Mastering the Art of Dunning Management in B2B Accounts Receivable

April 11, 2024Get the most out of NetSuite or Oracle Fusion with AI-Powered Accounts Receivable

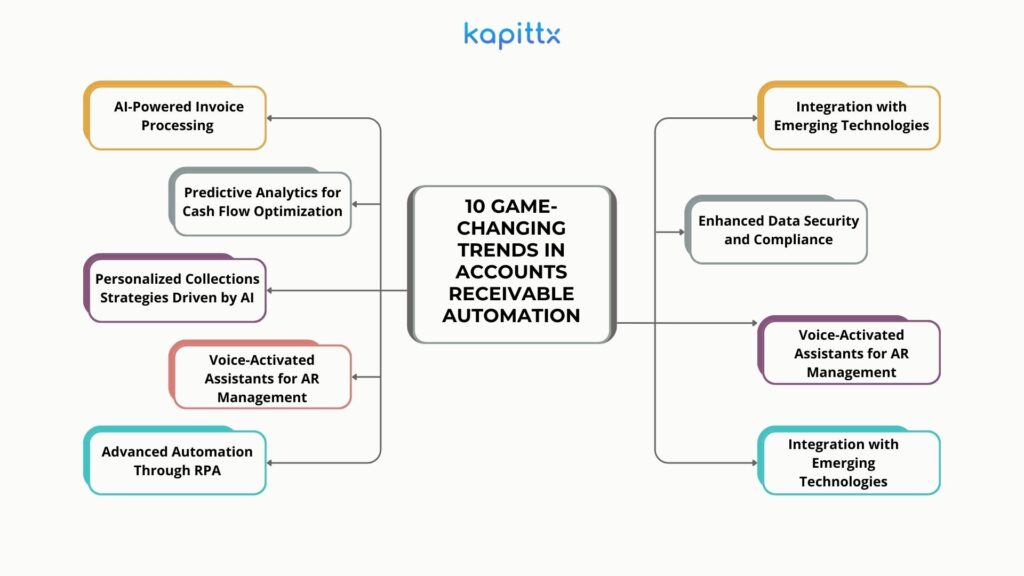

May 16, 2024As businesses continue to evolve and adapt to an increasingly digital landscape, the role of automation in accounts receivable (AR) management becomes ever more critical. In 2024, we anticipate several key trends that will shape the future of AI Powered Accounts Receivable automation, revolutionizing how businesses handle their invoicing, collections, and cash flow management. In this comprehensive guide,

We will explore the top 10 AR automation trends to watch in 2024 and their potential impact on finance operations.

1. AI-Powered Invoice Processing: AI-driven invoice processing is a game-changer. It automates tasks like data extraction, validation, and reconciliation from invoices. Machine learning algorithms enhance accuracy, reduce processing times, and boost overall efficiency in managing invoices.

Impact: Finance teams can bid farewell to manual data entry errors and tedious processes. With AI, they gain richer insights into customer payment behavior, allowing for accurate and personalized credit management strategies. Plus, forecasting future payment patterns becomes more precise, leading to better cash flow management.

2. Predictive Analytics for Cash Flow Optimization: By embracing AI powered accounts receivable software one can leverage the predictive analytics capabilities, historical data, and machine learning algorithms to forecast future cash flows. By analyzing receivables data, organizations can identify payment trends, anticipate liquidity needs, and make informed financial decisions.

Impact: Imagine having a crystal ball for your cash flow! Predictive analytics empowers finance leaders to proactively address potential payment delays. It’s like having a financial weather forecast—helping businesses stay prepared and agile.

3. Personalized Collections Strategies Driven by AI: AI analyzes customer payment behavior and preferences. With an AI powered accounts receivable software one can segment customers based on their likelihood to pay, finance teams can tailor collections communications and strategies. The result? Increased collections efficiency and fewer delinquencies.

Impact: Say goodbye to generic collection approaches. AI ensures that each customer receives personalized reminders, and payment options. It’s like having a virtual collections concierge—friendly, efficient, and effective.

4. Voice-Activated Assistants for AR Management: Imagine having a conversation with your AR system using natural language commands. The future of receivable management will be driven by AI powered accounts receivable software where the voice-activated assistants, powered by AI technology, make these conversations possible. They understand context, interpret requests, and execute tasks—all through spoken words.

Impact: Efficiency skyrockets as users interact seamlessly with AR systems. Whether it’s checking invoice statuses, retrieving payment details, or initiating collections, voice-activated assistants simplify the process. Just say the word!

5. Advanced Automation Through RPA (Robotic Process Automation): Picture a team of tireless digital workers—RPA bots—handling repetitive AR tasks. These bots mimic human actions, performing data entry, invoice processing, and payment reconciliation. Their superpower? Speed and accuracy.

Impact: Say goodbye to mundane manual work. RPA bots free up human resources, reduce errors, and ensure consistent execution. It’s like having an AR superhero squad at your service.

6. Integration with Emerging Technologies: AR automation isn’t an island—it collaborates with other tech marvels. Think IoT (Internet of Things) sensors embedded in products. When a product ships, an invoice is triggered automatically. And AR technology? It overlays visual cues during invoice processing and payment reconciliation.

Impact: Seamlessness becomes the norm. AR systems talk to IoT devices, visualize data, and orchestrate transactions. It’s like a symphony of efficiency across interconnected technologies.

7. Enhanced Data Security and Compliance: In the age of cyber threats and regulations, AR automation takes data security seriously. Encryption, multi-factor authentication, and access controls fortify sensitive AR data. Compliance with industry standards becomes non-negotiable.

Impact: Trust is paramount. Organizations safeguard customer information, prevent breaches, and stay compliant. It’s like locking the AR vault with an unbreakable code.

8. Voice-Activated Assistants for AR Management: Imagine having a conversation with your AR system using natural language commands. Voice-activated assistants, powered by AI technology, make this possible. They understand context, interpret requests, and execute tasks—all through spoken words.

Impact: Efficiency skyrockets as users interact seamlessly with AR systems. Whether it’s checking invoice statuses, retrieving payment details, or initiating collections, voice-activated assistants simplify the process. Just say the word!

9. Advanced Automation Through RPA (Robotic Process Automation): Picture a team of tireless digital workers—RPA bots—handling repetitive AR tasks. These bots mimic human actions, performing data entry, invoice processing, and payment reconciliation. Their superpower? Speed and accuracy.

Impact: Say goodbye to mundane manual work. RPA bots free up human resources, reduce errors, and ensure consistent execution. It’s like having an AR superhero squad at your service.

10. Integration with Emerging Technologies: AR automation isn’t an island—it collaborates with other tech marvels. Think IoT (Internet of Things) sensors embedded in products. When a product ships, an invoice is triggered automatically. And AR technology? It overlays visual cues during invoice processing and payment reconciliation.

Impact: Seamlessness becomes the norm. AR systems talk to IoT devices, visualize data, and orchestrate transactions. It’s like a symphony of efficiency across interconnected technologies.

Conclusion: In conclusion, the landscape of AI powered accounts receivable automation is evolving rapidly, driven by technological advancements and changing business needs. By staying abreast of these emerging trends and embracing innovative automation solutions, businesses can streamline their AR processes, improve cash flow management, and achieve greater efficiency and profitability in 2024 and beyond.

Click here to see a case study from Kapittx.

Check out Kapittx’s LinkedIn here.