How Accounts Receivable Automation Can Improve Customer Relationships and Satisfaction

March 13, 2023Are you ‘Able’ to Receive your Receivables?

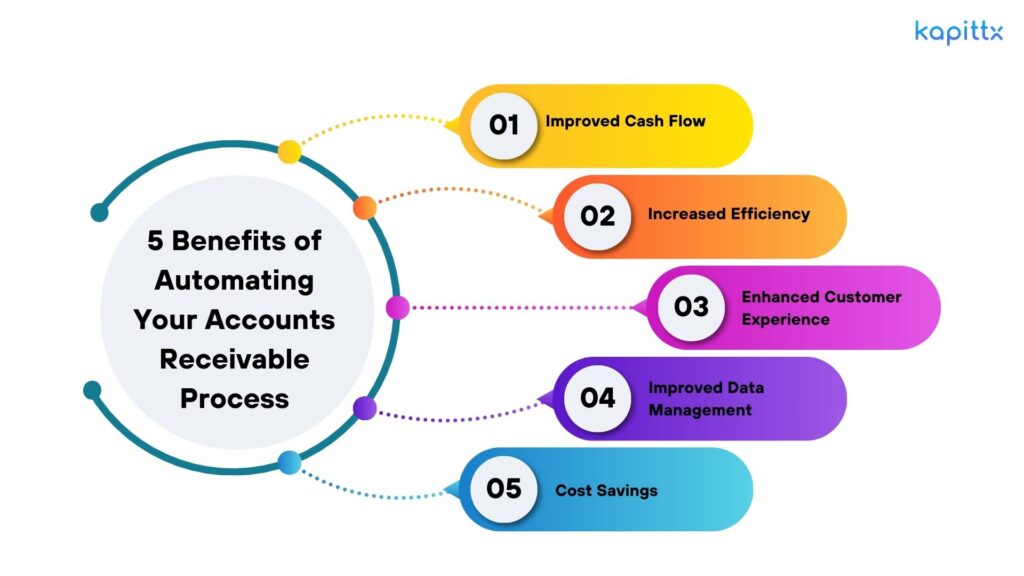

March 20, 2023Accounts Receivable (AR) is a critical function of any business that wants to maintain a healthy cash flow. However, traditional AR processes can be time-consuming, error-prone, and frustrating for both the business and its customers. This is where accounts receivable automation comes in. By automating the AR process, businesses can streamline their operations, reduce errors, and improve efficiency. In this blog, we will discuss five benefits of automating your accounts receivable process.

- Improved Cash Flow

The primary benefit of automating your accounts receivable process is improved cash flow. Automated AR systems can help businesses collect payments faster and reduce the number of overdue invoices. This can have a significant impact on a business’s bottom line and ensure that it has the cash flow it needs to operate and grow.

- Increased Efficiency

Automating your AR process can also increase efficiency. Automated systems can generate invoices, process payments, and send reminders without any human intervention. This not only saves time but also reduces the likelihood of errors, which can be costly to correct. Additionally, automated systems can route customer inquiries to the appropriate person or team, reducing response time and improving the customer experience.

- Enhanced Customer Experience

Automated AR systems can also enhance the customer experience. Automated systems can send reminders and follow-up emails automatically, reducing the need for manual follow-up. This can improve communication with customers and reduce the likelihood of late payments. Additionally, self-service options such as online payment portals can allow customers to view their account status, pay their invoices online, and track payment history, improving their experience and reducing the workload on the accounts receivable team.

- Improved Data Management

Automated AR systems can help businesses track customer payment patterns, identify potential payment issues, and store customer payment history. This information can be accessed quickly and easily, allowing the collections team to focus their efforts on high-risk customers and avoid wasting time on customers who are unlikely to default.

- Cost Savings

Automating your AR process can also result in cost savings. By automating many of the manual tasks associated with collections, businesses can reduce the need for additional staff or resources. Additionally, automated systems can help minimize errors and disputes, reducing the need for costly and time-consuming collections efforts.

In conclusion, automating your accounts receivable process can have significant benefits for your business. By improving cash flow, increasing efficiency, enhancing the customer experience, improving data management, and reducing costs, automated AR systems can help businesses maintain a healthy cash flow, improve collections strategy, and achieve long-term financial success.

Kapittx is a Software-as-a-Service (SaaS) platform to automate the critical process of Accounts Receivables or Debtors. It enables various stakeholders like Sales, Accounts, Logistics, and Customers to collaborate effectively and get paid faster. Founded in 2019, by veterans in the Payments, Finance, and Technology domains, Kapittx is built to integrate with your existing processes seamlessly. The easy-to-use interface, enables businesses in diverse fields like manufacturing, services, technology, transportation etc customize it to their own unique requirements. Kapittx recognizes that each industry and each company handles receivables in a different way and aims to eliminate the barriers to getting paid faster.

Click here to see a case study from Kapittx.

Check out Kapittx’s LinkedIn here.