Accounts Receivables Management Checklist

January 23, 2023Everything a CFO should know about Accounts Receivables Automation

January 23, 2023The best possible measures to improve DSO

Managing for cash is different from managing for accounting profits or revenue. Most managers understand the basics of profit or loss, such as revenues, margins and costs. Far fewer understand the importance of the key items of the balance sheet such as accounts receivable and inventories.

Accounts Receivable ( AR ) for many companies is among the top tangible assets and yet companies have under invested in accounts receivable processes to manage it leading to receivables getting locked in their own balance sheet. To generate cash through better AR collections, companies have interchangeably used accounts receivable aging report or days sales outstanding ( DSO ) reports.

What is DSO?

Days Sales Outstanding (DSO) is a financial metric that measures the number of days it takes a business to collect payment from its customers. A high DSO indicates that a business is having a hard time collecting payments from its customers, which can negatively impact cash flow and financial stability. there is a clear need to reduce DSO for businesses.

An accounts receivable aging report is a record that shows the duration of unpaid invoice balances for which they’ve been outstanding. This report helps businesses identify invoices that are open and allows them to keep on top of slow paying clients. On the other hand, DSO report expresses the average number of days it takes a company to convert its accounts receivables into cash DSO is one of the best indicators of company’s ability to convert their receivables to cash. Most companies will review their receivables on a weekly basis and adding DSO as a measurement can significantly improve the review process. Generally, DSO is determined on a monthly, quarterly or annual basis, and the DSO formula is calculated by dividing the amount of accounts receivable during a given period by the total value of credit sales during the same period, and multiplying the result by the number of days in the period measured.

DSO Formula :

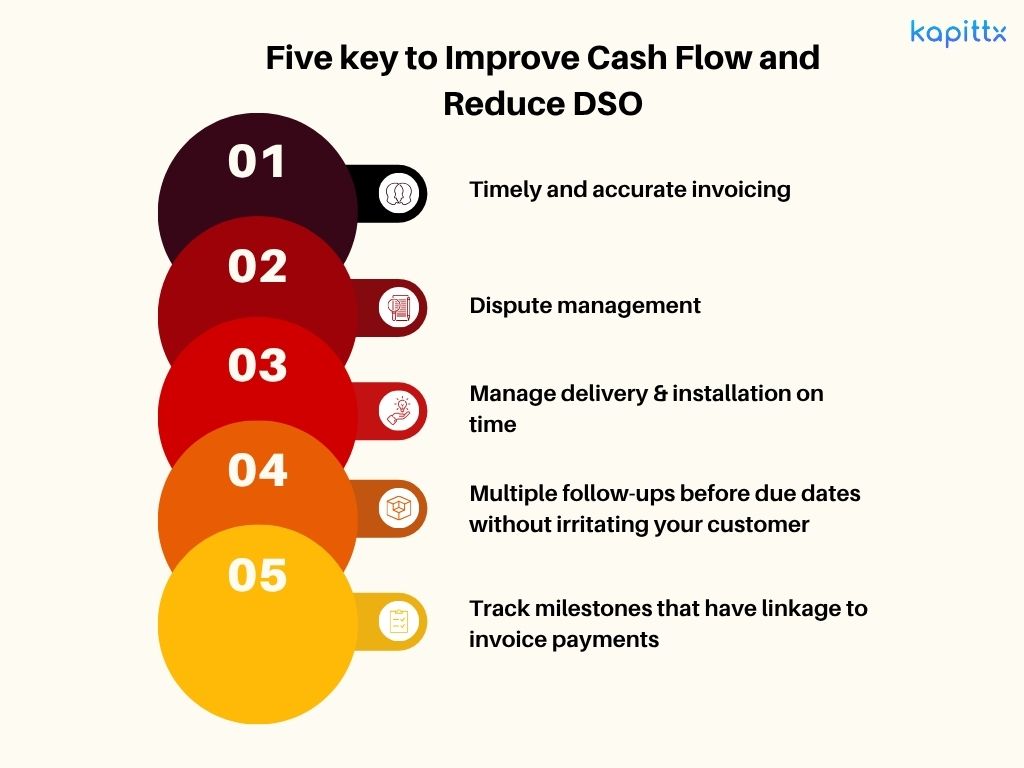

To improve cashflow and reduce DSO there are five key measures one can take and all of them are within your control –

- Timely and accurate invoicing

Companies, be it small or large, order processing, tracking and invoicing can be challenging due to manual processes or several disparate platforms. Common mistakes that occur are missing out of deadline set by customers to invoice and in turn missing their payable cycles. Another area that need closer supervision is the unit rates mismatch. This leads to next important measure, dispute management.

