduce Days Sales Outstanding (DSO) and more efficient collection of payments.

Distinguished by ISO27001, SOC1, and SOC2 type 2 certifications, Kapittx is crafted as a digital solution tailored for enterprises and their finance teams.

By closely working with SAP authorized partner, Kapittx has developed a secured API to integrate with your SAP Business One which ensures quick integration for your collection team to enjoy the benefits of Kapittx, as AI powered accounts receivable automation software.

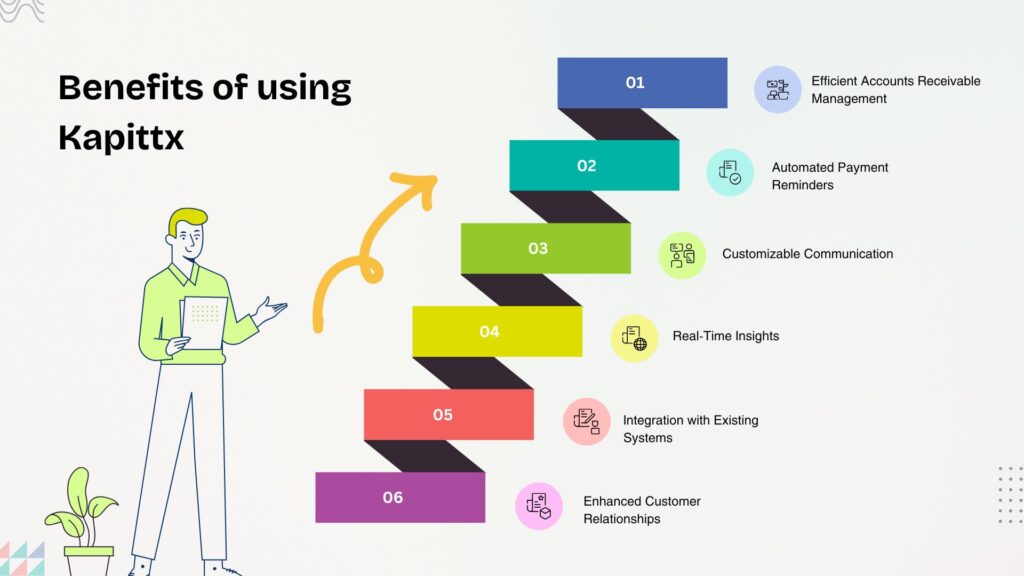

Let’s explore the benefits of using Kapittx:

Efficient Accounts Receivable Management:

- Kapittx leverages AI in accounts receivables to streamline AR processes, making it easier to manage outstanding payments.

- It helps reduce Days Sales Outstanding (DSO), improving cash flow and financial stability.

Automated Payment Reminders:

- Kapittx AI powered accounts receivable platform sends automated reminders to customers about pending payments.

- This proactive approach encourages timely payments and reduces manual follow-ups.

Customizable Communication:

- With AI in accounts receivable, Kapittx allows personalized communication with customers.

- You can tailor messages, payment terms, and follow-up schedules based on individual customer needs.

Real-Time Insights:

- Kapittx provides real-time visibility into payment statuses.

- Monitor receivables, track trends, and make informed decisions.

Integration with Existing Systems:

- Kapittx seamlessly integrates with ERP systems like SAP Business One.

- This ensures data consistency and eliminates manual data entry.

Enhanced Customer Relationships:

- By automating routine tasks, Kapittx frees up time for building stronger customer relationships.

- Focus on strategic initiatives rather than administrative work.

In summary, Kapittx empowers businesses to optimize accounts receivable processes, improve cash flow, and enhance customer interactions.