- Dispute management

Invoice disputes are part of parcel of any B2B business, however, the way disputes are handled can make a significant difference to improve DSO metrics as well as customer satisfaction. Customers tend to hold off the payment in case of multiple disputes. If disputes are not resolved quickly, the uncollectible amount owed could hurt a company’s cash flow resulting in a direct financial loss of the company. Setting a process and using a dispute resolution tool will lead to efficiently resolving any sort of discrepancies that could arise due to inaccuracy or incompleteness of invoices and billing documents.

- Manage delivery & installation on time

Products that have installation as the next milestones requires a close coordination between logistics, site readiness and services team. Often it is seen poor coordination between the three can lead to delayed payment cycles, disputes or even customer satisfaction issues leading to sales return / write-offs.

- Multiple follow-ups before due dates without irritating your customer

60% customers pay on time or closer to due date because they were reminded and their invoices related issues were resolved on time. An approach of a same cookie-cutter communication for all customers big or small, may backfire. One need to balance between multiple reminders, language used in communication and more importantly personalize basis the customers you are dealing with.

- Track milestones that have linkage to invoice payments

Invoices which have multiple milestones are the hard ones to keep DSO under control. They are hard because of dependencies on series of tasks that organization need delivery. Many of such tasks will involve cross functional collaboration as well with multiple stake holders at customers end.

What accounts receivable software can do for you?

Benefits of Accounts Receivable software are many. AR software can help you drive your Accounts receivable automation agenda. AR software can help businesses reduce DSO by streamlining the AR collection processes of managing and collecting payments from customers. Automation can help businesses to improve their overall efficiency and reduce the time and effort required to manage the accounts receivable processes. This can help businesses to improve their cash flow, reduce financial risks and increase the predictability of revenue.

One of the main benefits of AR software is that it can help businesses to improve the accuracy and efficiency of their invoicing process. Automated systems can automatically generate and send invoices to customers, which can help to reduce the risk of errors and improve the timeliness of invoicing. This can help businesses to improve their cash flow by ensuring that they receive payments in a timely and efficient manner.

Another key advantage of AR software is that it can help businesses to improve their credit control processes. Automated systems can automatically flag customers who are consistently late with their payments, which can help businesses to take action to mitigate any negative impact on cash flow. This can include implementing late payment fees, re-evaluating the creditworthiness of the customer, or even cancelling the customer’s account.

AR collection software can also help businesses to improve the accuracy and efficiency of their financial reporting. Automated systems can collect and aggregate data in real-time, which can help businesses to generate accurate financial statements and reports. This can also help to identify any discrepancies or errors in the data, allowing businesses to take corrective action quickly.

Additionally, AR automation software can also help businesses to improve the overall efficiency of the accounts receivable processes. By automating repetitive tasks such as data entry, the system can reduce the risk of errors and improve accuracy. This can also help to reduce the need for manual follow-up, freeing up time for other tasks.

In conclusion, AR software to execute accounts receivable automation agenda can help businesses reduce DSO by streamlining the process of managing and collecting payments from customers. Automation can help businesses to improve the accuracy and efficiency of their invoicing process, credit control processes, financial reporting, and overall efficiency of the accounts receivable process. This can help businesses to improve their cash flow, reduce financial risks and increase the predictability of revenue.

Kapittx is a Software-as-a-Service (SaaS) platform to automate the critical Accounts Receivables processes. Kapittx recognizes that each industry and each company handles receivables differently and aims to eliminate the barriers to getting paid faster. It enables various stakeholders like Sales, Accounts, Logistics, and Customers to collaborate effectively and get paid faster. Founded in 2019, by veterans in the Payments, Finance, and Technology domains, Kapittx is built to integrate with your existing ERPs and processes seamlessly. The easy-to-use interface, enables businesses in diverse fields like manufacturing, services, technology, transportation etc configure it to their own unique requirements.

Click here to see a case study from Kapittx.

Check out Kapittx’s LinkedIn here.